United States Commercial Banking Market Size, Share, and COVID-19 Impact Analysis, By Product (Commercial Lending, Treasury Management, Syndicated Loans, Capital Market, and Others), By Function (Accepting Deposits, Advancing Loans, Credit Creation, Financing Foreign Trade, Agency Services, and Others), and United States Commercial Banking Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Commercial Banking Market Insights Forecasts to 2033

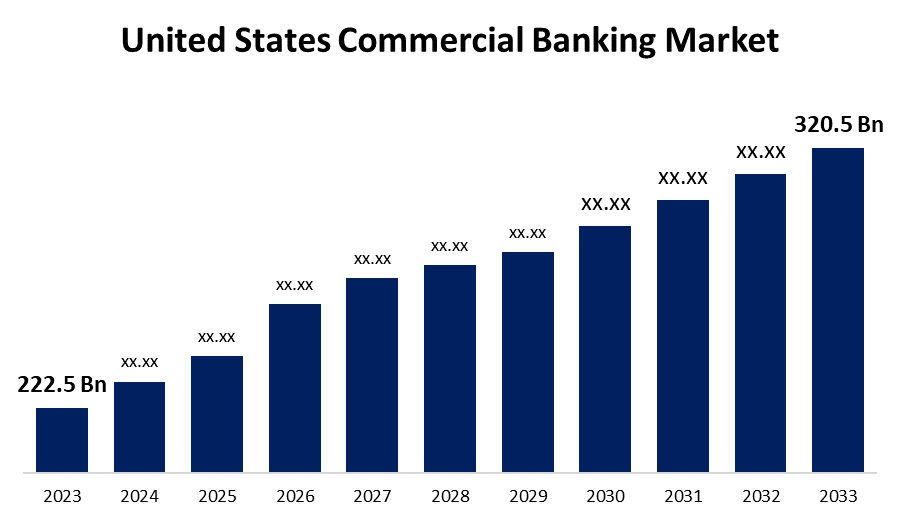

- The United States Commercial Banking Market Size was valued at USD 222.5 billion in 2023.

- The Market is growing at a CAGR of 3.72% from 2023 to 2033

- The U.S. Commercial Banking Market Size is expected to reach USD 320.5 billion by 2033

Get more details on this report -

The United States Commercial Banking Market is anticipated to exceed USD 320.5 billion by 2033, growing at a CAGR of 3.72% from 2023 to 2033. The growing expanding share of wallet with fee-based products and the integration of data and analytics in decision-making are driving the growth of the commercial banking market in the United States.

Market Overview

Commercial banking is financial organizations that offer a variety of services to the general public, such as lending for investments and withdrawals and deposits. Borrowing and lending are the primary functions of commercial banking. The commercial banking industry provides a broad range of services, including capital market services, syndicated loans, treasury management, and commercial lending. It offers credit and financial services to a wide range of customers, including people, SMEs, large corporations, and government organizations, which is essential to economic progress. US commercial banks are improving their customer portals and mobile applications on innovation and technology to satisfy changing consumer needs. Further, the investment by banks in digital transformation and open banking to enhance customer experiences and expand services is due to the competitive landscape. The industry is expanding despite obstacles including regulatory compliance and hefty collateral standards, because of developments in digital banking, personalized services, and partnerships between traditional banks and FinTech businesses. The ongoing rise of fintech companies as well as increased regulatory developments in commercial banking are leveraging market opportunity.

Report Coverage

This research report categorizes the market for the US commercial banking market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the commercial banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the commercial banking market.

United States Commercial Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 222.5 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.72% |

| 2033 Value Projection: | USD 320.5 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Function |

| Companies covered:: | JP Morgan, Bank of America, Citibank, Wells Fargo, Goldman Sachs Group Inc, Morgan Stanley, US Bancorp, Capital One Financial Corp, PNC Financial Services Group Inc, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expanding share of wallet (SOW) with fee-based products in the region is significantly driving the US commercial banking market. By using data-driven decision-making, financial firms may successfully reduce risks, predict market moves, and monitor trends in advances. Thus, the integration of data and analytics in decision-making is bolstering the market growth.

Restraining Factors

The increasing loan interest rates as well as the decrease in the application of big data, AI, and advanced analytics are restraining the US commercial banking market.

Market Segmentation

The United States Commercial Banking Market share is classified into product and function.

- The commercial lending segment dominated the market with the largest market share during the forecast period.

The United States commercial banking market is segmented by product into commercial lending, treasury management, syndicated loans, capital market, and others. Among these, the commercial lending segment dominated the market with the largest market share during the forecast period. Commercial lending includes a range of financial instruments that are necessary for running a business, including lines of credit, term loans, and financing for equipment. The steady demand for financing for capital expenditures, expansion, and operations is driving the market growth in the commercial lending segment.

- The accepting deposits segment accounted for the largest share of the United States commercial banking market in 2023.

Based on the function, the United States commercial banking market is divided into accepting deposits, advancing loans, credit creation, financing foreign trade, agency services, and others. Among these, the accepting deposits segment accounted for the largest share of the United States commercial banking market in 2023. Since deposits are the primary source of revenue for banks’ lending and investment activities, accepting deposits is essential to the banking business model. This is the primary responsibility of commercial banks as it is necessary to support other banking operations and preserve liquidity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US commercial banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JP Morgan

- Bank of America

- Citibank

- Wells Fargo

- Goldman Sachs Group Inc

- Morgan Stanley

- US Bancorp

- Capital One Financial Corp

- PNC Financial Services Group Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, J.P. Morgan Chase reportedly unveiled an artificial intelligence-powered tool designed to facilitate thematic investing. The tool, called IndexGPT, delivers thematic investment baskets created with the assistance of OpenAI’s GPT-4 model.

- In March 2024, Bank of America launched a new Access to Capital Connector, an online platform designed to help entrepreneurs and small business owners start and maintain strong and resilient businesses by linking them directly to local Community Development Financial Institutions (CDFIs) and other business support organizations for capital, coaching, and support.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Commercial Banking Market based on the below-mentioned segments

United States Commercial Banking Market, By Product

- Commercial Lending

- Treasury Management

- Syndicated Loans

- Capital Market

- Others

United States Commercial Banking Market, By Function

- Accepting Deposits

- Advancing Loans

- Credit Creation

- Financing Foreign Trade

- Agency Services

- Others

Need help to buy this report?