United States Business Jet Market Size, Share, and COVID-19 Impact Analysis, By Type (Light, Medium, Large), By Business Model (On-Demand Service, Ownership), By Range (< 3,000 NM, 3,000 - 5,000 NM, > 5000 NM), and United States Business Jet Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationUnited States Business Jet Market Insights Forecasts to 2033

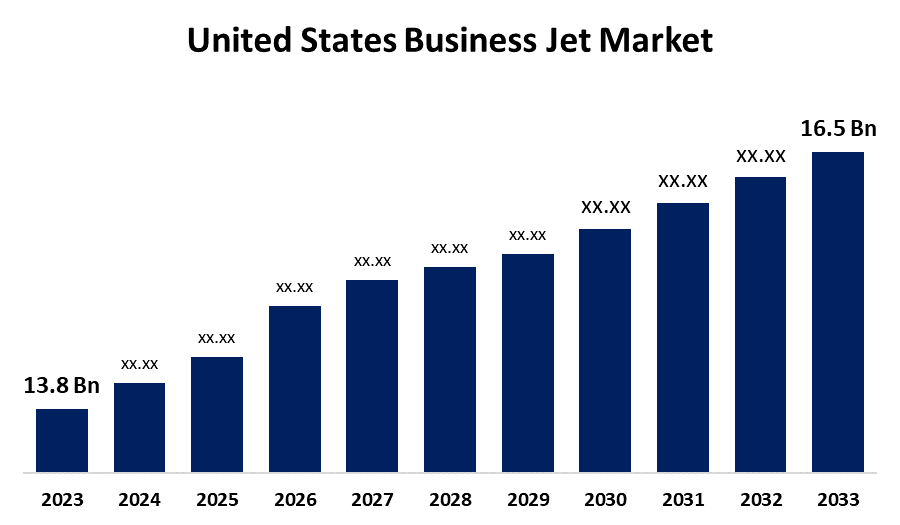

- The United States Business Jet Market Size was Valued at USD 13.8 Billion in 2023

- The United States Business Jet Market Size is Growing at a CAGR of 1.80% from 2023 to 2033

- The United States Business Jet Market Size is Expected to Reach USD 16.5 Billion by 2033

Get more details on this report -

The United States Business Jet Market Size is anticipated to exceed USD 16.5 Billion by 2033, Growing at a CAGR of 1.80% from 2023 to 2033. The United States business jet market is propelled by increased demand for private air travel, technology, and fractional ownership increases. High expenses, regulations, and environmental issues are still the main challenges that affect market growth.

Market Overview

The US business jet market includes the manufacture, production, sale, and operation of business aircraft for private use. The jets offer convenient, flexible air travel for corporations, individuals, and government agencies for purposes such as corporate transportation, recreation, medical evacuations, and diplomatic services, providing exclusivity and convenience over commercial aviation. Moreover, Key drivers of potential growth in the United States business jet market are growing demand for time-efficient travel, higher corporate profits, and the number of high-net-worth individuals. Technological advancements in the aviation sector, such as fuel-efficient engines and sustainable aviation fuel (SAF), also contribute significantly. Increased charter services, fractional ownership schemes, and requirements for private and flexible travel arrangements further enhance market demand, and economic recovery is driving long-term growth opportunities. Furthermore, opportunities driving the US jet market are growing air mobility networks, developing markets for on-demand chartering, green aviation technology adoption, and growing demand for specialized mission jets. For instance, In June 2023, Gulfstream Aerospace Corp. announced further expansion of its completions and outfitting facilities at St. Louis Downtown Airport. With the new expansion, Gulfstream will be increasing completion activity at the location while upgrading its current facilities by installing new, state-of-the-art equipment and tooling, a total capital investment of USD 28.5 million.

Report Coverage

This research report categorizes the market for the US business jet market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States business jet market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA business jet market.

United States Business Jet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.80% |

| 2033 Value Projection: | USD 16.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Business Model, By Range |

| Companies covered:: | General Dynamics Corporation, Honda Motor Co., Ltd., Pilatus Aircraft Ltd, Textron Inc., Bombardier Inc., Cirrus Design Corporation, Dassault Aviation, and Embraer. |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Major drivers of the US jet market are the increasing focus on business continuity through effective travel, post-pandemic trends toward private aviation for security, and the increasing use of hybrid work models requiring agile mobility. Growing urbanization and infrastructural development in regional airports, coupled with advancements in jet performance, cabin comfort, and digital solutions, are also driving demand. Moreover, changing customer preferences for customized travel experiences enhances market growth. Additionally, U.S. celebrities, pop artists, and sports professionals frequently use business jets for international travel to red-carpet premieres, performances, and fan meet-and-greets. For instance, Taylor Swift's 'The Eras Tour' (2023-2024) was conducted across five continents, necessitating regular back-and-forth journeys between cities such as Tokyo, Paris, and Rio. Business jets provide adaptability and effectiveness, allowing artists to maximize intensive schedules and overseas commitments.

Restraining Factors

Restraints for the US business jet market are high purchase and maintenance prices, strict regulations, increasing fuel costs, pilot shortages, and increased environmental pressures related to carbon emissions from private flights.

Market Segmentation

The United States business jet market share is classified into type, business model, and range.

- The large segment accounted for the largest share of the United States business jet market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of type, the United States business jet market is divided into light, medium, and large. Among these, the large segment accounted for the largest share of the United States business jet market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Large jets command the biggest market share because it has the longest range, best amenities, and ability to fly internationally, and therefore are most suitable for corporate executives and high-net-worth individuals who want long-distance, effective air travel solutions.

- The on-demand service segment accounted for a substantial share of the United States business jet market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the business model, the US business jet market is divided into on-demand service and ownership. Among these, the on-demand service segment accounted for a substantial share of the United States business jet market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is due to their cost-effectiveness, flexibility, and affordability. Such models suit private individuals and businesses requiring private aviation privileges without long-term financial and operating responsibilities for outright ownership.

- The 3,000 - 5,000 NM segment accounted for the largest share of the United States business jet market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of range, the United States business jet market is divided into < 3,000 NM, 3,000 - 5,000 NM, and> 5000 NM. Among these, the 3,000 - 5,000 NM segment accounted for the largest share of the United States business jet market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of its even range and effectiveness; it is most suited for both domestic and transcontinental flights. These jets appeal to companies and individuals alike due to their versatility and affordability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA jet market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Dynamics Corporation

- Honda Motor Co., Ltd.

- Pilatus Aircraft Ltd

- Textron Inc.

- Bombardier Inc.

- Cirrus Design Corporation

- Dassault Aviation

- Embraer

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Textron Aviation reported it signed a purchase agreement with Fly Alliance for as many as 20 Cessna Citation business jets, with options on 16 more planes. Fly Alliance plans to operate the aircraft in its luxury private jet charter service. It planned for delivery of the first aircraft, an XLS Gen2, in 2023.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U business jet market based on the below-mentioned segments:

United States Business Jet Market, By Type

- Light

- Medium

- Large

United States Business Jet Market, By Business Model

- On-Demand Service

- Ownership

United States Business Jet Market, By Range

- < 3,000 NM

- 3,000 - 5,000 NM

- >5000 NM

Need help to buy this report?