United States Captive Power Generation Market Size, Share, and COVID-19 Impact Analysis, By Technology Type (Heat Exchanger, Turbines, Gas Engines, Transformers, and Others), By Fuel Type (Diesel, Gas, Coal, and Others), By Ownership (Single Ownership, Multiple Ownership), and United States Captive Power Generation Market Insights Forecasts 2023 – 2033

Industry: Energy & PowerUnited States Captive Power Generation Market Insights Forecasts to 2033

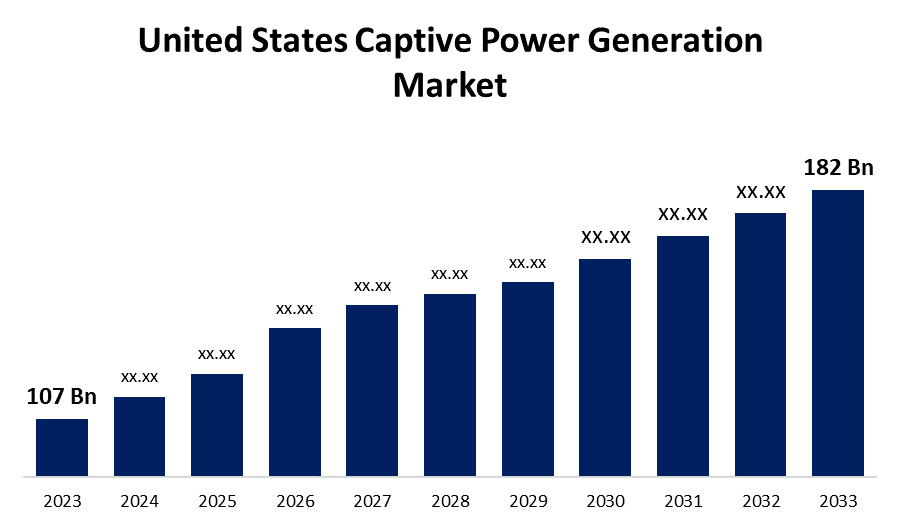

- The United States Captive Power Generation Market Size was valued at USD 107 Billion in 2023

- The Market Size is Growing at a CAGR of 5.46% from 2023 to 2033.

- The United States Captive Power Generation Market Size is Expected to Reach USD 182 Billion by 2033.

Get more details on this report -

The United States Captive Power Generation Market size is Expected to Reach USD 182 Billion by 2033, at a CAGR of 5.46% during the forecast period 2023 to 2033.

Market Overview

Power generation is defined as the process of converting various types of energy into electrical energy. Most modern applications require power (residential, commercial, and industrial), and power generation sources are generally classified as renewable or non-renewable. Electricity can be generated at a power plant (typically by electromechanical generators) using heat engines powered by combustion, nuclear fission, or other methods such as the kinetic energy of flowing water/wind, among others. Furthermore, the United States captive power generation market is expanding rapidly, driven by a number of factors reshaping the energy landscape. With a growing demand for dependable and resilient power solutions, businesses are increasingly turning to captive power generation to ensure continuous operations. As sustainability concerns and cost considerations gain traction, the Unite States captive power generation market leads in this regard, providing businesses with a strategic approach to meeting their changing energy needs while navigating an evolving and dynamic energy landscape. These facilities generate electricity using a variety of energy sources, including fossil fuels, nuclear, solar, geothermal, wind, and water. The majority of electrical energy in modern power systems comes from nonrenewable sources like coal, oil, and natural gas. Power generation is used in a variety of industries, including utilities, industrial, combined heat and power (CHP) systems, wastewater, oil and gas plants, commercial and public buildings, and more.

Report Coverage

This research report categorizes the market for the United States captive power generation market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States captive power generation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States captive power generation market.

United States Captive Power Generation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 107 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.46% |

| 2033 Value Projection: | USD 182 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology Type, By Fuel Type, By Ownership and COVID-19 Impact Analysis. |

| Companies covered:: | General Electric Company, Siemens AG, Caterpillar Inc., Cummins Inc., Schneider Electric SE, Wärtsilä Corporation, Rolls-Royce Holdings plc, Capstone Turbine Corporation, Mitsubishi Power, Ltd., ABB Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the United States captive power generation market is critical for improving energy resilience and reliability. The United States captive power generation market is characterized by the continuous evolution and integration of advanced distributed generation technologies. Furthermore, the integration of smart technologies improves the performance of captive power systems by allowing for real-time monitoring, control, and predictive maintenance. This not only improves the overall reliability of on-site power generation but also leads to better energy management and cost-effectiveness. Furthermore, energy independence improves national security by lowering the susceptibility of critical infrastructure to external disruption. Industries critical to national interests, such as defense and telecommunications, can benefit significantly from the security and autonomy provided by captive power generation, and the quest for energy independence is the third driver propelling the captive power generation market in the United States.

