United States Ceramic Ball Bearings Market Size, Share, and COVID-19 Impact Analysis, By Material (Silicon, Alumina, Zirconia, and Others), By Function (Inert and Active), By Application (Bearing, Grinding, Valve, and Others), and United States Ceramic Ball Bearings Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationUnited States Ceramic Ball Bearings Market Insights Forecasts to 2033

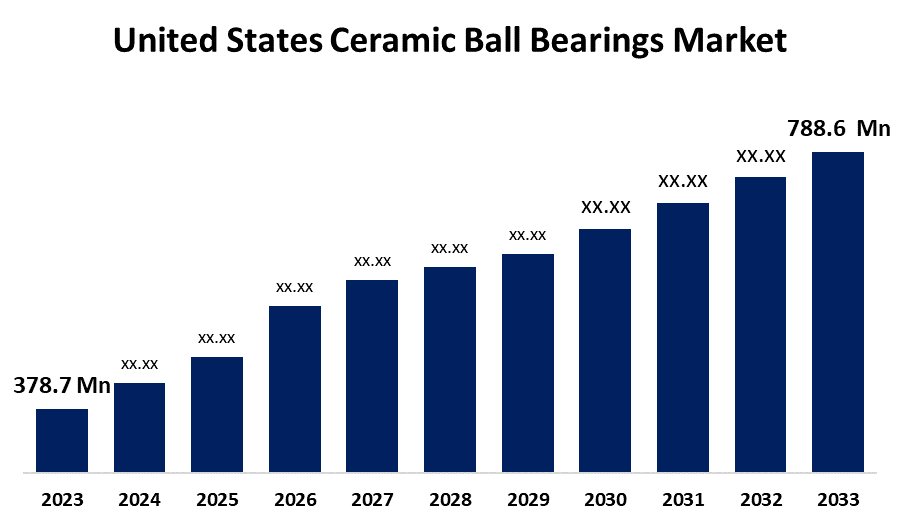

- The US Ceramic Ball Bearings Market Size was valued at USD 378.7 Million in 2023.

- The Market is Growing at a CAGR of 7.61% from 2023 to 2033

- The U.S. Ceramic Ball Bearings Market Size is Expected to reach USD 788.6 Million by 2033

Get more details on this report -

The United States Ceramic Ball Bearings Market Size is anticipated to Exceed USD 788.6 Million by 2033, Growing at a CAGR of 7.61% from 2023 to 2033.

Market Overview

Ceramic ball bearings are rolling elements composed of high-tech ceramic materials, usually zirconia (ZrO2) or silicon nitride (Si3N4). These materials are perfect for use in high-performance applications because of their exceptional qualities, which include high strength, hardness, and chemical stability. Ceramic ball bearings are widely used in industries where efficiency, accuracy, and dependability are essential. In comparison to steel balls, ceramic balls are rolling, spherical elements that offer superior electrical resistance, increased stiffness, less thermal expansion, and increased resistance to corrosion. They are made by combining several ceramic materials. For manufacturing, a mixture of ceramic powder binder is pressed into a premade shape, defining the parameters and design of the result requires precise finishing and lapping. Depending on what the end users demand, a variety of ceramic compounds can be used to produce these balls. Alumina, boron carbide, silicon nitride, aluminium silicate, alumina-zirconia, and boron nitride are a few combinations. Balls made of alumina have exceptionally high strength, resistance to abrasion, and resistance to furnace atmospheres. These balls can be used in roller tables, casters, lazy susan applications, conveyors, ball transfer systems, and more. It serves as a covering and supporting material for the catalyst in the reactor of petrochemical refineries. It can protect the catalyst, enhance the distribution of liquid and gas inside the reactor, and buffer the effects of gas and liquid entering the reactor on the catalyst. It is frequently utilized in automobiles as bearings for safety restraints, seat slides, and seatbelt locking systems.

Report Coverage

This research report categorizes the market for the United States ceramic ball bearings market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ceramic ball bearings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ceramic ball bearings market.

