United States Concrete Floor Coatings Market Size, Share, and COVID-19 Impact Analysis, By Product (Epoxy, Polyurethanes, Polyaspartics, Others), By Application (Residential, Commercial, Industrial), By Floor Product (Coated, Polished), By End-User (Do-It-Yourself (DIY), Professionals), and US Concrete Floor Coatings Market Insights Forecasts to 2032

Industry: Construction & ManufacturingUnited States Concrete Floor Coatings Market Insights Forecasts to 2032

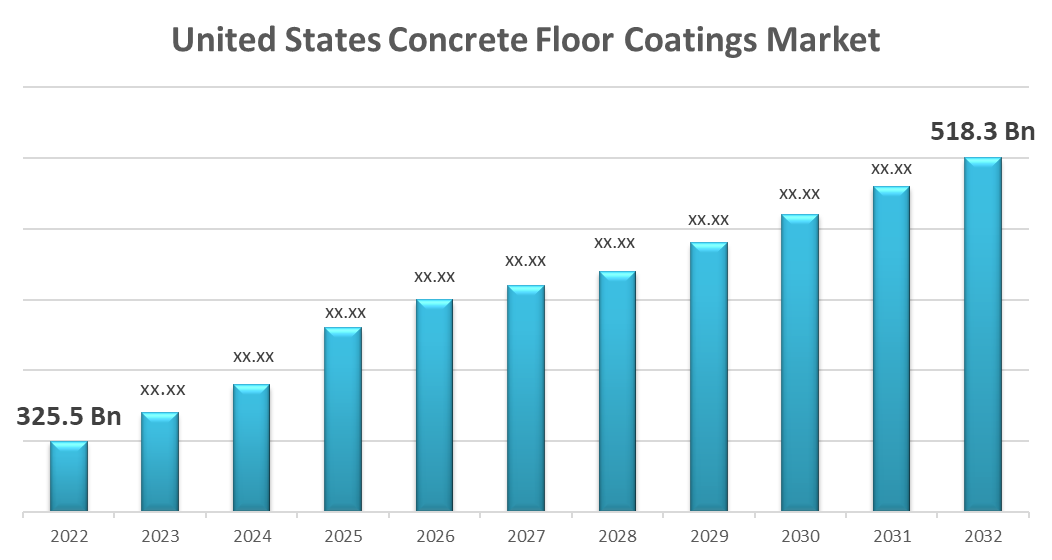

- The United States Concrete Floor Coatings Market Size was valued at USD 325.5 Billion in 2022.

- The Market is Growing at a CAGR of 4.7% from 2022 to 2032.

- The United States Concrete Floor Coatings Market Size is expected to reach USD 518.3 Billion by 2032.

- United States is expected to Grow the fastest during the Forecast period.

Get more details on this report -

The United States Concrete Floor Coatings Market Size is expected to reach USD 518.3 Billion by 2032, at a CAGR of 4.7% during the forecast period 2022 to 2032.

Market Overview

Concrete floor coating is the layer applied to the floors for protection, which is available in the form of liquid and semi-liquid. It exhibits a commendable grip with the concrete surface which further helps in retaining the appearance, texture, and quality of floorings. It is available in different types of material including epoxy, polyaspartics, acrylic, and polyurethane. These coatings increase the shelf life of concrete floors. Furthermore, concrete floor coatings offer several beneficial properties such as wear resistance, tear resistance, abrasion resistance, and heat resistance. These properties are expected to fuel the demand the demand for concrete floor coatings in residential and non-residential sectors. Growing construction spending in the U.S. is expected to increase over the forecast period owing to economic development. The country is characterized by a low-risk environment, a stable economy, and a robust financial sector. These factors have provided a multitude of opportunities for investors in recent years, which are likely to trigger infrastructure spending in the country. This, in turn, is projected to positively impact the demand for concrete floor coatings in the U.S. construction industry. The U.S. government has passed numerous regulations to improve the infrastructure including water supply systems at a domestic level for environmental protection. As a result, non-building structures, such as waste disposal and water supply systems, in the U.S. anticipated foreseeing an increased penetration of concrete floor coatings.

Report Coverage

This research report categorizes the market for United States Concrete Floor Coatings Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Concrete Floor Coatings Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States Concrete Floor Coatings Market.

