United States Biosurfactants Market Size, Share, and COVID-19 Impact Analysis, By Type (Glycolipids, Alkyl Polyglucosides, Methyl Ethyl Sulfonates, Sucrose Esters, Sorbitan Esters, Others), By Application (Household Detergents, Personal Care, Food Processing, Oilfield Chemicals, Textiles, Others), and United States Biosurfactants Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Biosurfactants Market Insights Forecasts to 2033

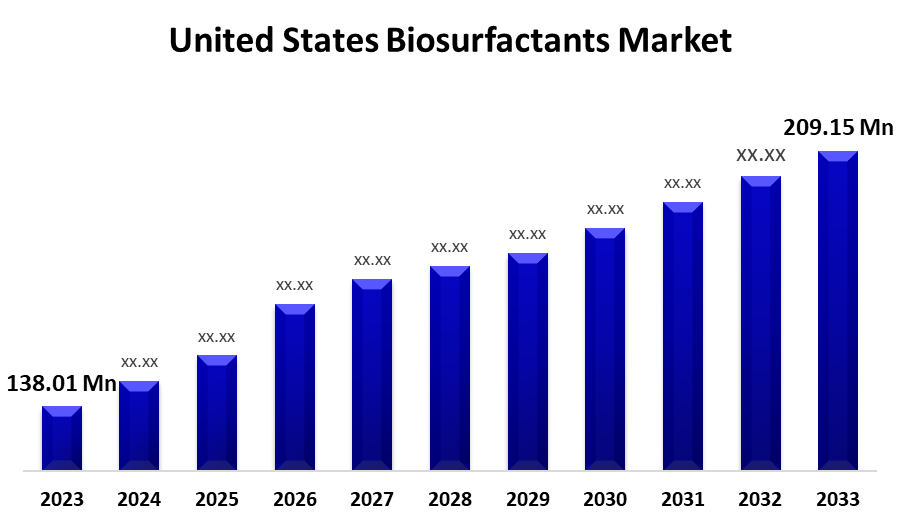

- The United States Biosurfactants Market Size was valued at USD 138.01 Million in 2023

- The Market Size is Growing at a CAGR of 4.2% from 2023 to 2033

- The United States Biosurfactants Market Size is Expected to Reach USD 209.15 Million by 2033

Get more details on this report -

The United States Biosurfactants Market Size is expected to reach USD 209.15 Million by 2033, at a CAGR of 4.2% during the forecast period 2023 to 2033.

Market Overview

Biosurfactants are active compounds or surface-active biomolecules that are primarily produced on the microbial cell surface and have a higher biodegradability and lower toxicity than synthetic surfactants. It contributes to bioremediation by increasing the surface area of substrates. They are used in a variety of industries such as cleaning, cosmetics and personal care, agriculture, and others. The United States biosurfactants market is expanding primarily due to their use in the cosmetic and personal care industries. Increased production of cosmetic and personal care products, as well as rising consumer preference for bio-based surfactants, are expected to drive the United States biosurfactants market size in the coming years.

Report Coverage

This research report categorizes the market for United States biosurfactants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biosurfactants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States biosurfactants market.

United States Biosurfactants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 138.01 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.2% |

| 2033 Value Projection: | USD 209.15 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Saraya USA, Inc., Jeneil Biotech, Inc., AGAE Technologies, LLC, Biotensidon GmbH, Logos Technologies, LLC and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers, businesses, and regulators are becoming more worried about the environmental impact of chemical products in a period of rising environmental consciousness. Biosurfactants are an environmentally friendly option for a wide range of applications because they are biodegradable and less harmful to ecosystems. Consumers who are concerned about the environment are looking for detergents that are biodegradable and degrade into non-toxic components in the environment. Green detergents that incorporate biosurfactants, such as biosurfactants, are preferred for their environmental friendliness. Furthermore, various marketing activities and campaigns conducted by market participants raise consumer awareness of detergent products such as gels, pods, and liquids. To minimize negative environmental effects and ensure customer safety, biodegradable and non-toxic surfactants are also used in the formulation of personal care products such as shampoos, soaps, and skincare products. Furthermore, rising living standards, a growing population, rising urbanization, a surge in innovative product launches, and rising consumer awareness of health and hygiene are all factors driving U.S. demand for household detergents and cleaning products.

Restraining Factors

Manufacturers face difficulties when achieving economically viable industrial production of biosurfactants. Biosurfactant production is expensive due to lower yields than commercial synthetic surfactants. High feedstock costs, as well as costly purification and downstream processing, all have an impact on production costs. The main disadvantage of biosurfactants is their high price, which is a major factor reducing biosurfactant demand.

Market Segment

- In 2023, the glycolipids segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States biosurfactants market is segmented into glycolipids, alkyl polyglucosides, methyl ethyl sulfonates, sucrose esters, sorbitan esters, and others. Among these, the glycolipids segment has the largest revenue share over the forecast period. Glycolipids, a type of biosurfactant, are well known for their excellent emulsifying properties. These remarkable molecules have a one-of-a-kind ability to reduce surface and interfacial tensions, making them highly desirable in a variety of industrial applications. The superior environmental compatibility of glycolipids is one of the primary factors contributing to their dominance in the biosurfactants market. Because of their environmentally friendly properties, glycolipids emerge as a standout choice as industries increasingly shift toward sustainable practices. These compounds are not only biodegradable, but also non-toxic, reducing their environmental impact significantly.

- In 2023, the household detergents segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States biosurfactants market is segmented into household detergents, personal care, food processing, oilfield chemicals, textiles, and others. Among these, the household detergents segment has the largest revenue share over the forecast period. Surfactants are essential in the creation of laundry and household cleaning products. They allow detergents to penetrate and remove dirt and grease more effectively by lowering surface tension. While synthetic surfactants have long been used, rising environmental concerns and shifting consumer preferences toward more environmentally friendly products have paved the way for eco-friendly alternatives such as biosurfactants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biosurfactants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saraya USA, Inc.

- Jeneil Biotech, Inc.

- AGAE Technologies, LLC

- Biotensidon GmbH

- Logos Technologies, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, BASF SE, a leading chemical company, recently made an exciting announcement. Plantapon Soy, a groundbreaking bio-based anionic surfactant, was introduced by its division, Care Creations. This innovative ingredient, derived from soy protein, provides numerous sustainability benefits to the personal care and cosmetics industries. Companies can now improve their product formulations while lowering their environmental impact with Plantapon Soy, making it a game changer in the pursuit of greener and more sustainable solutions.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States biosurfactants market based on the below-mentioned segments:

United States Biosurfactants Market, By Type

- Glycolipids

- Alkyl Polyglucosides

- Methyl Ethyl Sulfonates

- Sucrose Esters

- Sorbitan Esters

- Others

United States Biosurfactants Market, By Application

- Household Detergents

- Personal Care

- Food Processing

- Oilfield Chemicals

- Textiles

- Others

Need help to buy this report?