United States Buy Now Pay Later Services Market Size, Share, and COVID-19 Impact Analysis, By Channel (Online and POS), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), By End-use (Retail, Healthcare, and Leisure & Entertainment), and United States Buy Now Pay Later Services Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Buy Now Pay Later Services Market Insights Forecasts to 2033

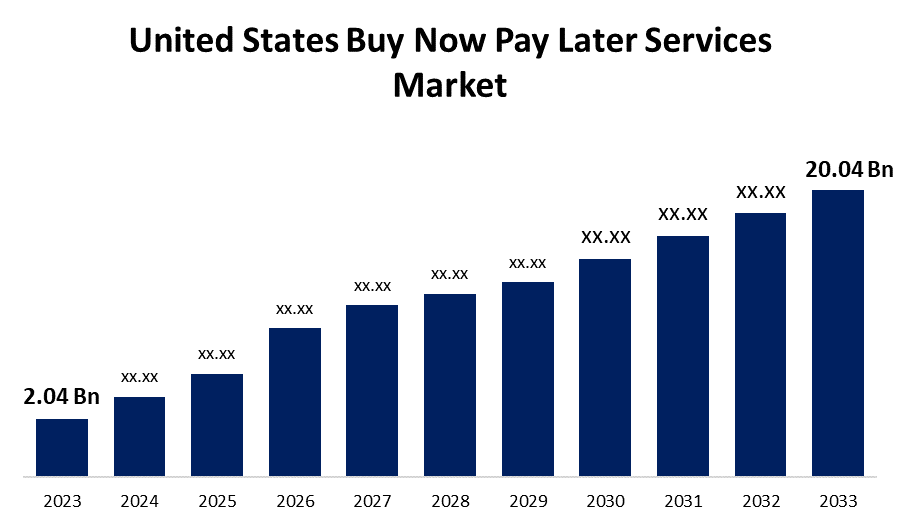

- The United States Buy Now Pay Later Services Market Size was valued at USD 2.04 Billion in 2023.

- The Market is growing at a CAGR of 25.67% from 2023 to 2033

- The United States Buy Now Pay Later Services Market Size is expected to reach USD 20.04 Billion by 2033

Get more details on this report -

The United States Buy Now Pay Later Services Market is anticipated to exceed USD 20.04 Billion by 2033, growing at a CAGR of 25.67% from 2023 to 2033.

Market Overview

The term "buy now pay later" (BNPL) describes financial services that let customers make upfront purchases of items and postpone making payments. It is made up of several steps and parts, including application procedures, retail partners, payment systems, credit evaluation, repayment plans, and interest charges. In recent years, the buy now pay later (BNPL) industry has grown in popularity in the United States. The ease it provides to customers is one of the key factors behind its rise. Customers who might not have instant cash on hand can purchase goods and services with BNPL since they can do so without having to pay the full amount up front. This enables clients to break up the expense of the purchase across time, which facilitates better money management and budgeting. By giving credit schemes an additional layer, BNPL develops an economic model. Companies that are BNPL and are listed on stock markets across the globe are reporting higher stock prices. Generally speaking, BNPL is a way to spread out payments for purchases purchased from retailers over a short period. Several companies are dominating the industry by offering private credit at multiple merchant stores, including Synchrony, Affirm, and Afterpay. To improve financial management, BNPL spreads out the cost of acquisition and offers its service by examining the borrower's capacity for payment; merchants are crucial in locating these clients.

Report Coverage

This research report categorizes the market for the United States buy now pay later services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the buy now pay later services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the buy now pay later services market.