United States Concrete Floor Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 325.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.7% |

| 2032 Value Projection: | USD 518.3 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Floor Product, By End-User |

| Companies covered:: | • Sherwin-Williams, • Sika Corporation, • Behr Paint Company, • Tennant Coatings, • PPG Pittsburgh Paints, • North American Coating, • Henkel AG & Co. KGaA, • Axalta Coating Systems, • EPMAR Corporation, • Cornerstone Coatings International, Inc. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing demand for coating as a protective medium in the flooring sector is one of the factors driving the United States concrete floor coatings market. Coating solutions are utilized in a wide range of functional areas in buildings and facilities, including industrial floors with mechanical and chemical resistance, cleanroom floors and walls, and decorative floors and walls in commercial and residential structures. The expanding residential, commercial, and industrial infrastructure will drive the concrete floor coatings market during the forecast period. These coatings exhibit characteristics such as excellent adhesion, heat and chemical resistance, and favorable electrical insulation, which leads to increase in the popularity of concrete floor coating formulations. Additionally, the low cost of these coatings compared to their counterparts is expected to have a favorable impact on the United States concrete floor coatings market over the forecast period.

Restraining Factors

Despite its durability and resistance, it must be changed at some point. Cracks can form, and chipping is a common problem. This aspect may act as an obstacle to the market’s growth.

Market Segment

- In 2022, the Epoxy segment accounted for the largest revenue share over the forecast period.

Based on the product type, the United States concrete floor coatings market is segmented into epoxy, polyurethanes, polyaspartics and others. Among these, the epoxy segment has the largest revenue share over the forecast period. These coatings have risen in popularity in concrete floor coating formulations due to qualities such as high adhesion, heat and chemical resistance, and advantageous electrical insulation. Furthermore, the low cost of these coatings in comparison to their competitors is likely to have a positive impact on the United States concrete floor coatings market over the forecast period. These coatings, however, are ineffective during ultraviolet (UV) exposure because the UV radiation reacts with the coated surface to create radicals.

- In 2022, the residential segment is expected to hold the largest share of the United States concrete floor coatings market during the forecast period.

Based on the application, the United States concrete floor coatings market is classified into residential, commercial, industrial. Among these, the residential segment is expected to hold the largest share of the United States concrete floor coatings market during the forecast period. Residential consumption consists of the use of concrete floor coatings in garages, patios, pathways, and basements for new houses and buildings built by the owner or on contract for the owner. The country's residential construction sector is mainly fueled by the increase in single-family housing units. Additionally, single-family housing units are using more usage of concrete floor for multi purposes.

- In 2022, the coated segment accounted for the largest revenue share over the forecast period.

On the basis of floor product, the United States concrete floor coatings market is segmented into coated, polished. Among these, the glass segment has the largest revenue share over the forecast period. A growth in building and construction spending in the United States is predicted to boost demand for coated flooring. The rise in raw material and transportation prices has significantly reduced manufacturers' profit margins. However, technical advancements focused on at improving manufacturing efficiency have reduced the issue of rising raw material prices. Because of qualities such as hardness, increased dimensional stability, and superior resistance to abrasion and UV light, epoxy-based concrete floor coatings account for a large share of the market. Furthermore, its ability to stick to a wide range of substrate surfaces such as concrete, metal, fiber, and glass is likely to drive demand for epoxy-based concrete floor coatings throughout the projection period. Factors such as the availability of new building solutions that require less maintenance and are long-lasting are predicted to boost market expansion.

- In 2022, the professional segment is expected to hold the largest share of the United States concrete floor coatings market during the forecast period.

Based on the end-user, the United States concrete floor coatings market is classified into Do-It-Yourself (DIY), professionals. Among these, the professional’s segment is expected to hold the largest share of the United States concrete floor coatings market during the forecast period. Professional floor coating is more durable than Do-It-Yourself (DIY). Trained professionals manually clean and scratch the floor using specialized tools such as a shot blaster or diamond grinder to ensure the coatings stay properly to the concrete and do not peel or delaminate over time. Thus, professional application is more cost-effective in the long run because of the low maintenance requirements and excellent durability when compared to DIY.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Concrete Floor Coatings Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sherwin-Williams

- Sika Corporation

- Behr Paint Company

- Tennant Coatings

- PPG Pittsburgh Paints

- North American Coating

- Henkel AG & Co. KGaA

- Axalta Coating Systems

- EPMAR Corporation

- Cornerstone Coatings International, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Sika AG announced the merger of Butterfield Color and Scofield to create a harmonized line of decorative concrete products knowns as Sika Color, Sika Cem, and Sika Stamp.

- In September 2020, PPG Industries, Inc. launched the PPG flooring coating, a comprehensive line of a coating system that includes prime coat, base coat, and topcoat to provide optimum performance based on the specific work environment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States concrete floor coatings market based on the below-mentioned segments:

United States Concrete Floor Coatings Market, By Product

- Epoxy

- Polyurethanes

- Polyaspartics

United States Concrete Floor Coatings Market, By Application

- Residential

- Commercial

- Industrial

United States Concrete Floor Coatings Market, By Floor Product

- Coated

- Polished

United States Concrete Floor Coatings Market, By End-User Channel

- Do-IT-Yourself (DIY)

- Professionals

Need help to buy this report?