United States Burn Care Market Size, Share, and COVID-19 Impact Analysis, By Product (Advanced Dressings, Biologics, Traditional Burn Care Products, and Others), By Depth of Burn (Minor Burns, Partial Burns, and Full-Thickness Burns), By Cause (Thermal, Electrical, Radiation, Chemical, and Friction), By End-Use (Hospitals, Outpatient Facilities, Home Care, and Research & Manufacturing), and United States Burn Care Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Burn Care Market Insights Forecasts to 2033

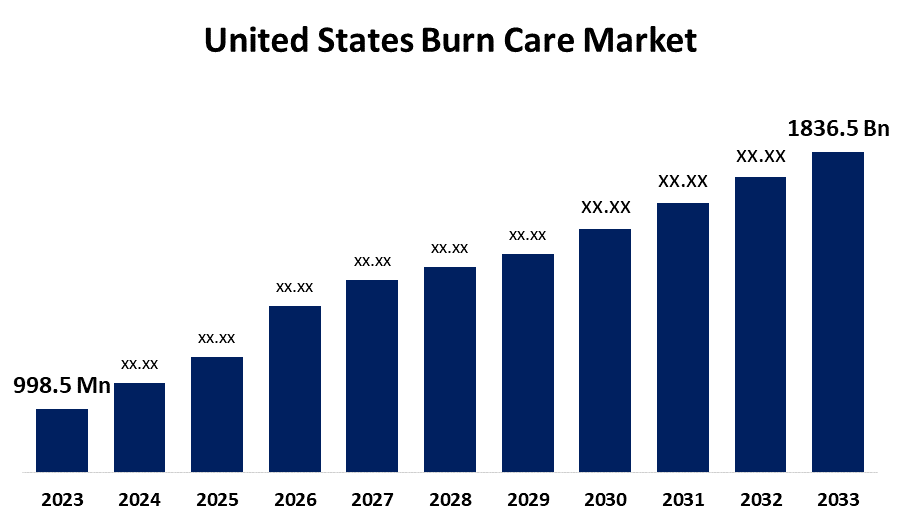

- The U.S. Burn Care Market Size was valued at USD 998.5 Million in 2023.

- The Market is growing at a CAGR of 6.28% from 2023 to 2033

- The U.S. Burn Care Market Size is expected to reach USD 1836.5 Million by 2033

Get more details on this report -

The United States Burn Care Market is anticipated to exceed USD 1836.5 Million by 2033, growing at a CAGR of 6.28% from 2023 to 2033. The growing prevalence of burn-related injuries, the geriatric population, technological advancement in wound management, and demand for skin grafts are driving the growth of the burn care market in the US.

Market Overview

Products for burn care are made specifically to treat burn injuries. Burns can result in the death of skin cells as well as an excruciating burning feeling. Serious burns require immediate emergency care in order to prevent complications or possibly death. Products for burn care aid in pain relief and scar prevention. One of the key developments in the burn care market is the growing usage of advanced wound care technologies such as bioactive and antimicrobial burn wood dressings that are made to encourage quicker recovery and guard against illness. Using natural and organic burn care solutions has also become more and more popular and outperforms synthetic products in terms of dependability and efficiency. Researchers, industry participants, and healthcare professionals are becoming more and more interested in developing burn treatment methods and supplies. There is an increasing emphasis on cutting-edge wound care products, such as sophisticated dressings, topical medications, and medical equipment to speed up burn healing.

Report Coverage

This research report categorizes the market for the US burn care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States burn care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US burn care market.

United States Burn Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 998.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.28% |

| 2033 Value Projection: | USD 1836.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Product, By Depth of Burn, By Cause, By End-Use |

| Companies covered:: | 3M, Cardinal Health, Integra LifeSciences Corporation, DeRoyal Industries, Inc., Smith & Nephew, Johnson & Johnson, Hollister Incorporated, PolyNovo Limited, Mölnlycke Health Care AB, Medline, Urgo, Convatec Inc., Hydrofera, McKesson, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. FDA reports that every year, 2,760 people with severe burn injuries accounting for over 30% of TBSA are admitted to hospitals. The increased cases of burn injuries driving the market demand in the region. Burn injuries are more common in older persons, and they can lead to more problems and longer healing times as they have weaker immune systems and a higher risk of infection which ultimately leads to drive the demand for burn care. Advanced products are rapidly replacing traditional wound care and closure options because they are more effective at managing wounds by facilitating faster healing. Thus, technological advancements in wound management are anticipated to drive the market. Further, the increasing and steady demand for skin grafts and alternative skin substitutes for acute burns propel the market growth.

