United States Coffee Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Whole Bean, Ground Coffee, Instant Coffee, and Coffee Pods and Capsules), By Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail, and Others), and United States Coffee Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesUnited States Coffee Market Insights Forecasts to 2033

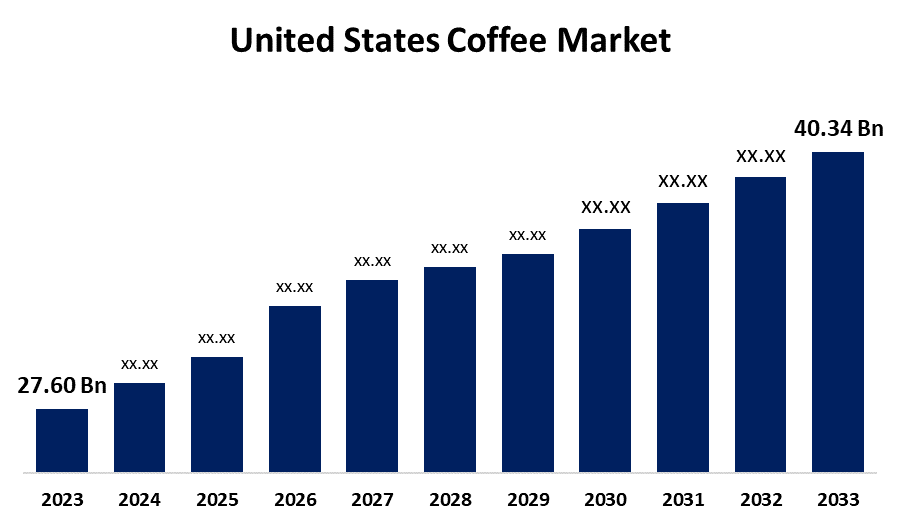

- The U.S. Coffee Market Size was Valued at USD 27.60 Billion in 2023

- The United States Coffee Market Size is Growing at a CAGR of 3.87% from 2023 to 2033

- The USA Coffee Market Size is Expected to Reach USD 40.34 Billion by 2033

Get more details on this report -

The USA Coffee market size is anticipated to exceed USD 40.34 Billion by 2033, growing at a CAGR of 3.87% from 2023 to 2033. The U.S. coffee market is thriving, driven by strong consumer demand, evolving preferences, and product innovation. Major players like Starbucks and Nestlé continue shaping trends across retail, specialty, and ready-to-drink segments.

Market Overview

The United States coffee market encompasses the importation, roasting, distribution, and consumption of coffee products nationwide. As one of the world's largest consumers, the U.S. relies heavily on imports, with approximately 22.3 million bags of coffee imported in recent years to satisfy domestic demand. Moreover, the U.S. coffee market's growth is driven by rising demand for specialty blends, cold brews, and ethically sourced products. Increasing health consciousness, premiumization, and a strong coffee culture among younger consumers drive innovation. The expansion of online retail, café chains, and at-home brewing trends further supports market potential, making coffee an essential and evolving daily beverage choice. For instance, Tim Hortons introduced four new espresso capsules that are compatible with Nespresso machines. Classic, bright, bold, and decaf are the four available flavors.

Report Coverage

This research report categorizes the market for the US coffee market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. coffee market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA coffee market.

United States Coffee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 27.60 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.87% |

| 023 – 2033 Value Projection: | USD 40.34 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Starbucks Corporation, Keurig Dr Pepper Inc., Califia Farms LLC, Nestlé S.A., Monster Beverage Corporation, The J.M. Smucker Co., White Wave Food Co., Fresh Roasted Coffee LLC, Eight O’Clock Coffee Company, Kraft Heinz Co., and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

Driving factors of the U.S. coffee market include increasing disposable incomes, growing urbanization, and the rise of coffee-centric lifestyles. The proliferation of coffee shops, drive-thrus, and subscription services enhances accessibility. Additionally, innovations in flavours, brewing techniques, and packaging attract diverse consumer segments, while social media trends and influencer marketing boost brand visibility and consumer engagement.

Restraining Factors

The U.S. coffee market faces restraints from fluctuating raw coffee prices, supply chain disruptions, and climate change affecting crop yields. Health concerns and rising competition from alternative beverages also impact growth.

Market Segmentation

The U.S. United States coffee market share is classified into product type and distribution channel.

- The ground coffee segment accounted for the largest share of the US coffee market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of product type, the United States coffee market is divided into whole bean, ground coffee, instant coffee, and coffee pods and capsules. Among these, the ground coffee segment accounted for the largest share of the United States coffee market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Its popularity stems from affordability, ease of preparation, and wide availability in supermarkets. Consumers favour it for home brewing due to its balance between convenience and flavour, making it a preferred choice across various demographics and age groups.

- The supermarkets/hypermarkets segment accounted for a substantial share of the U.S. coffee market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of distribution channel, the U.S. coffee market is divided into supermarkets/hypermarkets, convenience/grocery stores, online retail, and others. Among these, the supermarkets/hypermarkets segment accounted for a substantial share of the U.S. coffee market in 2023 and is anticipated to grow at a rapid pace during the projected period. Consumers prefer these outlets for their extensive selections, competitive pricing, and convenience of purchasing coffee alongside other groceries. Major retailers like Walmart, Costco, and Kroger cater to diverse preferences, offering various brands and private-label options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA coffee market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Starbucks Corporation

- Keurig Dr Pepper Inc.

- Califia Farms LLC

- Nestlé S.A.

- Monster Beverage Corporation

- The J.M. Smucker Co.

- White Wave Food Co.

- Fresh Roasted Coffee LLC

- Eight O'Clock Coffee Company

- Kraft Heinz Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, Nespresso, a Nestlé company, launched plant-based home compostable coffee capsules. It serves excellent quality coffee without sacrificing taste. The capsules are meant to work with Nespresso Original machines.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US coffee market based on the below-mentioned segments

United States Coffee Market, By Product Type

- Whole Bean

- Ground Coffee

- Instant Coffee

- Coffee Pods

- Capsules

United States Coffee Market, By Application

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail

- Others

Need help to buy this report?