United States Compound Feed Market Size, Share, and COVID-19 Impact Analysis, By Ingredient (Cereals, Cakes & Meals, and Animal B-products), By Livestock (Ruminants, Poultry, Swine, and Aquaculture), By Form (Mash, Pellets, and Crumbles), and United States Compound Feed Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited States Compound Feed Market Insights Forecasts to 2033

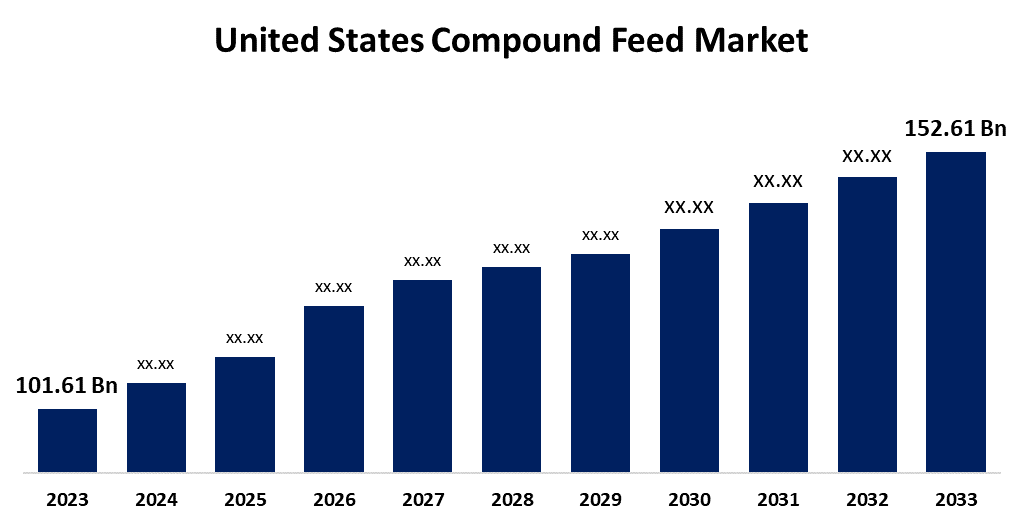

- The US Compound Feed Market Size was valued at USD 101.61 Billion in 2023.

- The Market is growing at a CAGR of 4.15% from 2023 to 2033

- The U. S. Compound Feed Market Size is expected to reach USD 152.61 Billion by 2033

Get more details on this report -

The United States Compound Feed Market is anticipated to exceed USD 152.61 Billion by 2033, growing at a CAGR of 4.15% from 2023 to 2033.

Market Overview

Compound feed is defined as feed that is produced based on the various growth stages, physiological needs, and production uses of animals as well as research and experimentation on the assessment of feed nutrition value and by a scientific formula that mixes feed from different sources uniformly in a specific proportion and is processed using prescribed technology. It is compound feeds that are the cause of the improvement in animal health. Feed is given in varying doses depending on the animal. During the projected period, the compound feed market is expected to see development prospects due to factors such as increased demand for meat and other end products like milk and eggs, as well as rapid urbanization in various areas. The feed enhances the animal's capabilities by supplying additional nutrients, hastening weight gain and growth, and boosting immunity. Due to an abundance of feed resources, the United States is one of the world's leading producers of poultry and has an expanding number of animal farms. Growing worries about the health and well-being of animals are driving demand for compound feed in the US market. Compound feeds minimize nutrient losses and waste while efficiently providing animals with the energy, minerals, amino acids, and trace minerals they need. Manufacturers are taking advantage of growing worries about animal health by customizing feed for stressed, post-weaning, lactation, and sick animals.

Report Coverage

This research report categorizes the market for the United States compound feed market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the compound feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the compound feed market.

