United States Car Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Third-Party Liability Coverage, Collision, Comprehensive, and Others), By Distribution Channel (Insurance Agents & Brokers, Direct Response, Banks, and Others), and United States Car Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Car Insurance Market Insights Forecasts to 2033

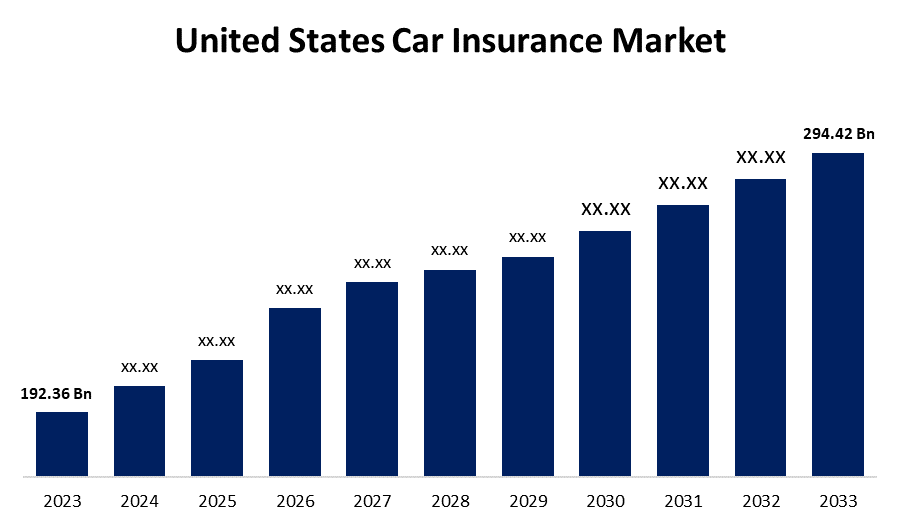

- The United States Car Insurance Market Size was valued at USD 192.36 Billion in 2023.

- The Market is growing at a CAGR of 4.35 % from 2023 to 2033

- The United States Car Insurance Market Size is expected to reach USD 294.42 Billion by 2033

Get more details on this report -

The United States Car Insurance Market is anticipated to exceed USD 294.42 Billion by 2033, growing at a CAGR of 4.35 % from 2023 to 2033.

Market Overview

The owner purchases car insurance coverage to shield their investment from loss and/or damage brought on by unforeseen and unavoidable events. It offers protection against theft, full or partial damage, and third-party liability resulting from car accidents. All registered automobiles in the United States are required by law to carry mandatory auto liability insurance to safeguard other people from unintentional injuries. These mandatory auto insurance policies lack coverage for the insured, third-party property damage, and repair or replacement of damaged vehicles, which leaves the market invalid and gives insurance companies a chance to introduce their specialized policies. Car insurance solutions are moving in a new direction due to emerging digital and technological advances. The non-life insurance market is growing steadily, which has prompted more and more auto insurance companies to launch online tools for purchasing, renewing, and filing claims. The requirement for car insurance is the main factor driving the market for car insurance.

Report Coverage

This research report categorizes the market for the United States car insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States car insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States car insurance market.

United States Car Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 192.36 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.35 % |

| 2033 Value Projection: | USD 294.42 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coverage,By Distribution Channel |

| Companies covered:: | State Farm Mutual Automobile Insurance, Clearcover, USAA Insurance Group., Amica, Berkshire Hathaway Inc., The Hartford, Progressive Corp., Metromile, Allstate Corp., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The insurance sector in the United States is constantly growing because of digital innovation. With the increasing use of data analytics, artificial intelligence-enabled tools, and other online platforms, United States auto insurance companies are developing products that meet the needs of the growing market. Furthermore, the requirement for motor insurance is the main factor driving the market for car insurance. Laws requiring auto owners to carry minimum liability coverage to protect third parties in the event of an accident are frequently enforced by governments. In addition, car insurance premium prices offered and charged by insurance firms have been steadily declining in the United States; as a result, more automobile owners are purchasing insurance, and car insurance providers' gross written premiums are rising. These factors, drive the growth of the car insurance market.

Restraining Factors

The car insurance market is hindered by some factors, such as insurance scams, fraudulent activities, and fraudulent claims. Customers' premiums may increase as a result of these fraudulent acts, which also drive up expenses for insurers. For insurance companies to successfully address these issues, they must make investments in reliable fraud detection systems and procedures.

Market Segmentation

The United States car insurance market share is classified into coverage and distribution channel.

- The third-party liability coverage segment is expected to hold the largest market share through the forecast period.

The United States car insurance market is segmented by coverage into third-party liability coverage, collision, comprehensive, and others. Among these, the third-party liability coverage segment is expected to hold the largest market share through the forecast period. Liability coverage for third parties involved in accidents caused by the insured vehicle is provided by this type of coverage. The understanding of legal requirements and the necessity of adhering to legislation about required car insurance can be ascribed to the demand for third-party insurance. It is less expensive than comprehensive insurance, and individuals on low incomes may find it appealing.

- The direct response segment dominates the market with the largest market share over the predicted period.

The United States car insurance market is segmented by distribution channel into insurance agents & brokers, direct response, banks, and others. Among these, the direct response segment dominates the market with the largest market share over the predicted period. It comprises insurance providers offering plans to clients directly via their channels. With this method, clients can easily communicate with the insurance company directly, which enables tailored support and efficient procedures. Insurance companies can build direct contact with their clients through direct sales, which promotes brand loyalty and trust.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States car insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- State Farm Mutual Automobile Insurance

- Clearcover

- USAA Insurance Group.

- Amica

- Berkshire Hathaway Inc.

- The Hartford

- Progressive Corp.

- Metromile

- Allstate Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, AXA S.A. launched STeP, their newest digital claims solution that improves the car insurance application procedure.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States car insurance market based on the below-mentioned segments:

United States Car Insurance Market, By Coverage

- Third-Party Liability Coverage

- Collision

- Comprehensive

- Others

United States Car Insurance Market, By Distribution Channel

- Insurance Agents & Brokers

- Direct Response

- Banks

- Others

Need help to buy this report?