United States Cargo Container X-ray Inspection Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Stationary Type and Mobile Type), By Application (Airports, Seaports, and Border Crossings/Roadways), and United States Cargo Container X-ray Inspection Systems Market Insights Forecasts to 2033

Industry: Automotive & TransportationUnited States Cargo Container X-ray Inspection Systems Market Insights Forecasts to 2033

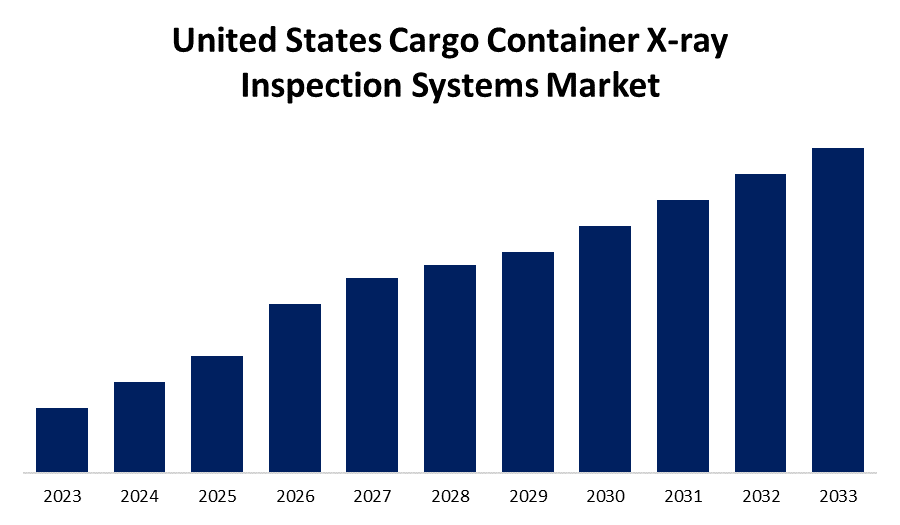

- The Market is growing at a CAGR of 5.9% from 2023 to 2033

- The US Cargo Container X-ray Inspection Systems Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Cargo Container X-ray Inspection Systems Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 5.9% from 2023 to 2033.

Market Overview

The cargo inspection consists of the growing numbers of merchandise and the risk of terrorist attacks to boost cargo examination. New methods are devised, and the scope of this field expands as the contents of the transportation system are applied to assess it further. Besides that, the physical foundation for the mode of inspection is electromagnetic. Additionally, the most effective method for inspecting imported goods in containers without the need to unload the latter is through the X-ray inspection of containers at the destination. Higher risks of illegal smuggling of weapons of mass destruction as well as arms and drug trafficking have seen most governments install more security measures to curb possible risks and interruptions to border trade safety. In the recent past, X-ray (Computed Tomography) scanners increased port screening, and terrorism and international smuggling became a more serious issue. Severe cognizance of regular terrorist attacks and international smuggling through seaport inspections using X-ray (Computed Tomographic) Scanners has seen a recent spate of increased highs.

Report Coverage

This research report categorizes the market for United States cargo container x-ray inspection systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cargo container x-ray inspection systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States cargo container x-ray inspection systems market.

United States Cargo Container X-ray Inspection Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application |

| Companies covered:: | OSI Systems, Inc, Leidos, VMI Security, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

This market will see one of the most significant growth drivers in the demand for increased security levels in transport and logistics. Trade is expanding consistently, with more emphasis placed on preventing the illegal trafficking of goods such as drugs, arms, and contraband. X-ray inspection systems provide a non-obtrusive yet efficient means to inspect cargo container contents, allowing authorities to accurately detect hidden threats and speed up the flow of legitimate trade.

Restraining Factors

False alarms and a need for manual verification of suspicious items can significantly slow down the screening process, and all these factors impact efficiency in general. In addition to creating demand, regulatory mandates also cause significant compliance problems for businesses.

Market Segment

The U.S. cargo container x-ray inspection systems market share is classified into type and application.

- The stationary type segment is expected to hold the largest market share through the forecast period.

The US cargo container x-ray inspection systems market is by type into stationary type and mobile type. Among these, the stationary type segment is expected to hold the largest market share through the forecast period. This is because they possess advanced security screening devices meant to inspect cargo containers without opening them physically. These systems make use of X-ray technology to give the most expansive image of the contents in a particular container, therefore allowing the authorities to detect contraband items or any other goods contravening the law.

- The seaports segment is expected to hold the largest market share through the forecast period.

The US cargo container x-ray inspection systems market is segmented by application into airports, seaports, and border crossings/roadways. Among these, the seaports segment is expected to hold the largest market share through the forecast period. Cargo container X-ray inspection systems have been strategically placed throughout the cargo handling process in seaports. These systems enable effective scanning of incoming and outgoing containers, contributing to growth in terms of CAGR and market share. X-ray inspection systems can be integrated with the security infrastructure at the ports in an effort to screen a large volume of containers while minimizing the interruption of the flow of goods. It enhances security measures, curbs illegal activities, and ensures that trade law is followed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cargo container x-ray inspection systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OSI Systems, Inc

- Leidos

- VMI Security

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, Astrophysics solidifies its position in the U.S. with a $82 million HXC-LaneScan for the United States Department of Homeland Security, Customs and Border Protection (CBP).

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States cargo container x-ray inspection systems market based on the below-mentioned segments:

United States Cargo Container X-ray Inspection Systems Market, By Type

- Stationary Type

- Mobile Type

United States Cargo Container X-ray Inspection Systems Market, By Application

- Airports

- Seaports

- Border Crossings/Roadways

Need help to buy this report?