United States Compound Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 101.61 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 4.15% |

| 2033 Value Projection: | USD 152.61 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Ingredient, By Livestock, By Form, and COVID-19 Impact Analysis |

| Companies covered:: | Cargill Inc., Land O Lakes Purina, Archer Daniels Midland, Kent Feeds, Alltech Inc., Zoetis Inc, Elanco Animal Health, Phibro Animal Health Corporation, Balchem Corporation, and others Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US compound feed market is expected to increase significantly as a result of the growing emphasis on sustainable animal production methods. Livestock producers are implementing compound feed solutions that support improved animal health, effective feed conversion, and decreased environmental impact in response to consumer demands for animal products obtained sustainably. As a result of this trend, feed formulations are becoming more innovative, utilizing natural and environmentally friendly components, improving nutrient absorption, and improving overall animal performance. The country's efforts to achieve more sustainable agriculture will be greatly aided by the compound feed sector, which will be essential in meeting consumer demand for morally and environmentally sound animal products.

Restraining Factors

The ongoing rise in raw material costs is a major growth hindrance in the US compound feed market. Supply chain disruptions, geopolitical conflicts, and unexpected weather patterns on the availability and cost of grains, cereals, protein feed, and other critical inputs are the main factors affecting the compound feed industry's capacity to deliver balanced animal feed. The need for feed for cattle and poultry is rising, which puts pressure on feed manufacturers to maintain competitive prices, aggravating the problem.

Market Segmentation

The United States compound feed market share is classified into ingredient, livestock, and form.

- The cereals segment is expected to hold the largest market share through the forecast period.

The United States compound feed market is segmented by ingredient into cereals, cakes & meals, and animal b-products. Among them, the cereals segment is expected to hold the largest market share through the forecast period. Due to their widespread use and high demand in the animal feed sector, cereals currently occupy the top spot in the market. Cereal grains, including wheat and corn, are dominant in the compound feed industry due to several factors. They are widely available for use in compound feed formulations since they are widely farmed and easily accessible.

- The poultry segment dominates the market with the largest market share over the predicted period.

The United States compound feed market is segmented by livestock into ruminants, poultry, swine, and aquaculture. Among them, the poultry segment dominates the market with the largest market share over the predicted period. Because of attributes like affordability, adaptability, and nutritional value, there is a constant need for poultry goods, including meat and eggs. The market for poultry products is mostly driven by their nutritional content. The market for these items is largely driven by the nutritious benefits of poultry meat, such as chicken. High-quality protein, vital amino acids, vitamins, and minerals are all found in abundance in poultry.

- The mash segment dominates the market with the largest market share over the predicted period.

The United States compound feed market is segmented by form into mash, pellets, and crumbles. Among them, the mash segment dominates the market with the largest market share over the predicted period. One benefit of mash feed is that the contents are evenly distributed throughout the mixture, reducing the likelihood of animals feeding themselves only certain foods. Mash feed makes sure animals get a balanced diet with all the nutrients they need by taking away the option to select individual ingredients. Furthermore, mash feed production is less expensive since it requires less processing and equipment than more complicated forms like pelleted or extruded feed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States compound feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Inc.

- Land O Lakes Purina

- Archer Daniels Midland

- Kent Feeds

- Alltech Inc.

- Zoetis Inc

- Elanco Animal Health

- Phibro Animal Health Corporation

- Balchem Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, A new version of Evonik Industries' "Biolys" product was introduced, and it now includes useful ingredients like lysin. The substance is used as an energy source in animal feed, particularly for pigs and poultry.

- In March 2023, In the US, International Flavors & Fragrances introduced "Axtra PRIME," a feed solution for piglets. It has a combination of alpha-amylase, beta-glucanase, and alpha-amylase that helps pigs overcome problems with digestion at a young age.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Compound Feed Market based on the below-mentioned segments:

United States Compound Feed Market, By Ingredient

- Cereals

- Cakes & Meals

- Animal B-products

United States Compound Feed Market, By Livestock

- Ruminants

- Poultry

- Swine

- Aquaculture

United States Compound Feed Market, By Form

- Mash

- Pellets

- Crumbles

Need help to buy this report?