United States Coffee Creamer Market Size, Share, and COVID-19 Impact Analysis, By Product (Dairy-based and Non-dairy), By Nature (Organic and Conventional), By Packaging Type (Plastic Jars, Tetrapacks, PET Bottles, and Others), and U.S. Coffee Creamer Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Coffee Creamer Market Insights Forecasts to 2033

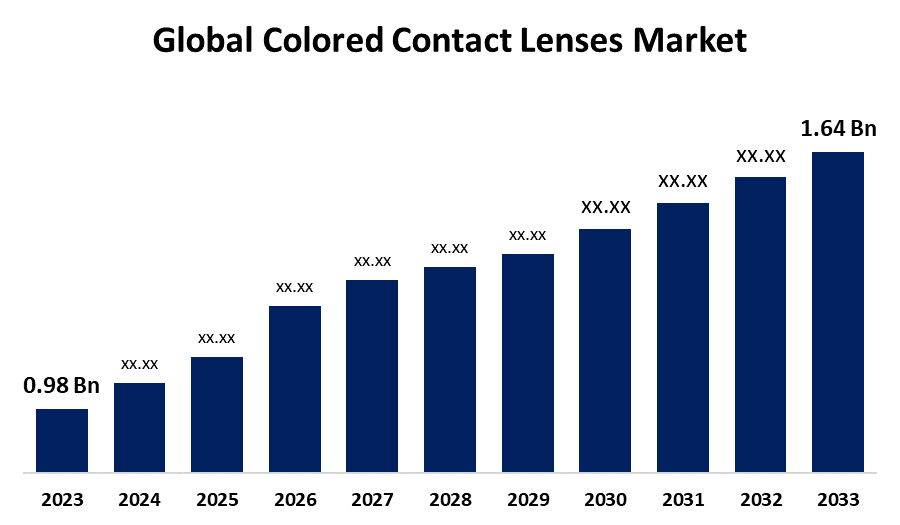

- The United States Coffee Creamer Market Size Was Estimated at USD 0.98 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.28% from 2023 to 2033

- The USA Coffee Creamer Market Size is Expected to Reach USD 1.64 Billion by 2033

Get more details on this report -

The United States Coffee Creamer Market Size is Expected to reach USD 1.64 Billion by 2033, Growing at a CAGR of 5.28% from 2023 to 2033

Market Overview

The industry that manufactures and distributes dairy-based and non-dairy creamers used to improve the flavor and texture of coffee is referred to as the United States coffee creamer market. These creamers, which satisfy consumer preferences for normal, flavored, sugar-free, and plant-based alternatives, are available in liquid and powder form. In the US, coffee creamers have grown significantly, mostly as a result of rising coffee consumption, particularly for specialty and high-end coffee beverages. The need for coffee creamers to improve flavor and diversity has increased as a result. The United States has seen a steady increase in coffee consumption due to increasingly busy schedules, which has also increased demand for coffee creamers. Additionally, the demand for coffee creamers has grown due to at-home consumption and the emergence of e-commerce. The country's growing internet penetration and the availability of a large variety of coffee creamers, from dairy to flavored, allow consumers to check out different brands, which increases demand for coffee creamers through online retail channels.

Furthermore, government initiatives aid in market expansion. For instance, in March 2025, the Food and Drug Administration (FDA) extended its recall notice to include the Hazelnut and Cinnabon Classic Cinnamon Roll flavors, advising consumers in 31 states to return or discard the impacted coffee creamers.

Report Coverage

This research report categorizes the market for the U.S. coffee creamer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US coffee creamer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA coffee creamer market.

United States Coffee Creamer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.98 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.28% |

| 2033 Value Projection: | USD 1.64 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Product, By Nature, By Packaging Type and COVID-19 Impact Analysis |

| Companies covered:: | Nestlé S.A., Danone, Chobani LLC, Califia Farms, LLC, nutPods, Laird Superfood, Land O’Lakes, Inc., Heartland Food Products Group, Leaner Creamer LLC, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US coffee creamer market is experiencing steady growth due to which can be attributed to changing consumer tastes, a growing desire for plant-based and healthier options, and a growing preference for making coffee at home. Initially a specialty product, coffee creamers have become commonplace in many American homes, offering a variety of flavored, low-fat, sugar-free, and non-dairy substitutes in addition to the conventional dairy-based options. The market's expansion is supported by premiumization, innovation, and the move to plant-based diets. In addition, the introduction of new flavors by major companies in the liquid and powder coffee creamer industry has increased the product's appeal among younger coffee consumers, who make up a significant portion of the US population.

Restraining Factors

The market for coffee creamer in the United States is hampered because of the increased cost of premium and plant-based coffee creamers may prevent certain customers from using them. In addition, food safety laws and labeling specifications, particularly for functional ingredients, must be followed by manufacturers.

Market Segmentation

The U.S. coffee creamer market share is classified into product, nature, and packaging type.

- The non-dairy segment accounted for the largest market share of 47.19% in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on the product, the U.S. coffee creamer market is classified into dairy-based and non-dairy. Among these, the non-dairy segment accounted for the largest market share of 47.19% in 2023 and is estimated to grow at a significant CAGR during the projected period. The rising demand for dairy-free substitutes is mostly due to consumers' growing inclination for plant-based diets and health-conscious lifestyles. This tendency has also been influenced by the growing knowledge of lactose intolerance and the desire for goods that are low in fat and cholesterol.

- The conventional segment accounted for the highest market share of 80.11% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the nature, the U.S. coffee creamer market is divided into organic and conventional. Among these, the conventional segment accounted for the highest market share of 80.11% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is driven by conventional creamer brands' broad availability and familiarity with consumers, which frequently provides a consistent taste and texture that many consumers desire. Furthermore, conventional creamers are generally less expensive than their organic or natural counterparts, which makes them more widely available.

- The PET bottles segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the packaging type, the U.S. coffee creamer market is divided into plastic jars, tetrapacks, PET bottles, and others. Among these, the PET bottles segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period. PET bottles are a safer and more convenient choice for customers to use and transport because they are lightweight and shatterproof. Additionally, they provide superior defense against light and oxygen, extending the creamer's shelf life and flavor. PET bottles are also recyclable, which makes them a more environmentally responsible packaging choice that satisfies consumer desire for greener products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. coffee creamer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestlé S.A.

- Danone

- Chobani LLC

- Califia Farms, LLC

- nutPods

- Laird Superfood

- Land O'Lakes, Inc.

- Heartland Food Products Group

- Leaner Creamer LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Vanilla, caramel, oatmeal cookie, and cinnamon spice are the four flavors of Organic Valley's first organic oat-based creamers, which were introduced across the country. Their product line is being expanded to satisfy the increasing demand for organic plant-based alternatives, and as a farmer-owned cooperative, they are procuring oats directly from their organic family farms in the United States.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. coffee creamer market based on the below-mentioned segments

U.S. Coffee Creamer Market, By Product

- Dairy-based

- Non-dairy

U.S. Coffee Creamer Market, By Nature

- Organic

- Conventional

U.S. Coffee Creamer Market, By Packaging Type

- Plastic Jars

- Tetrapacks

- PET Bottles

- Others

Need help to buy this report?