United States Cell and Gene Therapy Clinical Trial Services Market Size, Share, and COVID-19 Impact Analysis, By Service (Site Identification, Patient Recruitment, Laboratory Services, Regulatory Services, Supply and Logistic Services, and Others), By Phase (Phase I, Phase II, Phase III, and Phase IV), By Therapeutic Areas (Oncology, Central Nervous System (CNS) Disorders, Cardiovascular Diseases, Infectious Diseases, Musculoskeletal, and Others), By Therapy Type (Gene Therapy, Gene-modified Cell Therapy, and Cell Therapy), and United States Cell and Gene Therapy Clinical Trial Services Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Cell and Gene Therapy Clinical Trial Services Market Insights Forecasts to 2033

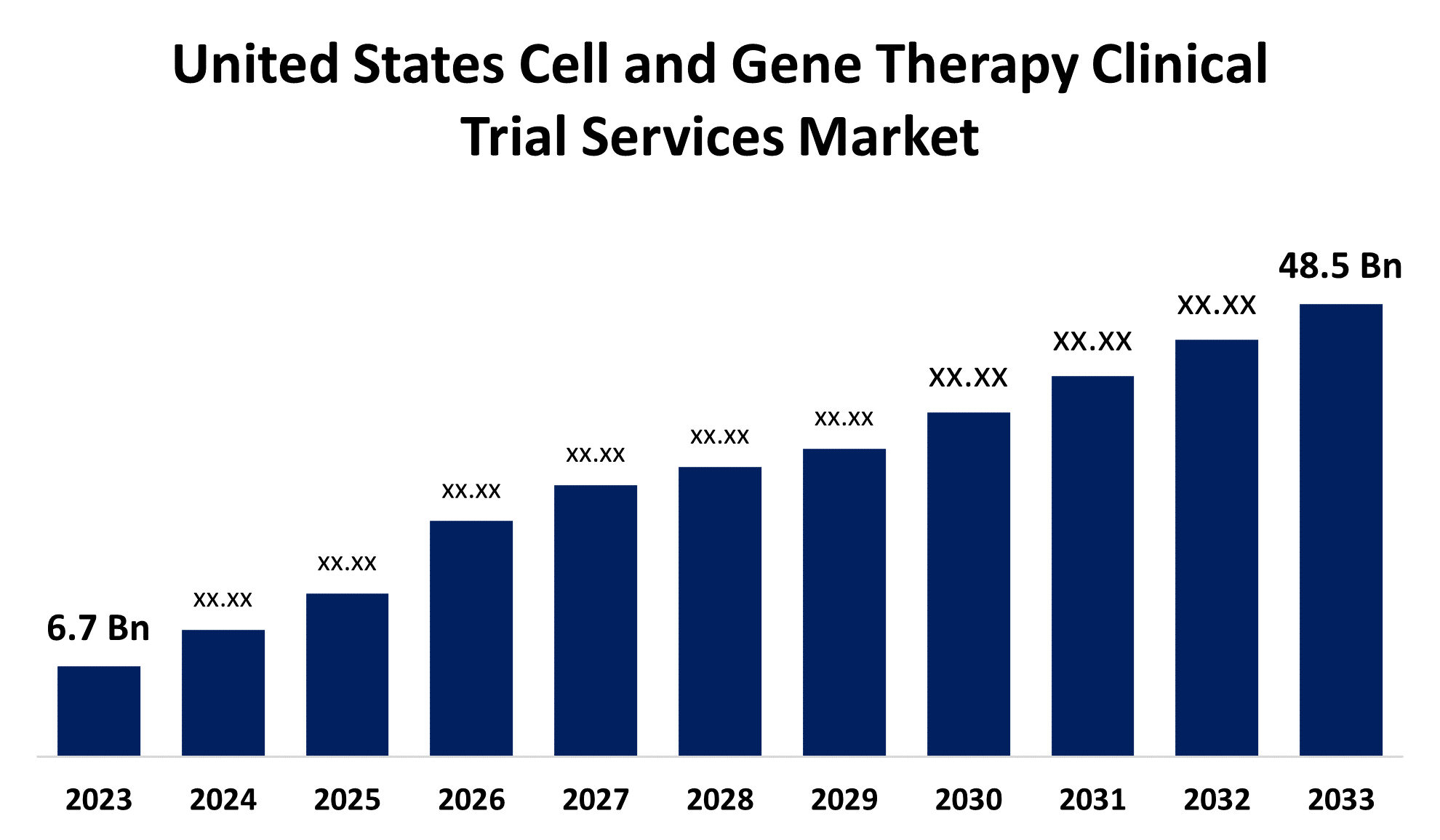

- The U.S. Cell and Gene Therapy Clinical Trial Services Market Size was valued at USD 6.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 21.89% from 2023 to 2033

- The U.S. Cell and Gene Therapy Clinical Trial Services Market Size is expected to reach USD 48.5 Billion by 2033

Get more details on this report -

The United States Cell and Gene Therapy Clinical Trial Services Market is anticipated to exceed USD 48.5 Billion by 2033, growing at a CAGR of 21.89% from 2023 to 2033. The growing biologics pipeline, increasing adoption of novel technologies across clinical research & supply chains, growing number of CROs, and rising R&D investments are driving the growth of the cell and gene therapy clinical trial services market in the US.

