United States Clean Label Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Colors, Natural Flavors, Fruit & Vegetable Ingredients, Starch & Sweeteners, Flour, Malt, and Others), By Application (Food, Pet Food, Dairy, Non-Dairy, Fermented Beverages, and Others), and US Clean Label Ingredients Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesUnited States Clean Label Ingredients Market Insights Forecasts to 2033

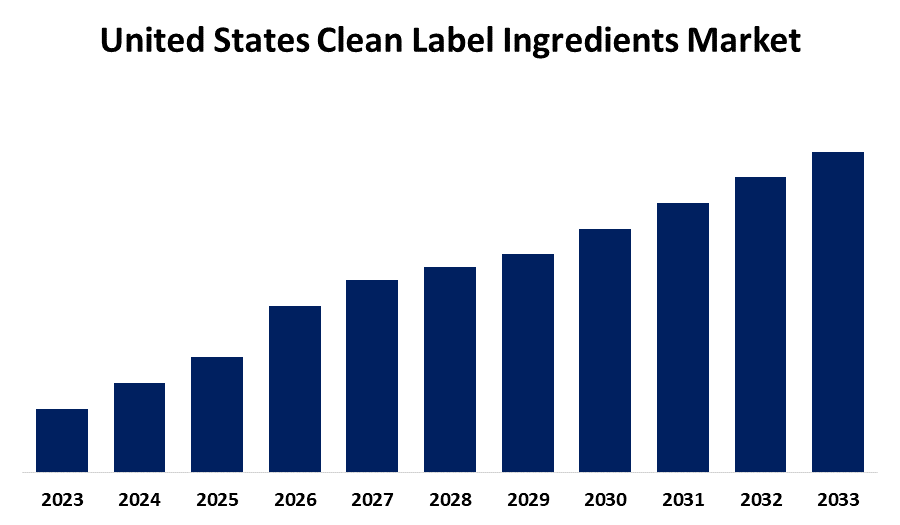

- The Market is growing at a CAGR of 5.93% from 2023 to 2033

- The U.S. Clean Label Ingredients Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.S. Clean Label Ingredients Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 5.93% from 2023 to 2033.

Market Overview

Clean-label ingredients such as herbs, spices, natural extracts, and plant-based ingredients are perfect for elevating flavor profiles, increasing shelf life, and enhancing product stability. By including these natural ingredients with clear labeling in their products, companies can attract health-conscious customers and have a competitive advantage in the market. American customers are showing a growing interest in transparency when it comes to food and beverage items. They are searching for simple and trustworthy ingredients with clean labels. The need is driven by a craving for healthier and more organic choices. Health-conscious habits are widespread in the United States. Consumers are making efforts to choose healthier foods by avoiding artificial additives and preferring clean-label products that support their wellness objectives. Regulatory bodies in the US, like the FDA, have enforced labeling rules mandating precise and transparent ingredient listings. Regulatory assistance helps food manufacturers strengthen their commitment to clean label practices. Clean label is spurring new product development, products commonly sold in the US are considered 'clean', meaning they are safe to eat even if the labeling is not always completely accurate. However, there have been several emerging trends related to the clean label movement that food producers can leverage to engage effectively with their specific customer base

Report Coverage

This research report categorizes the market for the US clean-label ingredients market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States clean-label ingredients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. clean-label ingredients market.

United States Clean Label Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.93% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 181 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Cargill, Archer Daniels Midland, Koninklijke DSM N.V, Dupont De Nemours and Company, Kerry Group Plc, Tate & Lyle Plc, Corbion Inc., Frutarom, Kerry Group PLC, Sensient Technologies, Ingredion Incorporated, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is a growing demand in the United States for probiotic cultures and fatty foods with healthier fatty acid and vitamin compositions, leading to an increased need for clean-label ingredients. Moreover, the increasing number of individuals choosing healthier diets is driving a growing demand for organic food. The increase in health spending and promotion of chemical-free products are also contributing to the trend. Food and beverage producers are meeting the demand for clean-label products by providing organically sourced ingredients that can be used in various applications. The components are versatile and can be utilized in a range of vegan dishes, precooked meals, and sauces.

Restraining Factors

A major limitation is the functionality and versatility of clean-label ingredients when compared to their synthetic counterparts. Artificial additives are frequently selected for their capacity to improve the taste, consistency, longevity, and other favorable attributes of food items.

Market Segmentation

The US clean label ingredients market share is classified into type and application.

- The natural colors segment is expected to hold a significant market share through the forecast period.

The United States clean label ingredients market is segmented by type into natural colors, natural flavors, fruit & vegetable ingredients, starch & sweeteners, flour, malt, and others. Among these, the natural colors segment is expected to hold a significant market share through the forecast period. Many customers are looking for healthier options than artificial flavors, causing an increase in the popularity of flavors derived from natural sources. Furthermore, the segment is experiencing increased demand due to the positive regulatory environment and government backing for the use of natural flavors in various applications. Advancements and new products in natural food flavor sources have also benefited the natural flavor industry.

- The food segment is expected to dominate the US clean-label ingredients market during the projected period.

Based on the application, the United States clean label ingredients market is divided into food, pet food, dairy, non-dairy, fermented beverages, and others. Among these, the food segment is expected to dominate the US clean-label Ingredients market during the projected period. Manufacturers are updating their product portfolios to adhere to clean label standards due to the increasing demand for minimally processed ingredients from consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States clean label ingredients market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill

- Archer Daniels Midland

- Koninklijke DSM N.V

- Dupont De Nemours and Company

- Kerry Group Plc

- Tate & Lyle Plc

- Corbion Inc.

- Frutarom

- Kerry Group PLC

- Sensient Technologies

- Ingredion Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Ajinomoto Co. inaugurated a new office in Silicon Valley, USA. The office offers various food options, such as clean-label ingredients, in the US market. The expansion was done in order to grow the company's business.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Clean Label Ingredients Market based on the below-mentioned segments:

United States Clean Label Ingredients Market, By Type

- Natural Colors

- Natural Flavors

- Fruit & Vegetable Ingredients

- Starch & Sweeteners

- Flour

- Malt

- Others

United States Clean Label Ingredients Market, By Application

- Food

- Pet Food

- Dairy

- Non-Dairy

- Fermented Beverages

- Others

Need help to buy this report?