United States Cardiovascular Needle Market Size, Share, and COVID-19 Impact Analysis, By Type (Round-Bodied Needles and Cutting Needles), By Application (Open Heart Surgery and Cardiac Valve Procedures), By Usage (Single Use and Multiple Uses), and United States Cardiovascular Needle Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Cardiovascular Needle Market Insights Forecasts to 2033

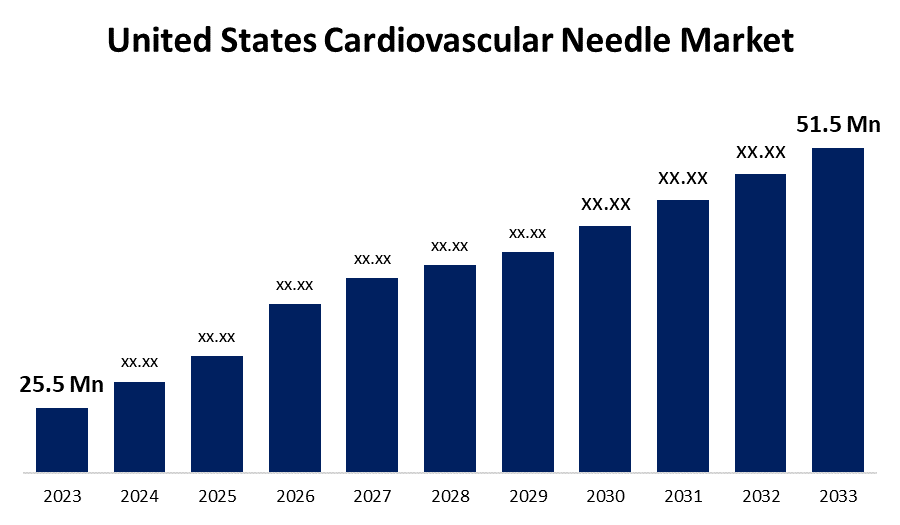

- The U.S. Cardiovascular Needle Market Size was valued at USD 25.5 Million in 2023.

- The Market is growing at a CAGR of 7.28% from 2023 to 2033

- The U.S. Cardiovascular Needle Market Size is expected to reach USD 51.5 Million by 2033

Get more details on this report -

The United States Cardiovascular Needle Market is anticipated to exceed USD 51.5 Million by 2033, growing at a CAGR of 7.28% from 2023 to 2033. The growing number of cardiovascular procedures, prevalence of cardiovascular conditions, urbanization, old age population, and US healthcare expenditure are driving the growth of the cardiovascular needle market in the US.

Market Overview

Cardiovascular needles are utilized in a variety of heart and vascular interventions to seal the surgical wound. They are made from two new stainless-steel alloys with high nickel concentrations: Surgalloy and Ethalloy. Different types of surgeries, including open heart surgery, coronary artery bypass graft surgery, cardiac valve surgery, and heart transplantation, surge the need for cardiovascular needles. The market for cardiovascular needles has more potential because innovative materials and designs have made it possible for cutting-edge technologies. The increasing technological improvements, as well as the introduction of novel goods and techniques such as cardiovascular needles with laser drilling, would boost suturing effectiveness and propel market expansion. Further, the integration of telemedicine and AI in cardiovascular surgery is anticipated to leverage market opportunities.

Report Coverage

This research report categorizes the market for the US cardiovascular needle market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Cardiovascular Needle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US cardiovascular needle market.

United States Cardiovascular Needle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.28% |

| 2033 Value Projection: | USD 51.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Usage |

| Companies covered:: | Johnson & Johnson Inc., Becton, Dickinson and Company (BD), Teleflex Incorporated, Medtronic Plc, KLS Martin Group, CP Medical, Meril Life Science, Rumex International Corporation, Sklar Surgical Instruments, FSSB surgical needles GmbH, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

In the United States, cardiovascular disease affects at least 48.0% of individuals, according to the American Heart Association. Thus, the increased prevalence of cardiovascular conditions is driving the market demand. In the 2022 year, 20,399,425 cardiovascular procedures were carried out in the United States. The growing number of cardiovascular procedures, including open heart surgery, cardiac valve procedures, heart transplant procedures, and coronary artery bypass graft treatment, surges the need for cardiovascular needles, which is also responsible for propelling market growth. Further, the increased urbanization, old age population, and US healthcare expenditure are significantly contributing to market growth.

Restraining Factors

The increasing usage of surgical staples and the high expense of cardiac treatments are two more issues hindering market growth. Further, as robotic treatments necessitate stapling wounds, the use of robots in cardiovascular surgery has reduced the need for needles.

Market Segmentation

The United States Cardiovascular Needle Market share is classified into type, application, and usage.

- The round-bodied needles segment dominated the market with the largest market share in 2023.

The United States cardiovascular needle market is segmented by type into round-bodied needles and cutting needles. Among these, the round-bodied needles segment dominated the market with the largest market share in 2023. Round bodied needles are the most common form of needle, employed in all soft tissue approximations, including cardiovascular surgery. The quick tissue separation and leak-proof suture of this needle drive the market.

- The open heart surgery segment is anticipated to hold the largest market share during the forecast period.

The United States cardiovascular needle market is segmented by application into open heart surgery and cardiac valve procedures. Among these, the open heart surgery segment is anticipated to hold the largest market share during the forecast period. The CC needle's unique tip design offers noticeably better penetrating properties for cardiac and vascular surgery. The increase in vascular dysfunction and congenital anomalies in the elderly population is driving market growth.

- The single use segment is expected to grow at the fastest CAGR during the forecast period.

Based on the usage, the U.S. cardiovascular needle market is divided into single use and multiple uses. Among these, the single use segment is expected to grow at the fastest CAGR during the forecast period. Unlike multipe use needles, which would be cleaned and reused, single use needles prevent the spread of blood-borne diseases. The decreased risk of accidental contamination and low-maintenance of single use cardiovascular needles are driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. cardiovascular needle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson Inc.

- Becton, Dickinson and Company (BD)

- Teleflex Incorporated

- Medtronic Plc

- KLS Martin Group

- CP Medical

- Meril Life Science

- Rumex International Corporation

- Sklar Surgical Instruments

- FSSB surgical needles GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Cardiovascular Needle Market based on the below-mentioned segments:

US Cardiovascular Needle Market, By Type

- Round-Bodied Needles

- Cutting Needles

US Cardiovascular Needle Market, By Application

- Open Heart Surgery

- Cardiac Valve Procedures

US Cardiovascular Needle Market, By Usage

- Single Use

- Multiple Uses

Need help to buy this report?