Market Overview

Cell and gene therapy clinical trial services are a new frontier in the fight against numerous fatal diseases, such as cancer and uncommon genetic disorders. It stands for the most recent innovation wave in the life sciences sector. The expanding patient demand for novel therapeutics and increasing interest in cell and gene therapies for cancer therapy as well as a rising shift towards gene therapy for the treatment of cancer and other rare diseases are anticipated to boost the market growth. Cell and gene treatments have a higher success rate than small-molecule pharmaceuticals which leads to a growing preference for alternative therapy options or customized drugs as CGT emphasizes particular illness (specific target). The rapid pace of technological advancement in cell and gene therapy not only improves treatment outcomes but also broadens the therapeutic uses of gene and cell therapy for a variety of illnesses.

Report Coverage

This research report categorizes the market for the US cell and gene therapy clinical trial services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cell and gene therapy clinical trial services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US cell and gene therapy clinical trial services market.

United States Cell and Gene Therapy Clinical Trial Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 6.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 21.89% |

| 2033 Value Projection: | USD 48.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Service, By Phase, By Therapeutic Areas, By Therapy Type |

| Companies covered:: | Novartis AG, Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, Amgen Inc., bluebird bio, Inc., CRISPR Therapeutics, Pfizer, Regeneron Pharmaceuticals Inc., Biocair, Modality Solutions LLC, BioLife Solutions, Inc., Marken, Almac Group, Yourway, Quick International Courier, Catalent, Inc, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing biologics pipeline and increasing adoption of novel technologies across clinical research & supply chains are driving the US cell and gene therapy clinical trial services market. As of 2023, 4,232 Contract Research Organizations were operating in the US, up 3.6% over the previous year. Thus, the growing number of CROs in the US is responsible for driving the market. Further, the rising investment in R&D activities is significantly contributing to driving market growth.

Restraining Factors

The strict regulatory challenges and high development costs are restraining the market for cell and gene therapy clinical trial services.

Market Segmentation

The United States Cell and Gene Therapy Clinical Trial Services Market share is classified into service, phase, therapeutic areas, and therapy type.

- The regulatory services segment accounted for the largest revenue share of the US cell and gene therapy clinical trial services market in 2023.

The United States cell and gene therapy clinical trial services market is segmented by service into site identification, patient recruitment, laboratory services, regulatory services, supply and logistic services, and others. Among these, the regulatory services segment accounted for the largest revenue share of the US cell and gene therapy clinical trial services market in 2023. Regulatory services offered by the cell and gene therapy business offer direction for improving the value of clinical trials at every stage of the product lifecycle. The initiatives for supporting the CGT product development are augmenting market growth.

- The phase II segment dominates the market with the largest market share during the forecast period.

The United States cell and gene therapy clinical trial services market is segmented by phase into phase I, phase II, phase III, and phase IV. Among these, the phase II segment dominates the market with the largest market share during the forecast period. Phase II trials are required to evaluate the safety and effectiveness of cell and gene therapy candidates in a variety of patient populations due to the growing pipeline of these treatments. The growing investments in R&D and generic product launches for cancer treatment are driving the market.

- The oncology segment dominates the US cell and gene therapy clinical trial services market in 2023.

Based on the therapeutic areas, the U.S. cell and gene therapy clinical trial services market is divided into oncology, central nervous system (CNS) disorders, cardiovascular diseases, infectious diseases, musculoskeletal, and others. Among these, the oncology segment dominates the US cell and gene therapy clinical trial services market in 2023. The rising prevalence of cancer and the development of novel CGT therapeutics by various pharmaceutical and biopharmaceutical companies are propelling the market demand in the oncology segment.

- The cell therapy segment held the largest revenue share of the US cell and gene therapy clinical trial services market in 2023.

Based on the therapy type, the U.S. cell and gene therapy clinical trial services market is divided into gene therapy, gene-modified cell therapy, and cell therapy. Among these, the cell therapy segment held the largest revenue share of the US cell and gene therapy clinical trial services market in 2023. Cell therapy services are often offered by various specialized facilities, research institutions, and healthcare experts with experience in cell-based therapies. The rising generic product launches for cancer therapy are propelling the market growth in the cell therapy segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. cell and gene therapy clinical trial services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis AG

- Gilead Sciences, Inc.

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- bluebird bio, Inc.

- CRISPR Therapeutics

- Pfizer

- Regeneron Pharmaceuticals Inc.

- Biocair

- Modality Solutions LLC

- BioLife Solutions, Inc.

- Marken

- Almac Group

- Yourway

- Quick International Courier

- Catalent, Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Cell and Gene Therapy Clinical Trial Services Market based on the below-mentioned segments:

US Cell and Gene Therapy Clinical Trial Services Market, By Service

- Site Identification

- Patient Recruitment

- Laboratory Services

- Regulatory Services

- Supply and Logistic Services

- Others

US Cell and Gene Therapy Clinical Trial Services Market, By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

US Cell and Gene Therapy Clinical Trial Services Market, By Therapeutic Areas

- Oncology

- Central Nervous System (CNS) Disorders

- Cardiovascular Diseases

- Infectious Diseases

- Musculoskeletal

- Others

US Cell and Gene Therapy Clinical Trial Services Market, By Therapy Type

- Gene Therapy

- Gene-Modified Cell Therapy

- Cell Therapy

Need help to buy this report?