United States Ceramic Ball Bearings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 378.7 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.61% |

| 2033 Value Projection: | USD 788.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Function, By Application |

| Companies covered:: | SKF USA Inc., Timken Company, Schaeffler Technologies AG & Co. KG, NTN Corporation, NSK Americas, JTEKT North America Corporation, MinebeaMitsumi Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for ceramic ball bearings in the US is primarily driven by the need for high-performance bearings in industries such as industrial machinery, automotive, and aerospace. Compared to conventional steel ball bearings, ceramic ball bearings have several benefits, such as increased stiffness, decreased friction, and increased resistance to fatigue, wear, and corrosion. These characteristics make ceramic ball bearings perfect for use in machine tool spindles, car engines, airplane landing gear, and medical devices, among other applications where dependability, efficiency, and durability are crucial. The use of ceramic ball bearings in challenging operating environments is also being fueled by developments in ceramic materials, manufacturing techniques, and bearing designs, which have improved performance, precision, and reliability. The need for ceramic ball bearings is anticipated to increase as long as industries continue to place a premium on lightweight, highly efficient components. This will drive market expansion and technical advancement.

Restraining Factors

Ceramic ball bearings are generally more expensive than traditional steel ball bearings because of the higher cost of the ceramic material, as well as the special manufacturing processes required to produce ceramic components with tighter tolerances and surface finishes. In addition, ceramic materials such as silicon nitride and zirconia have certain limitations in terms of mechanical properties, thermal stability, and impact resistance, which might limit their scope of application in certain industries and operating conditions.

Market Segmentation

The United States ceramic ball bearings market share is classified into material, function, and application.

- The alumina segment is expected to hold the largest market share through the forecast period.

The United States ceramic ball bearings market is segmented by material into silicon, alumina, zirconia, and others. Among them, the alumina segment is expected to hold the largest market share through the forecast period. Owing to its advantages over competing materials, alumina material had a dominant market share for ceramic balls. The benefits of alumina balls are numerous and include increased density, a consistent shape, effective sorting and classification, and increased grinding efficiency. Choosing premium alumina balls ensures that the firing temperature can be precisely controlled and that the right crystalline structure is reached.

- The inert segment dominates the market with the largest market share over the predicted period.

The United States ceramic ball bearings market is segmented by function into inert and active. Among them, the inert segment dominates the market with the largest market share over the predicted period. Due to increased demand from the automotive industry and expanding installations for the use of bearings and valves, inert ceramic balls held a higher market share. Inert ceramic balls are widely used in the production of fertilizer, chemicals, petrochemicals, and environmentally friendly products because they can withstand high pressure and temperature. The main use is to support the low-strength active catalyst by increasing the number of gas and liquid distribution sites.

- The bearing segment dominates the market with the largest market share over the predicted period.

The United States ceramic ball bearings market is segmented by application into bearing, grinding, valve, and others. Among them, the bearing segment dominates the market with the largest market share over the predicted period. Because of its greater strength and capacity to withstand shock, the bearing sector leads the market due to its expansion in the automotive and aerospace industries. High-purity ceramic spherical balls are utilized in grinding with alumina compounds and some proportional zircon that is produced via the isotactic method. The primary benefit of utilizing ceramic grinding balls over steel ones is their effective energy conservation, which lowers cement temperature, noise pollution, and main motor current by 20–30%.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ceramic ball bearings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SKF USA Inc.

- Timken Company

- Schaeffler Technologies AG & Co. KG

- NTN Corporation

- NSK Americas

- JTEKT North America Corporation

- MinebeaMitsumi Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024 SKF has joined a novel research and innovation initiative with the goal of eradicating greenhouse gas emissions.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Ceramic Ball Bearings Market based on the below-mentioned segments:

United States Ceramic Ball Bearings Market, By Material

- Silicon

- Alumina

- Zirconia

- Others

United States Ceramic Ball Bearings Market, By Function

- Inert

- Active

United States Ceramic Ball Bearings Market, By Application

- Bearing

- Grinding

- Valve

- Others

Need help to buy this report?