United States Busbar Market Size, Share, and COVID-19 Impact Analysis, By Conductor (Copper and Aluminium), By End-User (Utilities, Industrial, Residential, and Commercial), and U.S. Busbar Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Busbar Market Insights Forecasts to 2033

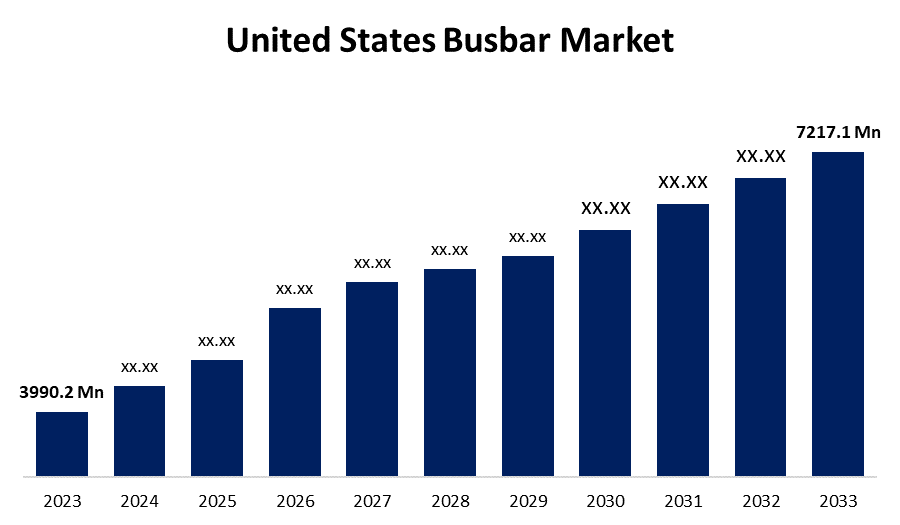

- The US Busbar Market Size was valued at USD 3,990.2 Million in 2023.

- The Market is growing at a CAGR of 6.11% from 2023 to 2033

- The U.S. Busbar Market Size is expected to reach USD 7,217.1 Million by 2033

Get more details on this report -

The US Busbar Market is Anticipated to Exceed USD 7,217.1 Million by 2033, growing at a CAGR of 6.11% from 2023 to 2033.

Market Overview

Busbar is an electrical connection point that gathers electric current from incoming lines and transfers it to outgoing lines. It includes a circuit breaker that turns off if there is a fault and separates from the busbar. It provides inexpensive and quick installation services without any interruptions, simplifying the power distribution process for more convenience and flexibility. As a result, it is widely used in American factories, data centers, retail facilities, hospitals, laboratories, universities, metros, and railways. Busbars are metal bars or strips that are essential for distributing power. Their main component is copper. Busbars are created and fine-tuned according to the performance specifications and power distribution needs of their applications. Despite being primarily focused on electricity, busbar designers must also consider the structural aspect to ensure efficient functionality and heat distribution. The main driver in the market is the increasing emphasis on energy efficiency and the preference for busbars over cables. The growth in smart city development and the switchgear and energy & power market present opportunities. Increasing investments in creating a reliable power supply network, busbar's capacity to deliver high voltage power in buildings without taking up extra space, the growing need for consistent electricity supply, and a heightened emphasis on reducing energy loss in transmission and distribution are key factors propelling market growth in the forecast period.

Report Coverage

This research report categorizes the market for the U.S. busbar market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US busbar market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. busbar market.

United States Busbar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3,990.2 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.11% |

| 2033 Value Projection: | USD 7,217.1 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 243 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Conductor, By End-User |

| Companies covered:: | ABB Ltd, American Power Connection Systems Inc, Luvata, Siemens Aktiengesellschaft, Schneider Electric SE, Rittal, Eaton Corporation PLC, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Due to growing environmental worries, there is a rise in the use of renewable energy sources for power generation in the US. Due to the increasing needs of various industries and businesses, power usage is on the rise, leading to a boost in market expansion. Furthermore, the increasing number of warehouse and storage spaces in the nation is leading to a higher need for busbars that have low power ratings. Additionally, the government has intentions to enhance the current transmission and distribution (T&D) infrastructure, which is predicted to result in a favourable market growth perspective. The cost of installing busbars is comparatively lower and does not include additional expenses for electricians. They do not need regular upkeep and are more cost-effective for remodelling or construction.

Restraining Factors

The busbar manufacturing industry is facing a significant challenge due to the increasing expenses and volatility of raw materials.

Market Segmentation

The United States busbar market share is classified into conductor and end-user.

- The aluminium segment is expected to hold the largest market share through the forecast period.

The US busbar market is segmented by conductor into copper and aluminium. Among them, the aluminium segment is expected to hold the largest market share through the forecast period. The aluminium busbar is commonly used in large-scale power transmission. It possesses a technical characteristic like strong metal durability and lightweight. Additionally, due to its strong mechanical properties and lightweight characteristics. The ability to transport heavier loads over extended distances and cost efficiency compared to other available options.

- The commercial segment dominates the market with the largest market share over the predicted period.

The US busbar market is segmented by end-user into utilities, industrial, residential, and commercial. Among them, the commercial segment dominates the market with the largest market share over the predicted period. Growing power needs due to rapid urbanization and commercialization will thrive in the business environment. Additionally, there has been a rise in the energy-efficient technology utilized by businesses. The strong economic growth in the country is driving the manufacturing industry, leading to a promising forecast for the industrial busbar market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States busbar market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd

- American Power Connection Systems Inc

- Luvata

- Siemens Aktiengesellschaft

- Schneider Electric SE

- Rittal

- Eaton Corporation PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2021, Siemens installed a bus depot equipped with charging and power distribution technology using busbar trunking to improve the power supply at the eBus charging stations. The company expanded its diverse range of businesses to increase revenue and earnings.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Busbar Market based on the below-mentioned segments:

United States Busbar Market, By Conductor

- Copper

- Aluminium

United States Busbar Market, By End-User

- Utilities

- Industrial

- Residential

- Commercial

Need help to buy this report?