Restraining Factors

The intricacy of reimbursement and insurance policies is hampering the market for burn care. According to a 2022 American Burn Association survey, approximately 40% of burn care experts reported serious difficulties getting advanced burn care product reimbursement, which frequently causes treatment delays and puts more financial strain on patients and healthcare facilities.

Market Segmentation

The United States Burn Care Market share is classified into product, depth of burn, cause, and end-use.

- The advanced dressings segment dominates the US burn care market with the largest market share in 2023.

The United States burn care market is segmented by product into advanced dressings, biologics, traditional burn care products, and others. Among these, the advanced dressings segment dominates the US burn care market with the largest market share in 2023. Advanced dressings come with advantages such as a shorter recovery period, cost-effectiveness, and improved fluid flow over the surface of the wound. Advanced dressings are extensively used in burn care as they retain moisture or absorb exudate, regulating wound surface and safeguarding the surrounding tissue and wound foundation.

- The full-thickness burns segment dominates the market with a significant market share during the forecast period.

The United States burn care market is segmented by depth of burn into minor burns, partial burns, and full-thickness burns. Among these, the full-thickness burns segment dominates the market with a significant market share during the forecast period. The burn care for full-thickness burns requires advanced medical treatments such as skin grafting, reconstructive surgery, and extended rehabilitation. The growing emphasis on burn care treatment by the government and non-government organizations is driving the market demand.

- The thermal burns segment accounted for the largest revenue share of the US burn care market in 2023.

The United States burn care market is segmented by cause into thermal, electrical, radiation, chemical, and friction. Among these, the thermal burns segment accounted for the largest revenue share of the US burn care market in 2023. Burns brought on by flames, steam, flash, hot materials, or hot liquids are classified as thermal burns. As per the American Burn Association, forty-three percent of all burn admissions to burn centres are caused by fire burns.

- The hospitals segment held the largest market share of the US burn care market in 2023.

Based on the end-use, the U.S. burn care market is divided into hospitals, outpatient facilities, home care, and research & manufacturing. Among these, the hospitals segment held the largest market share of the US burn care market in 2023. Hospital burn centres provide expert wound treatment, pain management, and psychological support to patients suffering from burns. The National Inpatient Sample (NIS) of the Healthcare Cost and Utilisation Project (HCUP) indicates that the 29,165 burn admissions annually (weighted estimates) correspond to 88.5 admissions per million lives annually.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. burn care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Cardinal Health

- Integra LifeSciences Corporation

- DeRoyal Industries, Inc.

- Smith & Nephew

- Johnson & Johnson

- Hollister Incorporated

- PolyNovo Limited

- Mölnlycke Health Care AB

- Medline

- Urgo

- Convatec Inc.

- Hydrofera

- McKesson

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Wound care management specialist AVITA Medical obtained US Food and Drug Administration (FDA) approval for its RECELL GO skin restoration system. RECELL GO is a cell-harvesting device that utilizes the regenerative properties of a patient’s skin to treat thermal burn wounds and full-thickness skin defects.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Burn Care Market based on the below-mentioned segments:

US Burn Care Market, By Product

- Advanced Dressings

- Biologics

- Traditional Burn Care Products

- Others

US Burn Care Market, By Depth of Burn

- Minor Burns

- Partial Burns

- Full-Thickness Burns

US Burn Care Market, By Cause

- Thermal

- Electrical

- Radiation

- Chemical

- Friction

US Burn Care Market, By End-Use

- Hospitals

- Outpatient Facilities

- Home Care

- Research & Manufacturing

Need help to buy this report?