U.S. Clearing Houses and Settlements Market Size, Share, and COVID-19 Impact Analysis, By Market Type (Equity Markets, Fixed Income Markets, Derivatives Markets, Foreign Exchange (FX) Markets, and Others), By Application (Large Banks, Rural Credit Cooperatives, and Others), and US Clearing Houses and Settlements Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Clearing Houses and Settlements Market Insights Forecasts to 2033

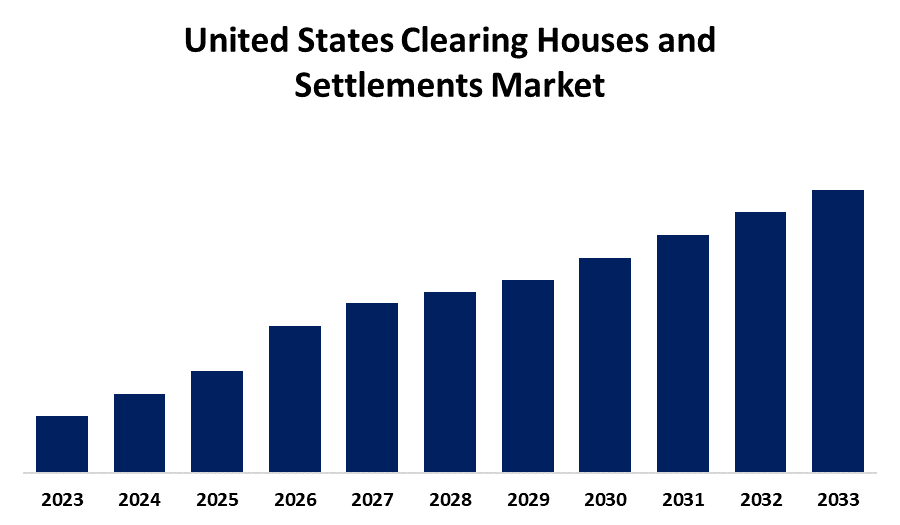

- The Market Size is Growing at a CAGR of 5.7% from 2023 to 2033

- The US Clearing Houses and Settlements Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.S. Clearing Houses and Settlements Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 5.7% from 2023 to 2033.

Market Overview

A clearing house, also known as a settlement agency, acts as a middleman between financial instrument purchasers and sellers. It is a distinct company that handles trade clearing, account settlement, margin money collection and maintenance, delivery regulation, and trading data reporting. A clearing house holds the counter position for each trade. A clearing house acts as an intermediary for both parties when two investors reach an agreement on a financial transaction, like buying or selling a security. The aim of a clearing house is to enhance market efficiency and provide stability to the financial system. This is handled by the New York Stock Exchange (NYSE) and the NASDAQ, two significant clearing houses in the US. The market is governed by the US Securities and Exchange Commission (SEC). Since most financial products require borrowing in order to invest, the clearing house plays a crucial role in the futures market. The swift expansion of the stock market will have a beneficial influence on the US economy. The market has great potential for US clearing houses, prompting firms to invest in strategic initiatives to seize opportunities. Numerous companies are implementing strategic actions like forming partnerships, introducing new products, consolidating through mergers, and making acquisitions to expand their market presence and improve customer satisfaction.

Report Coverage

This research report categorizes the market for the United States clearing houses and settlements market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US clearing houses and settlements market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. clearing houses and settlements market.

U.S. Clearing Houses and Settlements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Market Type, By Application |

| Companies covered:: | New York Stock Exchange, NASDAQ, International Securities Exchange, Miami Stock Exchange, CBOE Option Exchange, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Through the transformation of the financial marketplace due to digitalization, clearing and settling firms have the chance to create a new market structure merging traditional securities with digital assets in the future. A digital asset is any digitally stored item that is uniquely identifiable and can be used by organizations to create value. The emergence of platforms in the clearinghouse market is simply digitalization in action. Numerous companies are introducing a digital platform to simplify the process for customers to invest and withdraw their funds in the market. The market's growth is predicted to see a rise due to the increasing use of digitalization and digital assets.

Restraining Factors

The volume and value of transactions clearing houses handle exposes them to considerable risks. Risk management frameworks are constantly challenged by operational failures, counterparty risks, and market volatility.

Market Segmentation

The United States clearing houses and settlements market share is classified into market type, and application.

- The equity markets segment is expected to hold the largest market share through the forecast period.

The U.S. clearing houses and settlements market is segmented by market type into equity markets, fixed income markets, derivatives markets, foreign exchange (FX) markets, and others. Among them, the equity markets segment is expected to hold the largest market share through the forecast period. The New York Stock Exchange (NYSE) and NASDAQ perceive substantial trading volumes from the U.S. equity markets, which are among the biggest and busiest in the world. Trade matching, novation, netting, and the settlement of funds and securities are just a few of the numerous transactions that clearing and settlement services for stocks handle every day.

- The large banks segment dominates the market with the largest market share over the predicted period.

The US clearing houses and settlements market is segmented by application into large banks, rural credit cooperatives, and others. Among them, the large banks segment dominates the market with the largest market share over the predicted period. Large banks dominate this sector because they typically handle large amounts of transactions that call for clearing and settlement services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States clearing houses and settlements market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- New York Stock Exchange

- NASDAQ

- International Securities Exchange

- Miami Stock Exchange

- CBOE Option Exchange

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, The Wynwood neighbourhood of Miami is home to the actual trading floor known as MIAX Sapphire, which was unveiled by Miami International Holdings, Inc. The fourth national securities exchange for U.S. multi-listed options offered by MIAX will be the new MIAX Sapphire exchange, which will operate both an electronic exchange and a physical trading floor.

Market Segment

This study forecasts revenue at US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Clearing Houses and Settlements Market based on the below-mentioned segments:

United States Clearing Houses and Settlements Market, By Market Type

- Equity Markets

- Fixed Income Markets

- Derivatives Markets

- Foreign Exchange (FX) Markets

- Others

United States Clearing Houses and Settlements Market, By Application

- Large Banks,

- Rural Credit Cooperatives

- Others

Need help to buy this report?