United States Clinical Laboratory Services Market Size, Share, and COVID-19 Impact Analysis, By Test Type (Clinical Chemistry, Hematology, Genetic Testing, Microbiology & Cytology, and Others), By Age (Pediatric and Adult), By Source of Payment (Public, Private, and Out of Pocket), and By Service Provider (Hospital-based Laboratories, Stand-alone Laboratories, Clinic-based Laboratories, and Others), and United States Clinical Laboratory Services Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Clinical Laboratory Services Market Insights Forecasts to 2033

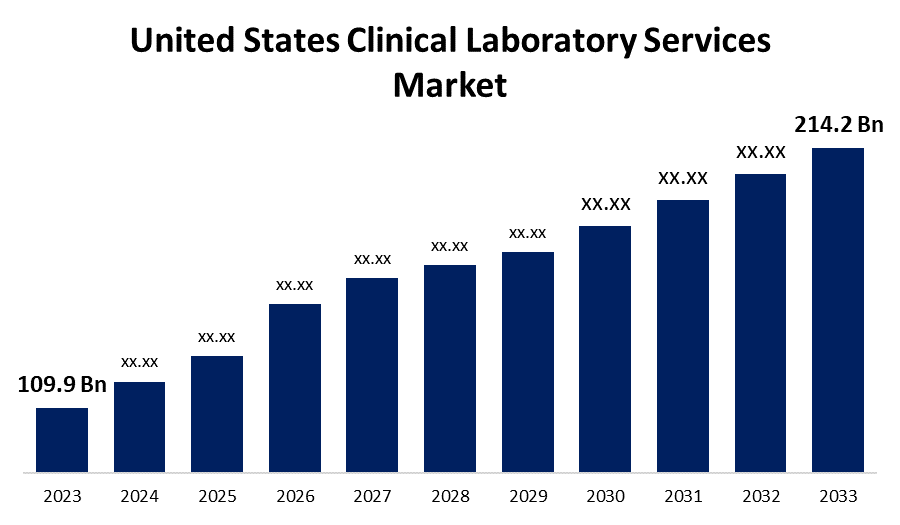

- The U.S. Clinical Laboratory Services Market Size was valued at USD 109.9 Billion in 2023.

- The Market is growing at a CAGR of 6.9% from 2023 to 2033

- The U.S. Clinical Laboratory Services Market Size is expected to reach USD 214.2 Billion by 2033

Get more details on this report -

The United States Clinical Laboratory Services Market is anticipated to exceed USD 214.2 Billion by 2033, growing at a CAGR of 6.9% from 2023 to 2033. The growing prevalence of chronic disorders is driving the growth of the clinical laboratory services market in the US.

Market Overview

Clinical laboratory services include clinical pathology tests that are carried out on collected clinical specimens to obtain information about the patient’s health to aid in the diagnosis, prevention, and treatment of diseases. The Centers for Disease Control and Prevention (CDC) released a piece in May 2023. Approximately 805,000 Americans suffer a heart attack each year, and 1 in 20 adults over the age of 20 have coronary artery disease (CAD). Thus, the increased prevalence of chronic diseases surges the need for clinical laboratory services for diagnosis and treatment. Prominent major players in the U.S. industry are emphasizing greater focus and effort on creating automated clinical diagnostic labs and healthcare systems. The adoption of automated lab instruments for quicker results is driving the market opportunity. Advanced apparatus and automation techniques are widespread in clinical laboratory services. Further, there is an increasing application of clinical chemistry and molecular diagnostics.

Report Coverage

This research report categorizes the market for the US clinical laboratory services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States clinical laboratory services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US clinical laboratory services market.

United States Clinical Laboratory Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 109.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.9% |

| 2033 Value Projection: | USD 214.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Test Type, By Age, By Source of Payment, By Service Provider |

| Companies covered:: | Laboratory Corporation of America, Illumina, Inc., Quest Diagnostics Incorporated, NeoGenomics Laboratories, Inc., ARUP Laboratories, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The rising incidences of chronic diseases such as cystic fibrosis, sickle cell, Down Syndrome, and breast cancer in the country along with the growing aging population are driving up the US clinical laboratory services market. In April 2023, the National Center for Biotechnology Information (NCBI) issued an article stating that 129,624 genetic tests, including upgraded versions of the previously available ones, were made available in the United States. The number of hospital stays and clinical laboratory tests that doctors prescribe has increased as a result of the rise in the prevalence of chronic illnesses driving the market. Further, the increasing need for early diagnosis and clinical laboratory services are significantly contributing to driving the market.

