The United States Care Management Solutions Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services), By Type (Standalone and Integrated), and By United States Care Management Solutions Market Insights Forecasts to 2033

Industry: Information & TechnologyUnited States Care Management Solutions Market Insights Forecasts to 2033

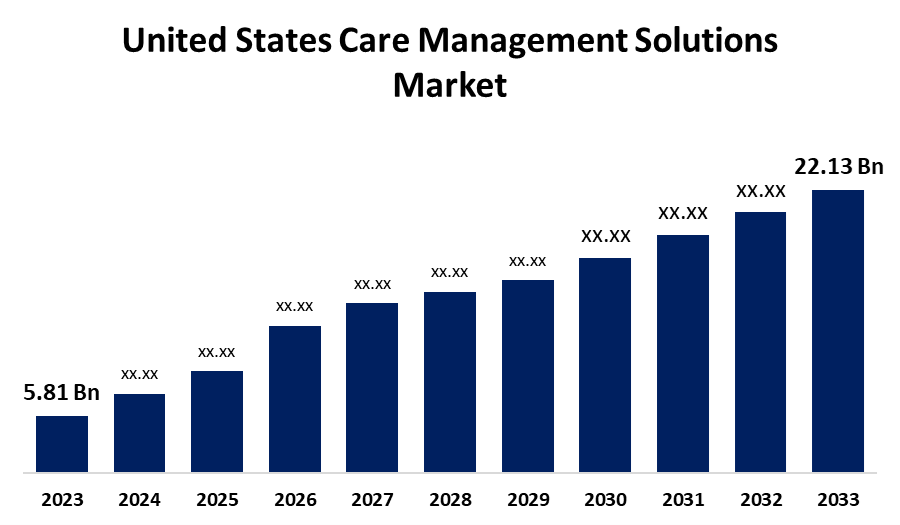

- The United States Care Management Solutions Market Size was valued at USD 5.81 Billion in 2023.

- The Market is growing at a CAGR of 14.31% from 2023 to 2033

- The United States Care Management Solutions Market Size is Expected to Reach USD 22.13 Billion by 2033

Get more details on this report -

The United States Care Management Solutions Market is Anticipated to Exceed USD 22.13 Billion by 2033, growing at a CAGR of 14.31% from 2023 to 2033.

Market Overview

The United States care management solutions market comprises the sector focused on software and services designed to enhance patient care coordination, optimize healthcare workflows, and improve clinical outcomes. These solutions integrate healthcare data from multiple sources, facilitating population health management, chronic disease management, and personalized treatment plans. The market is driven by the growing need for cost-effective healthcare delivery, the increasing prevalence of chronic diseases, and advancements in digital health technologies. With the ongoing transition toward value-based care models, healthcare providers are increasingly adopting care management solutions to enhance efficiency and improve patient engagement. Several factors contribute to the growth of this market. The rising adoption of electronic health records (EHRs) and interoperability solutions is a key driver, enabling seamless data exchange among healthcare providers. Additionally, the increasing demand for integrated healthcare systems and real-time patient monitoring has accelerated the adoption of advanced care management platforms. The shift toward patient-centric care, combined with advancements in artificial intelligence and predictive analytics, further supports market expansion. Government initiatives play a crucial role in shaping the market landscape. Programs such as the Medicare Access and CHIP Reauthorization Act (MACRA) and the implementation of the 21st Century Cures Act emphasize interoperability and data-sharing standards. Federal investments in healthcare IT infrastructure and regulatory mandates for care coordination continue to drive the adoption of care management solutions, positioning the United States as a leading market for digital health innovations.

Report Coverage

This research report categorizes the market for the United States care management solutions market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States care management solutions market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States care management solutions market sub-segment.

Driving Factors

The United States care management solutions market is driven by several key factors. The growing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, has increased the demand for advanced care coordination and patient management solutions. The shift toward value-based care models and reimbursement structures incentivizes healthcare providers to adopt care management technologies for improved efficiency and patient outcomes. The rapid adoption of electronic health records (EHRs) and interoperability solutions facilitates seamless data exchange. Additionally, advancements in artificial intelligence and predictive analytics enhance personalized treatment plans, while regulatory policies promoting healthcare IT adoption further accelerate market growth.

Restraining Factors

The United States care management solutions market faces challenges such as high implementation costs, data security concerns, interoperability issues between systems, and resistance to adopting new technologies, which may hinder market growth and adoption rates.

Market Segment

The U.S. care management solutions market share is classified into components and types.

- The software segment is expected to hold the largest market share through the forecast period.

The US care management solutions market is segmented by components into software and services. Among these, the software segment is expected to hold the largest market share through the forecast period. This dominance is attributed to the increasing adoption of electronic health records (EHRs) and the need for integrated healthcare systems that enhance patient care coordination and data management. The software solutions offer advanced functionalities, including real-time data analytics, predictive modeling, and decision support, which are essential for effective care management.

- The integrated segment is expected to hold the largest market share through the forecast period.

The US care management solutions market is segmented by type into standalone and integrated. Among these, the integrated segment is expected to hold the largest market share through the forecast period. This trend is driven by the increasing demand for comprehensive solutions that facilitate seamless data exchange and interoperability across various healthcare systems. Integrated care management solutions enable healthcare providers to coordinate patient care more effectively, leading to improved clinical outcomes and operational efficiency

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States care management solutions market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Veradigm LLC (Allscripts Healthcare, LLC)

- Epic Systems Corporation

- Cognizant

- Koninklijke Philips N.V.

- Oracle (Cerner Corp.)

- ZeOmega

- Medecision

- IBM

- ExlService Holdings, Inc.

- HealthSnap, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Innovaccer Inc., a leading company in healthcare AI, secured USD 275 million in its Series F funding round. This recent funding achievement increases Innovaccer’s total capital raised to USD 675 million and positions the company for substantial progress in healthcare technology. The capital will be used to enhance Innovaccer’s Healthcare Intelligence Cloud, grow its developer ecosystem, and strengthen partnerships with its current customers.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States care management solutions market based on the below-mentioned segments:

United States Care Management Solutions Market, By Component

- Software

- Services

United States Care Management Solutions Market, By Type

- Standalone

- Integrated

Need help to buy this report?