United States Commercial Auto Insurance Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Vehicles, Trucks, and Specialty Vehicles), By Business Type (Small Business, Medium to Large Business, and Specialty Businesses), By Coverage Options (Liability Coverage, Collision Coverage, Comprehensive Coverage, and Uninsured/Underinsured Motorist Coverage), and U.S. Commercial Auto Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Commercial Auto Insurance Market Insights Forecasts to 2033

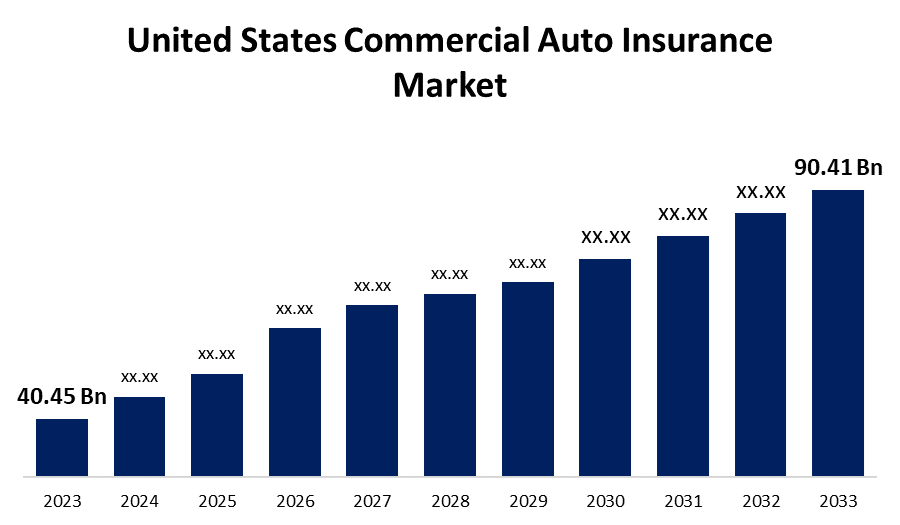

- The US Commercial Auto Insurance Market Size was valued at USD 40.45 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.38% from 2023 to 2033

- The U.S. Commercial Auto Insurance Market Size is Expected to Reach USD 90.41 Billion by 2033

Get more details on this report -

The US Commercial Auto Insurance Market Size is Anticipated to Exceed USD 90.41 Billion by 2033, Growing at a CAGR of 8.38% from 2023 to 2033.

Market Overview

Commercial auto insurance provides various types of coverage for commercial vehicles such as cars, trucks, vans and other types of vehicles. Every commercial auto insurance policy has three basic components, including collision and bodily damage insurance that includes comprehensive coverage. Liability insurance covers bodily injury, property damage, uninsured motorist and underinsured motorist. Additional coverage may include coverage for medical payments, towing and labour, rental reimbursement, and auto loan or lease gap in addition to collision insurance. Insurance that protects individuals or businesses from being held liable for damages or injuries caused to others. In addition to these basic components, choices and additional features, customers have the option to personalize their commercial auto insurance policy by adding the coverages known as endorsements. Roadside assistance provides coverage for situations not normally covered by commercial auto insurance. These can include vehicle breaking down, having a dead battery, and flat tires. The market is further enhanced by insurance companies providing personalized policies and risk management solutions designed for businesses using commercial vehicles, ensuring adherence to regulations and protecting against monetary losses. Recently, the American market for business vehicle insurance has experienced sharp rises in premiums. The increasing costs of car repairs due to advanced technology in modern vehicles. Although sensors and cameras enhance safety, they also raise repair costs. Moreover, an uptick in claim frequency and compensation has been driven by distracted driving incidents and severe weather events.

Report Coverage

This research report categorizes the market for the U.S. commercial auto insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US commercial auto insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. commercial auto insurance market.

United States Commercial Auto Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 40.45 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.38% |

| 2033 Value Projection: | USD 90.41 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Business Type, By Coverage Options |

| Companies covered:: | Allstate, American Family Insurance, Berkshire Hathaway, Chubb, Cincinnati Financial, Farmers Insurance, GEICO, The Hartford, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of businesses using vehicles for operations, regulatory demands, and the necessity for thorough risk management are driving factors in the US commercial auto insurance market. Economic activities in different industries like transportation, logistics, construction, and services are driving growth in this market, as they heavily depend on fleets of vehicles for their daily operations. Commercial auto insurance offers protection for business-related vehicles such as trucks, vans, taxis, and specialized vehicles, including coverage for liabilities, property damage, and accidents. Additionally, the integration of technology like telematics systems and GPS tracking in fleet management improves risk evaluation, driver supervision, and claims handling procedures, leading to increased market expansion and productivity.

Restraining Factors

Insurance costs can create obstacles for certain businesses, especially small ones with restricted funding.

Market Segmentation

The United States commercial auto insurance market share is classified into vehicle type, business type, and coverage options.

- The trucks segment is expected to hold the largest market share through the forecast period.

The US commercial auto insurance market is segmented by vehicle type into passenger vehicles, trucks, and specialty vehicles. Among them, the trucks segment is expected to hold the largest market share through the forecast period. Trucks are crucial in the logistics and transportation industries, which are vital for the economy, leading to their dominance. The increased use of trucks for shipping goods, whether it be within a specific region or between different states, leads to a greater need for insurance protection.

- The medium to large business segment dominates the market with the largest market share over the predicted period.

The US commercial auto insurance market is segmented by business type into small business, medium to large business, and specialty businesses. Among them, the medium to large business segment dominates the market with the largest market share over the predicted period. The reason for this dominance lies in a number of important factors. Medium to large companies frequently manage large numbers of vehicles, leading to a higher need for thorough insurance coverage. Their size enables them to secure more favourable conditions and prices from insurance companies. Moreover, these companies often possess intricate risk profiles that necessitate tailored insurance options which can protect various types of vehicles and usage situations.

- The liability coverage segment is expected to hold the largest market share through the forecast period.

The US commercial auto insurance market is segmented by coverage options into liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Among them, the liability coverage segment is expected to hold the largest market share through the forecast period. The main reason for this domination is the legal obligations in place in most states, which require businesses to have a minimum level of liability insurance to address any bodily injury or property damage from their vehicles. This form of insurance shields companies from possible severe financial damages caused by lawsuits and claims.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States commercial auto insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allstate

- American Family Insurance

- Berkshire Hathaway

- Chubb

- Cincinnati Financial

- Farmers Insurance

- GEICO

- The Hartford

- Liberty Mutual

- Nationwide

- Progressive

- State Farm

- Travelers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Ford and State Farm introduced an innovative Usage-based Insurance (UBI) program. This project is intended for individuals who own eligible Ford and Lincoln vehicles starting from the 2020 model year. Cars with uninterrupted connectivity can securely transmit driving information directly to State Farm, giving drivers more control.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Commercial Auto Insurance Market based on the below-mentioned segments:

United States Commercial Auto Insurance Market, By Vehicle Type

- Passenger Vehicles

- Trucks

- Specialty Vehicles

United States Commercial Auto Insurance Market, By Business Type

- Small Business

- Medium to Large Business

- Specialty Businesses

United States Commercial Auto Insurance Market, By Coverage Options

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

Need help to buy this report?