Driving Factors

United States Buy Now Pay Later Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.04 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 25.67% |

| 2033 Value Projection: | USD 20.04 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Channel, By Enterprise Size, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Afterpay US Services, LLC, PayPal Holdings, Inc., Affirm, Inc., Splitit, Sezzle, Perpay, Inc., Uplift, Inc., Amazon, Quadpay, Inc., Klarna, Inc., and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

In the retail sector, BNPL services are frequently utilized to boost conversion rates by lowering transactional friction. Additionally, a lot of shops use BNPL services to provide exclusive financing plans and price breaks to draw in more customers during promotional campaigns and seasonal discounts. Another reason driving development is the ability of clients to afford premium and luxury products, which is made possible by BNPL services. Patients frequently utilize them to pay for recurring, high-cost medical procedures and treatments. The market is expanding because of the widespread use of subscription-based healthcare services like wellness memberships, mental health counseling, and telemedicine platforms. The application of artificial intelligence (AI) in BNPL services to evaluate customer creditworthiness, optimize workflows, and detect possible fraud threats is driving market expansion.

Restraining Factors

There are numerous alternative options for payment, such as post-dated cheques, financing using credit and debit cards, and much more. The industry's overall growth is hindered by the availability of multiple payment options and a lack of awareness among consumers, retailers, and merchants.

Market Segmentation

The United States buy now pay later services market share is classified into channel, enterprise size, and end-use.

- The online segment is expected to hold the largest market share through the forecast period.

The United States buy now pay later services market is segmented by channel into online and POS. Among these, the online segment is expected to hold the largest market share through the forecast period. The proliferation of e-commerce and virtual shopping has facilitated consumers' access to an extensive array of goods and services from the convenience of their homes. By giving clients the option to pay for their products in installments, BNPL alternatives have grown in popularity as a means for online shops to draw in and keep customers. Because customers can apply for and access BNPL choices straight from the retailer's website or application without needing to visit a physical store or talk with a salesperson, the online channel provides a smoother and more convenient shopping experience for customers.

- The large enterprises segment dominates the market with the largest market share over the predicted period.

The United States buy now pay later services market is segmented by enterprise size into large enterprises and small & medium enterprises. Among these, the large enterprises segment dominates the market with the largest market share over the predicted period. Offering BNPL alternatives to consumers is becoming more common among shops and e-commerce companies, especially those with large average order values, as a way to boost sales and foster customer loyalty. To give seamless payment choices to their clients, large organizations might afford to invest in cutting-edge technological systems and develop collaborations with top providers of BNPL solutions. They also possess the risk management capabilities and financial stability to cover any losses brought on by missed payments or defaults.

- The retail segment is expected to hold the largest share of the United States buy now pay later services market during the forecast period.

Based on the end use, the United States buy now pay later services market is divided into retail, healthcare, and leisure & entertainment. Among these, the retail segment is expected to hold the largest share of the United States buy now pay later services market during the forecast period. To boost consumer conversion rates and give customers more flexible payment alternatives, retailers are progressively providing BNPL options at checkout. Additionally, retailers are collaborating with BNPL solution providers to provide their clients with specialized financing choices. Furthermore, younger generations, who value flexibility and convenience in their purchasing experiences, have found BNPL solutions especially appealing due to their simplicity and ease of use. Therefore, it is anticipated that during the projection period, the retail end-use sector will continue to dominate the U.S. BNPL market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States buy now pay later services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Afterpay US Services, LLC

- PayPal Holdings, Inc.

- Affirm, Inc.

- Splitit

- Sezzle

- Perpay, Inc.

- Uplift, Inc.

- Amazon

- Quadpay, Inc.

- Klarna, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, Fiserv and Affirm announced their relationship, with Affirm to be made available to Fiserv enterprise merchant clients by year's end. Through this collaboration, Affirm will be the first company to offer buy now, pay later services that are completely integrated into Fiserv's Carat operating system.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Buy Now Pay Later Services Market based on the below-mentioned segments:

United States Buy Now Pay Later Services Market, By Channel

- Online

- POS

United States Buy Now Pay Later Services Market, By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

United States Buy Now Pay Later Services Market, By End-Use

- Retail

- Healthcare

- Leisure & Entertainment

Need help to buy this report?