Restraining Factors

The high capital investment for the installation of laboratory animals and the shortage of skilled laboratory professionals are restraining the market for clinical laboratory services.

Market Segmentation

The United States Clinical Laboratory Services Market share is classified into test type, age, source of payment, and service provider.

- The clinical chemistry segment accounted for the largest market share in 2023.

The United States clinical laboratory services market is segmented by test type into clinical chemistry, hematology, genetic testing, microbiology & cytology, and others. Among these, the clinical chemistry segment dominates the market with the largest market share in 2023. Clinical chemistry laboratory services provide essential tests for diagnosis of diseases. The rising incidence of diabetes, hormone imbalances, and cardiovascular illnesses in the United States surges the need for diagnostic labs which is expected to drive the market demand in the clinical chemistry segment.

- The adult segment dominates the US clinical laboratory services market during the forecast period.

Based on the age, the U.S. clinical laboratory services market is divided into pediatric and adult. Among these, the adult segment dominates the US clinical laboratory services market during the forecast period. According to the US Department of Health and Human Services, 129 million Americans are thought to have at least one significant chronic illness, such as diabetes, cancer, heart disease, obesity, or hypertension and there has been a steady rise in prevalence over the past 2 decades. Infectious and chronic diseases are more common in the adult and geriatric populations. The increase in adult cases of tuberculosis and cardiac problems leads to an increasing number of clinical laboratory visits.

- The public segment dominates the US clinical laboratory services market with the largest market share during the forecast period.

Based on the source of payment, the U.S. clinical laboratory services market is divided into public, private, and out of pocket. Among these, the public segment dominates the US clinical laboratory services market during the forecast period. As per a 2023 article released by the Peter G. Peterson Foundation, the government insurance programs of the United States, including Medicare and Medicaid, account for approximately 42.0%, or USD 1.8 trillion, of the total national spending on healthcare. The expansion of health insurance offered by important public entities and government agencies, together with benefits like large discounts that are primarily intended for low-income individuals or families are driving the market.

- The hospital-based laboratories segment dominates the market with the largest market share in 2023.

The United States clinical laboratory services market is segmented by service provider into hospital-based laboratories, stand-alone laboratories, clinic-based laboratories, and others. Among these, the hospital-based laboratories segment dominates the market with the largest market share in 2023. The growing number of patient admissions as well as the increasing partnerships between major business participants and hospital laboratories are significantly driving the market growth in the hospital-based laboratories segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. clinical laboratory services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Laboratory Corporation of America

- Illumina, Inc.

- Quest Diagnostics Incorporated

- NeoGenomics Laboratories, Inc.

- ARUP Laboratories

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Illumina Inc., and Myriad Genetics Inc., a leader in genetic testing and precision medicine, announced the expansion of a strategic partnership to broaden access to and availability of oncology homologous recombination deficiency (HRD) testing in the United States.

- In July 2022, Labcorp, a leading life sciences company, announced the began of testing for monkeypox using the U.S. Centers for Disease Control and Prevention’s (CDC) orthopoxvirus test, which detects all non-smallpox related orthopoxviruses, including monkeypox.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Clinical Laboratory Services Market based on the below-mentioned segments

US Clinical Laboratory Services Market, By Test Type

- Clinical Chemistry

- Hematology

- Genetic Testing

- Microbiology & Cytology

- Others

US Clinical Laboratory Services Market, By Age

- Pediatric

- Adult

US Clinical Laboratory Services Market, By Source of Payment

- Public

- Private

- Out of Pocket

US Clinical Laboratory Services Market, By Service Provider

- Hospital-based Laboratories

- Stand-alone Laboratories

- Clinic-based Laboratories

- Others

Need help to buy this report?