The United States Breast Reconstruction Market Size, Share, and COVID-19 Impact Analysis, By Product (Implants, Tissue Expander, and Acellular Dermal Matrix), By Shape (Round and Anatomical), and By United States Breast Reconstruction Market Insights Forecasts to 2033

Industry: HealthcareUnited States Breast Reconstruction Market Insights Forecasts to 2033

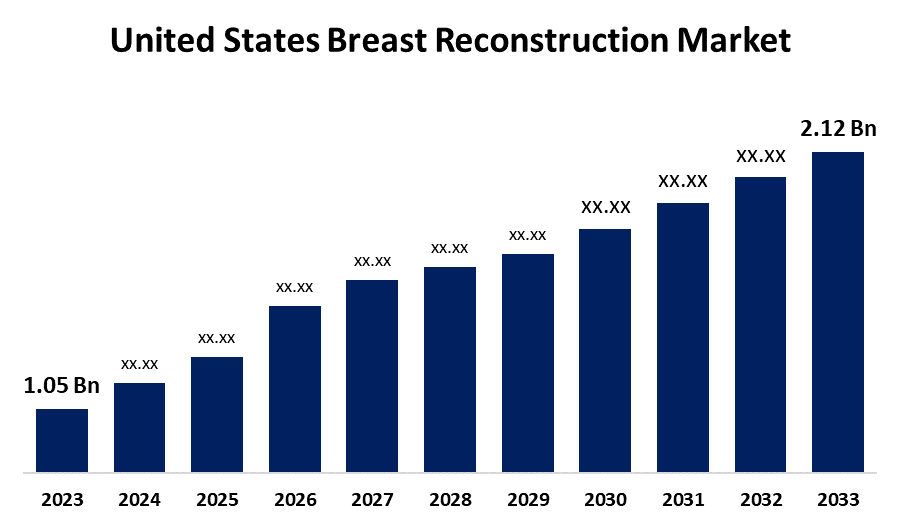

- The United States Breast Reconstruction Market Size was valued at USD 1.05 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.28% from 2023 to 2033

- The United States Breast Reconstruction Market Size is Expected to Reach USD 2.12 Billion by 2033

Get more details on this report -

The United States Breast Reconstruction Market Size is Anticipated to Exceed USD 2.12 Billion by 2033, Growing at a CAGR of 7.28% from 2023 to 2033.

Market Overview

The United States breast reconstruction market refers to the segment of the healthcare industry focused on surgical procedures and medical devices designed to restore breast shape and appearance following mastectomy or trauma. This market encompasses various reconstruction techniques, including implant-based reconstruction and autologous tissue reconstruction, as well as associated products such as silicone and saline implants, tissue expanders, and acellular dermal matrices. The market is driven by the rising incidence of breast cancer, advancements in reconstructive surgical techniques, and increasing awareness regarding post-mastectomy breast reconstruction options. The growing number of mastectomy procedures and the psychological benefits associated with reconstruction further contribute to market growth. Additionally, the introduction of technologically advanced products, such as 3D-printed implants and regenerative tissue matrices, enhances procedural outcomes and patient satisfaction—favorable reimbursement policies and expanding healthcare infrastructure further support market expansion. The Women’s Health and Cancer Rights Act (WHCRA) mandates insurance coverage for breast reconstruction after mastectomy, significantly improving patient access to reconstructive procedures. Various awareness campaigns led by government agencies and non-profit organizations promote informed decision-making regarding breast reconstruction. Moreover, regulatory approvals and initiatives by the U.S. Food and Drug Administration (FDA) ensure the safety and efficacy of reconstructive devices, fostering trust and adoption among patients and healthcare providers.

Report Coverage

This research report categorizes the market for the United States breast reconstruction market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States breast reconstruction market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States Breast Reconstruction market sub-segment.

United States Breast Reconstruction Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.05 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.28% |

| 2033 Value Projection: | USD 2.12 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Shape |

| Companies covered:: | Mentor Medical Systems (Johnson & Johnson), Allergan, Inc. (AbbVie), Sientra, Inc. (Acquired by Tiger Aesthetics Medical, LLC), Ideal Implant, Inc. (Bimini Health Tech.), Establishment Labs, RTI Surgical, Integra LifeSciences Corporation, and Others. |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States breast reconstruction market is driven by several key factors, including the rising incidence of breast cancer, which increases the demand for post-mastectomy reconstruction procedures. Advancements in surgical techniques, such as autologous tissue reconstruction and 3D-printed implants, enhance procedural outcomes. Growing awareness about the psychological and aesthetic benefits of breast reconstruction further contributes to market expansion. Favorable reimbursement policies under the Women’s Health and Cancer Rights Act (WHCRA) improve accessibility. Additionally, increasing investments in healthcare infrastructure, the introduction of regenerative tissue matrices, and FDA-approved innovations support market growth by ensuring safer and more effective reconstruction options.

Restraining Factors

High procedure costs, surgical complications, limited access in rural areas, and the risk of implant-related issues, such as capsular contracture, hinder market growth. Additionally, stringent regulatory approvals delay product launches.

Market Segment

The U.S. breast reconstruction market share is classified into product and shape.

- The implants segment is expected to hold the largest market share through the forecast period.

The US breast reconstruction market is segmented by product into implants, tissue expanders, and acellular dermal matrix. Among these, the implants segment is expected to hold the largest market share through the forecast period. This dominance is attributed to the widespread adoption of implant-based reconstruction due to its shorter surgical time, minimal donor site morbidity, and advancements in implant technology, such as highly cohesive silicone gel implants.

- The round segment is expected to hold the largest market share through the forecast period.

The US breast reconstruction market is segmented by shape into round and anatomical. Among these, the round segment is expected to hold the largest market share through the forecast period. This dominance is driven by the widespread preference for round implants due to their natural appearance, versatility, and ability to maintain shape even if rotation occurs. Additionally, round implants provide enhanced upper pole fullness, making them a preferred choice among both patients and surgeons.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States breast reconstruction market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mentor Medical Systems (Johnson & Johnson)

- Allergan, Inc. (AbbVie)

- Sientra, Inc. (Acquired by Tiger Aesthetics Medical, LLC)

- Ideal Implant, Inc. (Bimini Health Tech.)

- Establishment Labs

- RTI Surgical

- Integra LifeSciences Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, establishment Labs announced the commercial launch of Motiva Implants in China and the completion of the first procedure with Motiva Flora SmoothSilk Tissue Expander in the U.S. Establishment Labs' strategic moves in China and the U.S. demonstrate their commitment to expanding their market presence and offering advanced breast implant technologies.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States breast reconstruction market based on the below-mentioned segments:

United States Breast Reconstruction Market, By Product

- Implants

- Tissue Expander

- Acellular Dermal Matrix

United States Breast Reconstruction Market, By Shape

- Round

- Anatomical

Need help to buy this report?