United States Circuit Breaker Market Size, Share, and COVID-19 Impact Analysis, By Voltage (High, Medium), By Type (Outdoor Circuit Breaker, Indoor Circuit Breaker), and United States Circuit Breaker Market Insights Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Circuit Breaker Market Insights Forecasts to 2033

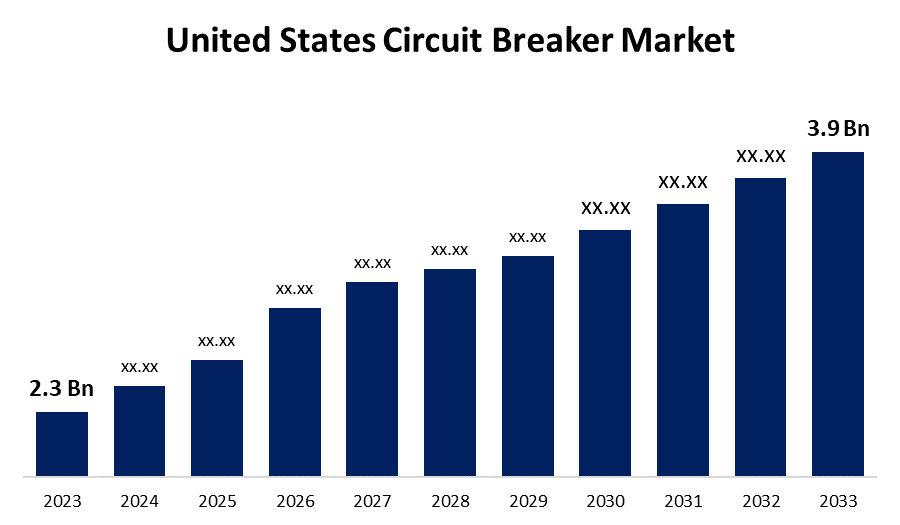

- The United States Circuit Breaker Market Size was valued at USD 2.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.4% from 2023 to 2033.

- The United States Circuit Breaker Market Size is Expected to Reach USD 3.9 Billion by 2033.

Get more details on this report -

The United States Circuit Breaker Market Size is Expected to Reach USD 3.9 Billion by 2033, at a CAGR of 5.4% during the forecast period 2023 to 2033.

Market Overview

A circuit breaker is an electrical switch that can be operated automatically and is designed to protect an electrical circuit from damage caused by an overload or short circuit. When a fault is detected, it interrupts the current flow. Circuit breakers come in a variety of sizes, ranging from small devices that protect low-current circuits to large switchgears that protect high-voltage circuits. Circuit breakers are primarily classified according to their rated voltages. Circuit breakers with voltages less than 1000V are known as low-voltage circuit breakers, while those with voltages greater than 1000V are known as high-voltage circuit breakers. Several factors are currently driving demand for circuit breakers in the United States. Circuit breakers protect an electrical circuit from damage caused by an overload or a short circuit. Its primary function is to stop current flow when it detects fluctuations. It is effective against fluctuations in low, medium, and high voltages. Furthermore, circuit breakers are designed in such a way that they are effective in detecting high-voltage fluctuations, which is the device's primary advantage over fuses. Fuses can only function at low voltages. As a result, circuit breakers are widely used in large residential and commercial construction projects, locomotive and transportation industries, and so on.

Report Coverage

This research report categorizes the market for United States Circuit Breaker market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Circuit Breaker market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States Circuit Breaker market.

United States Circuit Breaker Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.3 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.4% |

| 2033 Value Projection: | USD 3.9 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Voltage, By Type and COVID-19 Impact Analysis. |

| Companies covered:: | ABB Ltd., Schneider Electric SE, Siemens AG, General Electric Company, Eaton Corporation plc, Mitsubishi Electric Corporation, Hitachi, Ltd., Toshiba Corporation, Fuji Electric Co., Ltd., Larsen & Toubro Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A variety of other factors contribute to the demand for circuit breakers. The Circuit Breaker Industry is benefiting from increased energy sector investment. Renewable energy is becoming more popular. As a result, circuit breakers are in high demand. A circuit breaker is a combination of technologies that connects power plants and electrical grids. As a result, rising investments in the renewable energy sector are a key factor driving the circuit breaker market. The demand for electricity is high in the residential, commercial, and industrial sectors. Furthermore, there is growing concern about the availability of uninterrupted power. Another motivator for the market is end-user concern. The need for continuous and uninterrupted power flow, as well as protection from short circuits, are the key drivers of market growth. Power reliability is a critical factor that will drive up demand in the coming years.

Restraining Factors

The increasing investment in technological advancement to break the circuit has enabled the major players to compete in the U.S market. Competitive pricing among small competitors, as well as rising competition from unorganized players to meet demand from industries such as manufacturing, construction, transportation, and processing, are expected to be major factors restraining market growth during the forecast period.

Market Segment

- In 2023, the medium segment accounted for the largest revenue share over the forecast period.

Based on the voltage, the United States circuit breaker market is segmented into high, medium. Among these, the medium segment has the largest revenue share over the forecast period. Medium voltage breakers are increasingly used in industrial, infrastructure, and utility applications. The medium-scale breaker applications have the most diverse applications and are expected to grow at the fastest rate.

- In 2022, the outdoor circuit breakers segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States circuit breaker market is segmented into outdoor circuit breakers, indoor circuit breakers. Among these, the outdoor circuit breakers segment has the largest revenue share over the forecast period. The majority of breakers installed are outdoor electrical switches that operate automatically. Outdoor breakers have nearly double the market size of indoor breakers. It is used in outdoor switchgear assembly for utility-scale applications. Few industrial machines and equipment necessitate the use of outdoor breakers. Indoor breakers are widely used in residential, commercial, and industrial circuit breakers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States circuit breaker market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- General Electric Company

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Larsen & Toubro Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States circuit breaker market based on the below-mentioned segments:

United States Circuit Breaker Market, By Voltage

- High

- Medium

United States Circuit Breaker Market, By Type

- Indoor Circuit Breaker

- Outdoor Circuit Breaker

Need help to buy this report?