United States Commercial Restoration Waterproofing Membranes Market Size, Share, and COVID-19 Impact Analysis, By Product (Liquid Applied and Sheet), By Application (Roofing and Building Structures), and United States Commercial Restoration Waterproofing Membranes Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsUnited States Commercial Restoration Waterproofing Membranes Market Insights Forecasts to 2033

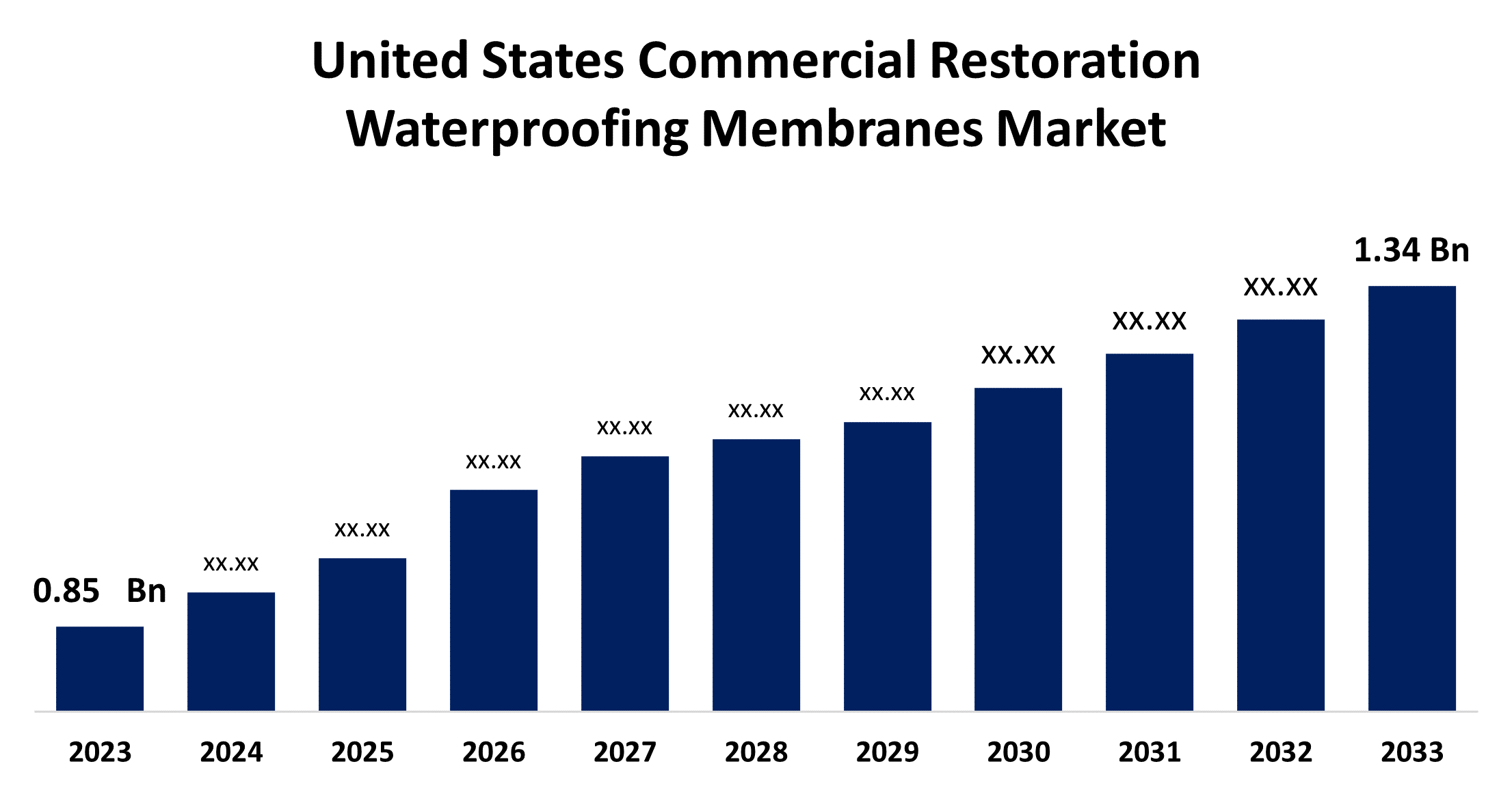

- The United States Commercial Restoration Waterproofing Membranes Market Size was valued at USD 0.85 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.66% from 2023 to 2033

- The U.S Commercial Restoration Waterproofing Membranes Market Size is Expected to reach USD 1.34 Billion by 2033

Get more details on this report -

The United States Commercial Restoration Waterproofing Membranes Market is anticipated to exceed USD 1.34 billion by 2033, growing at a CAGR of 4.66% from 2023 to 2033. The growing emphasis on disaster management plans in government and private offices is driving the growth of the commercial restoration waterproofing membranes market in the United States.

