United States Biostimulants Market Size, Share, and COVID-19 Impact Analysis, By Active Ingredients (Humic Substances, Seaweed Extracts, Amino Acids, Microbial Amendments, Minerals & Vitamins, and Others), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Flowers & Ornamentals, and Others), By Application (Foliar Sprays, Seed Treatments, Soil Treatments, and Others), and United States Biostimulants Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Biostimulants Market Insights Forecasts to 2033

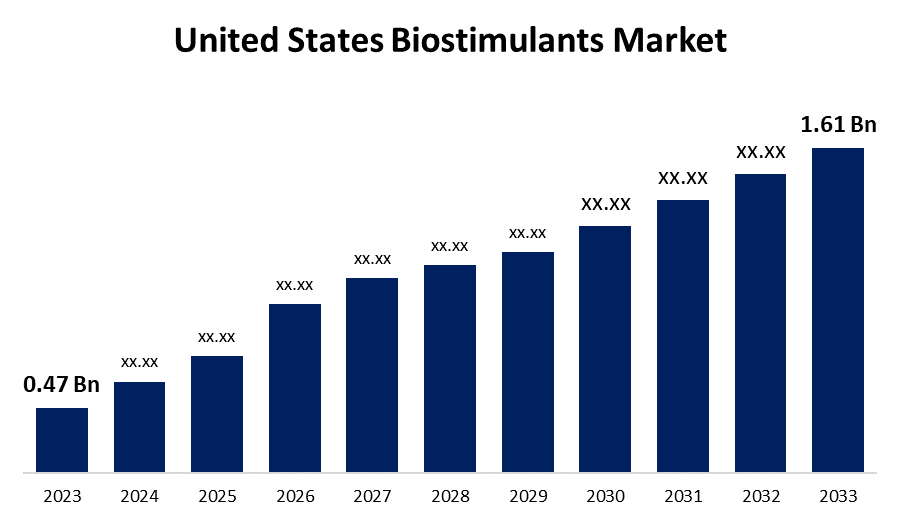

- The U.S. Biostimulants Market Size was valued at USD 0.47 Billion in 2023.

- The Market is growing at a CAGR of 13.10% from 2023 to 2033

- The U.S. Biostimulants Market Size is expected to reach USD 1.61 Billion by 2033

Get more details on this report -

The United States Biostimulants Market is anticipated to exceed USD 1.61 Billion by 2033, growing at a CAGR of 13.10% from 2023 to 2033. The growing demand for organic food and new product launches are driving the growth of the biostimulants market in the US.

Market Overview

Biostimulants are the substances or microorganism cultures that are applied to plants, seeds, or rhizosphere to stimulate plant growth and health. These include natural or artificial plant growth regulators and biofertilizers. Biostimulants are gaining traction as a result of farmers' increasing attention to efficiency and facilitating these crops' easier access to nutrients. This is due to the improved lipid biosynthesis and sugar transport while also regulating cell growth, division, and metabolism to increase productivity. It has shown to be advantageous to combine biologically based seed treatments with synthetic crop protection. By effectively increasing seed activity in the soil, seed treatments shield roots and seedlings against pests and diseases that are transmitted through the soil. The growing responsibility to support sustainable agriculture in areas with appropriate water availability and shortages is further offering lucrative market growth.

Report Coverage

This research report categorizes the market for the US biostimulants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biostimulants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US biostimulants market.

United States Biostimulants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.47 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.10% |

| 2033 Value Projection: | USD 1.61 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Active Ingredients, By Crop Type, By Application |

| Companies covered:: | BioLine Corporation, Corteva Agriscience, FBSciences Inc., Humic Growth Solutions Inc., Hello Nature USA Inc., Symborg Inc., Sigma Agriscience LLC, Valagro USA, Ocean Organics Corp., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Biostimulants are associated with organic farming and organic gardening, playing an important role in conventional agriculture as a complement to crop nutrition and crop protection. The agricultural industry of the nation is dominated by the production of grain crops. The primary grains consist of millet, wheat, rice, and maize. Due to the numerous health advantages of eating organic food, US consumers are choosing to consume an increasing amount of organic products. The increasing demand for organic food products in the country is driving the market growth. The increasing number of product launches and the use of technological advancements for the development of biostimulants are driving the market growth.

Restraining Factors

The lack of harmonized regulations and definitions associated with biostimulants may restrain the market as a lack of standard definitions may generate misconceptions regarding performance and application among farmers, retailers, and consumers.

Market Segmentation

The United States Biostimulants Market share is classified into active ingredients, crop type, and application.

- The seaweed extracts segment dominates the US biostimulants market during the forecast period.

Based on the active ingredients, the U.S. biostimulants market is divided into humic substances, seaweed extracts, amino acids, microbial amendments, minerals & vitamins, and others. Among these, the seaweed extracts segment dominates the US biostimulants market during the forecast period. Seaweeds are naturally grown plants in the sea comprising various marine algae, including kelps, dulse, rockweeds, and sea lettuce. These are used in horticulture and agriculture crops. The growing inclination toward organic foods among consumers as well as the popularity of horticulture are driving the market growth.

- The cereals & grains segment dominates the market with a significant market share during the forecast period.

The United States biostimulants market is segmented by crop type into cereals & grains, oilseeds & pulses, fruits & vegetables, flowers & ornamentals, and others. Among these, the cereals & grains segment dominates the market with a significant market share during the forecast period. The increasing need for cereals emphasizes how critical it is to raise agricultural productivity, which could result in increased usage of biostimulants to maximize yields and satisfy local needs. The increasing demand to enhance cereals & grains production is driving the market demand for biostimulants.

- The foliar sprays segment dominates the US biostimulants market with the largest share during the forecast period.

The United States biostimulants market is segmented by application into foliar sprays, seed treatments, soil treatments, and others. Among these, the foliar sprays segment dominates the US biostimulants market with the largest share during the forecast period. Foliar spray is a technique used in agriculture to apply nutrients or pesticides directly to the leaves of a plant. The foliar application of biostimulants is one of the most widely used methods for boosting plant productivity. Biostimulant foliar sprays may be useful in low-quality soil conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. biostimulants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BioLine Corporation

- Corteva Agriscience

- FBSciences Inc.

- Humic Growth Solutions Inc.

- Hello Nature USA Inc.

- Symborg Inc.

- Sigma Agriscience LLC

- Valagro USA

- Ocean Organics Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Rovensa Group, a global leader in agricultural inputs for sustainable agriculture, announced the acquisition of Agro-K, a leading family-owned biostimulants developer in the U.S. The acquisition solidifies Rovensa Next’s foothold in the U.S., a key strategic growth market, and it brings a high-quality portfolio of complementary solutions and a technical sales team fully dedicated to biostimulation.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Biostimulants Market based on the below-mentioned segments:

US Biostimulants Market, By Active Ingredients

- Humic Substances

- Seaweed Extracts

- Amino Acids

- Microbial Amendments

- Minerals & Vitamins

- Others

US Biostimulants Market, By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Flowers & Ornamentals

- Others

US Biostimulants Market, By Application

- Foliar Sprays

- Seed Treatments

- Soil Treatments

- Others

Need help to buy this report?