United States Bleeding Disorder Testing Market Size, Share, and COVID-19 Impact Analysis, By Product (Reagents & Consumables and Instruments), By Indication (Hemophilia A, Hemophilia B, Von Willebrand Disease, Idiopathic Thrombocytopenic Purpura, and Others), By End-user (Hospitals & clinics, Diagnostic Centers, and Others), and United States Bleeding Disorder Testing Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Bleeding Disorder Testing Market Insights Forecasts to 2033

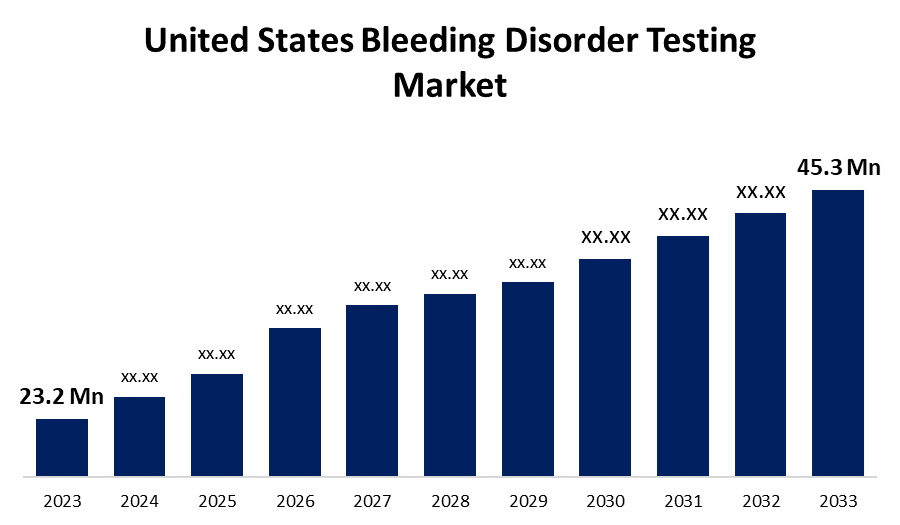

- The U.S. Bleeding Disorder Testing Market Size was valued at USD 23.2 Million in 2023.

- The Market Size is Growing at a CAGR of 6.92% from 2023 to 2033

- The U.S. Bleeding Disorder Testing Market Size is Expected to reach USD 45.3 Million by 2033

Get more details on this report -

The United States Bleeding Disorder Testing Market Size is anticipated to exceed USD 45.3 Million by 2033, Growing at a CAGR of 6.92% from 2023 to 2033.

The growing innovative product launches and growing implementation of nanomaterials & artificial intelligence in blood disorders testing are driving the growth of the bleeding disorder testing market in the US.

Market Overview

Bleeding disorder is a condition when blood cannot clot properly which is usually caused by problems associated with clotting factors. The demand to treat bleeding disorders is growing due to the increased occurrence of conditions including hemophilia A and hemophilia B, anemia, liver diseases, and other blood coagulation issues. According to the National Centers for Biotechnology Information (NCBI), the most frequent congenital coagulopathy is hemophilia A, which affects around 1 in 5000 males; hemophilia B, an X-linked hereditary coagulopathy, will afflict about 1 in 30,000 male births in the United States. Patients who receive early diagnosis and detection of bleeding disorders are at a decreased risk of developing severe bleeding as well as developing fewer co-morbid diseases. The increasing awareness about the diagnosis of the disorder is anticipated to drive the adoption of bleeding disorder testing, thereby driving the market growth.

Report Coverage

This research report categorizes the market for the US bleeding disorder testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bleeding disorder testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US bleeding disorder testing market.

United States Bleeding Disorder Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 23.2 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.92% |

| 2033 Value Projection: | USD 45.3 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Indication, By End-user |

| Companies covered:: | Abbott, F. Hoffmann-La Roche Ltd., Siemens Healthcare GmbH, Sysmex America, Thermo Fisher Scientific Inc., Precision Biologics, Atlas Medical GmbH, HORIBA Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

The growing innovative product launches are driving the market. For instance, CRYOcheck Chromogenic Factor IX Assay was launched by Precision BioLogic Inc. to improve testing for haemophilia B. The potential application of nanoparticles and nanosensors in the diagnosis of bleeding disorders is driving the market. Further, the integration of machine learning algorithms in medical diagnosis for predicting bleeding disorders is propelling the market growth. In addition, the U.S. bleeding disorder testing market is expected to benefit from the prevalence of bleeding disorders and rising public knowledge of testing procedures.

Restraining Factors

The presence of strict regulatory approval procedures by the FDA in clinical laboratory tests is challenging the market.

Market Segmentation

The United States Bleeding Disorder Testing Market share is classified into product, indication, and end-user.

- The reagents & consumables segment dominates the US bleeding disorder testing market with a significant share in 2023.

The United States bleeding disorder testing market is segmented by product into reagents & consumables and instruments. Among these, the reagents & consumables segment dominates the US bleeding disorder testing market with a significant share in 2023. The accuracy and consistency of reagents as well as the quality of consumables play important roles in diagnostic testing. The increasing number of product launches and technological advances in diagnostic procedures are driving the market.

- The hemophilia A segment dominates the market with the largest market share during the forecast period.

The United States bleeding disorder testing market is segmented by indication into hemophilia A, hemophilia B, Von Willebrand disease, idiopathic thrombocytopenic purpura, and others. Among these, the hemophilia A segment dominates the market with the largest market share during the forecast period. Hemophilia A is the most common coagulation factor deficiency with an increased prevalence rate in the country. The increasing government initiatives for early neonate detection and increasing awareness about the diagnosis are propelling the market.

- The hospitals & clinics segment accounted for the largest revenue share of the US bleeding disorder testing market in 2023.

Based on the end-user, the U.S. bleeding disorder testing market is divided into hospitals & clinics, diagnostic centers, and others. Among these, the hospitals & clinics segment accounted for the largest revenue share of the US bleeding disorder testing market in 2023. The most prevalent bleeding disorders like haemophilia and von Willebrand disease are encountered in emergency departments in hospitals. The growing rate of hospitalization along with the diagnosis rate and healthcare infrastructure are driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. bleeding disorder testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- F. Hoffmann-La Roche Ltd.

- Siemens Healthcare GmbH

- Sysmex America

- Thermo Fisher Scientific Inc.

- Precision Biologics

- Atlas Medical GmbH

- HORIBA Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Siemens Healthineers launched its Innovance VWF Ac assay which mimics the true von Willebrand factor function (VWF) for U.S. laboratories. The assay is available for use on the Siemens Healthineers BCS XP System and the Sysmex CS-2500 and CS-5100 hemostasis analyzers.

- In May 2022, Babson Diagnostics, a science-first, health care technology company, and BD (Becton, Dickinson and Company), a leading global medical technology company, announced the expansion of a strategic partnership to move blood sample collection into new care settings, including enabling patients to collect blood samples at home for diagnostic testing.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Bleeding Disorder Testing Market based on the below-mentioned segments:

US Bleeding Disorder Testing Market, By Product

- Reagents & Consumables

- Instruments

US Bleeding Disorder Testing Market, By Indication

- Hemophilia A

- Hemophilia B

- Von Willebrand Disease

- Idiopathic Thrombocytopenic Purpura

- Others

US Bleeding Disorder Testing Market, By End-user

- Hospitals & clinics

- Diagnostic Centers

- Others

Need help to buy this report?