Restraining Factors

A captive power plant faces significant operating and maintenance costs. Thermal facilities contain complex machinery and equipment that must be handled with care by qualified personnel. Machine problems occur frequently, necessitating additional maintenance. The facility's ability to expand its capacity and resources is hampered by a lack of current equipment and qualified employees for maintenance and operations.

Market Segment

- In 2023, the gas engines segment accounted for the largest revenue share over the forecast period.

Based on technology type, the United States captive power generation market is segmented into heat exchangers, turbines, gas engines, transformers, and others. Among these, the gas engines segment has the largest revenue share over the forecast period. Gas engines' dominance can be attributed to their adaptability, efficiency, and compatibility with a wide range of applications across various industries. Gas engines provide a dependable and cost-effective solution for on-site power generation, especially in applications that require fuel flexibility. These engines can run efficiently on natural gas, biogas, or even synthetic gases, giving businesses the freedom to select fuel sources based on availability, cost, and environmental concerns. Gas engines also have quick start-up times and can respond quickly to changing energy demands, which contributes to their popularity in applications with dynamic load profiles. Furthermore, the growing emphasis on sustainability and environmental responsibility has promoted the adoption of gas engines, which are known for producing lower emissions than traditional power generation technologies. Gas engines' adaptability, efficiency, and environmental benefits align with industries' changing energy needs, ensuring their continued dominance as a preferred technology type in the United States captive power generation market over the forecast period.

- In 2023, the waterways activity segment is witnessing significant CAGR growth over the forecast period.

Based on fuel type, the United States captive power generation market is segmented into diesel, gas, coal, and others. Among these, the waterways activity segment is witnessing the significant CAGR growth over the forecast period. Diesel-based captive power generation systems have maintained their popularity due to their widespread use in a variety of industries, providing a dependable and efficient source of on-site power. The diesel segment's dominance can be attributed to several factors, including well-established diesel distribution infrastructure, ease of storage and transportation, and diesel engines' ability to deliver consistent power output. Furthermore, diesel generators have high fuel efficiency, and advances in engine technology continue to improve their overall performance and environmental impact. The ability of diesel generators to respond quickly to unexpected power outages adds to their resilience in emergencies. Looking ahead, the diesel segment is expected to maintain its dominance as a fuel type in the United States captive power generation market, aided by ongoing technological advancements that improve efficiency and lower emissions. Diesel distribution's adaptability, reliability, and established infrastructure all contribute to its continued prominence, ensuring that diesel-based captive power generation will remain a cornerstone of on-site power solutions for the foreseeable future.

- In 2023, the multiple ownership segment accounted for the largest revenue share over the forecast period.

Based on the ownership, the United States captive power generation market is segmented into single ownership and multiple ownership. Among these, the multiple ownership segment has the largest revenue share over the forecast period. multiple ownership, also known as shared or community captive power generation, has grown in popularity due to its ability to facilitate collaborative energy initiatives by allowing multiple entities to invest in and benefit from on-site power generation systems. This segment's dominance is fueled by the benefits of shared ownership, such as cost-sharing, risk mitigation, and increased access to capital for captive power projects. Looking ahead, the multiple ownership segment is expected to remain dominant as businesses recognize the strategic benefits of shared investment in captive power generation. The model not only supports sustainability goals but also promotes energy independence and resilience within a community or business cluster. As the United States captive power generation market evolves, the multiple ownership model is expected to remain a key driver, encouraging collaborative energy solutions that contribute to the decentralization and sustainability of the country's energy infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States captive power generation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric Company

- Siemens AG

- Caterpillar Inc.

- Cummins Inc.

- Schneider Electric SE

- Wärtsilä Corporation

- Rolls-Royce Holdings plc

- Capstone Turbine Corporation

- Mitsubishi Power, Ltd.

- ABB Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, PowerTech Solutions, a major player in the US Captive Power Generation Market, introduced an innovative energy storage solution, representing a significant advancement in on-site power generation technology. The new solution uses cutting-edge battery storage technology to improve the efficiency and reliability of captive power systems. PowerTech Solutions aims to address the intermittent nature of renewable energy sources by offering seamless energy storage capabilities, allowing businesses to store excess energy during low-demand periods and release it during peak demand or grid outages. This development is consistent with the industry's emphasis on optimizing energy management and ensuring a continuous power supply, contributing to the evolution of resilient and sustainable captive power solutions.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Captive Power Generation Market based on the below-mentioned segments:

United States Captive Power Generation Market, By Technology Type

- Heat Exchanger

- Turbines

- Gas Engines

- Transformers

- Others

United States Captive Power Generation Market, By Fuel Type

- Diesel

- Gas

- Coal

- Others

United States Captive Power Generation Market, By Ownership

- Single Ownership

- Multiple Ownership

Need help to buy this report?