Market Overview

A waterproofing membrane is a layer of water-tight material either liquid-applied or pre-formed sheet membranes that lies on a surface to prevent water leaks or damages. The objective of waterproofing is to secure a building from all kinds of water damage and prevent further repair work on the structure. It prevents the enlargement of foundation cracks and joints that are caused by excess water exposure, thus preventing repair work to issues with leakage, deterioration, and spalling. It also helps to avoid the corrosion of TMT bars and other structural instruments, lowering structural strength and thus helping in increasing the life of the building structure. Thus, companies in the U.S. tend to invest a large sum of money in the repair and maintenance of buildings to keep up operations and avoid losses due to them. Waterproofing prevents water damage in buildings and can provide safety, strengthen the structure, healthier environment, reduce maintenance costs, and increase property value. The use of nanotechnology in ceramic coating for waterproofing is a well-known application of nanotechnology in modern life.

Report Coverage

This research report categorizes the market for the US commercial restoration waterproofing membranes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing US commercial restoration waterproofing membranes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of US commercial restoration waterproofing membranes market.

United States Commercial Restoration Waterproofing Membranes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 0.85 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.66% |

| 2033 Value Projection: | USD 1.34 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Sika AG, DuPont de Nemours, Inc., Johns Manville, BASF SE, Kemper System America, Inc., Alchimica, Covestro AG, Saint-Gobain Weber GmbH, GAF Materials Corporation, Isomat S.A., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The factors such as aging infrastructure, population growth, urbanization, and government initiatives in US aimed at modernizing and expanding transportation, utilities and public facilities that leads to rising infrastructure construction activities resulted into growing market demand of commercial restoration waterproofing membranes. Further, the increasing emphasis on sustainable building practices and need for eco-friendly commercial restoration waterproofing membranes urges to develop and manufacture sophisticated and eco-friendly waterproofing membrane. These factors are enhancing market growth. Additionally, the rising infrastructure development project investments are responsible for driving the market.

Restraining Factors

Lockdown and social distancing norms have limited the building and construction activity and delaying commercial restoration projects negatively affected the market of waterproofing membranes. This leads to restraining the US commercial restoration waterproofing membranes market.

Market Segmentation

The United States Commercial Restoration Waterproofing Membranes Market share is classified into product and application.

- The liquid applied segment is expected to witness the highest CAGR growth during the forecast period.

The United States commercial restoration waterproofing membranes market is segmented by product into liquid applied and sheet. Among these, the liquid applied segment is expected to witness the highest CAGR growth during the forecast period. Liquid-applied waterproofing membranes are easy to apply, providing a monolithic, seamless fluid membrane. It is good for use in complex geometries and provides quick spray application coverage.

- The roofing segment accounted for the largest market share in 2023.

Based on the application, the United States commercial restoration waterproofing membranes market is divided into roofing and building structures. Among these, the roofing segment accounted for the largest market share in 2023. Waterproofing membranes are preferably used for protection against rainwater and environmental moisture. It also provides strength properties to roofing materials to withhold foot traffic.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US commercial restoration waterproofing membranes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sika AG

- DuPont de Nemours, Inc.

- Johns Manville

- BASF SE

- Kemper System America, Inc.

- Alchimica

- Covestro AG

- Saint-Gobain Weber GmbH

- GAF Materials Corporation

- Isomat S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Sika designed the next generation of waterproofing membranes with the launch of SikaProof A+, a new system for below-ground waterproofing of reinforced concrete structures.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Commercial Restoration Waterproofing Membranes Market based on the below-mentioned segments:

United States Commercial Restoration Waterproofing Membranes Market, By Product

- Liquid Applied

- Sheet

United States Commercial Restoration Waterproofing Membranes Market, By Application

- Roofing

- Building Structures

Need help to buy this report?