United States Construction Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Project Management, Financial Management, Quality and Safety, Field Productivity, Others), By Deployment Mode (Cloud, On-Premise), By Organization Size (Small & Medium Enterprise, Large Enterprise), By Application (General Contractors, Building Owners, Architects and Engineers, Specialty Contractors, Sub-Contractors), and United States Construction Software Market Insights Forecasts 2023 – 2033

Industry: Electronics, ICT & MediaUnited States Construction Software Market Insights Forecasts to 2033

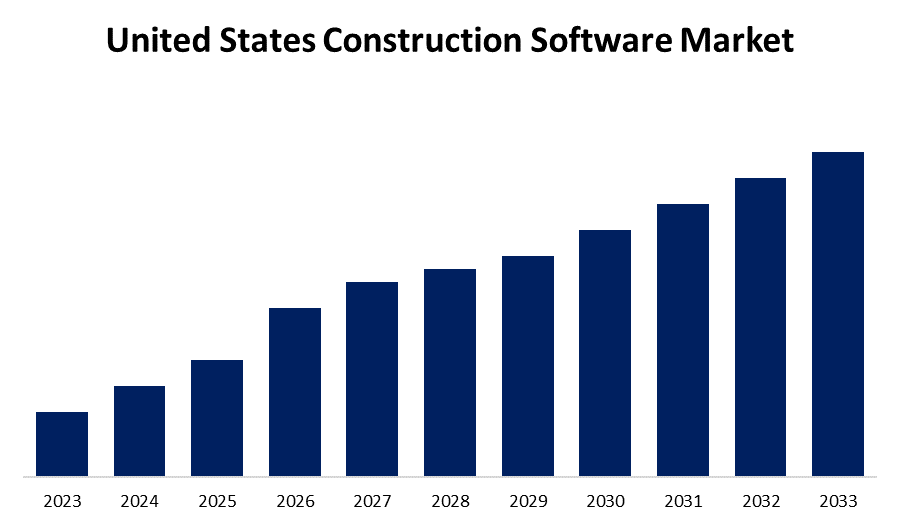

- The Market Size is Growing at a CAGR of 7.85% from 2023 to 2033.

- The United States Construction Software Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Construction Software Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 7.85% during the forecast period 2023 to 2033.

Market Overview

Construction software is a digital solution designed to help with every stage of the construction project management cycle, from initial planning and design to final execution. It also refers to the various software solutions and programs developed to assist construction companies and contractors in increasing productivity, efficiency, and collaboration across construction projects. Furthermore, the United States construction software market is at the cutting edge of technological transformation in the construction industry, disrupting traditional practices. This market addresses the industry's changing needs by providing a suite of software solutions that improve project management, collaboration, and construction workflows. Construction software includes a variety of tools such as project planning and scheduling, building information modelling (BIM), accounting, procurement, and resource management systems. Its adoption is fueled by the industry's pursuit of increased efficiency, cost savings, and productivity. The integration of technology into construction processes has become critical, allowing for real-time communication, data-driven decision-making, and increased project transparency. In addition, the growth of the United States construction software market is being driven by the industry's stringent regulatory compliance requirements and an increased emphasis on safety standards.

Report Coverage

This research report categorizes the market for the United States construction software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States construction software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States construction software market.

United States Construction Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.85% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Deployment Mode, By Organization Size, By Application |

| Companies covered:: | Procore Technologies, Inc., Autodesk, Inc., Oracle Corporation, Trimble Inc., Bentley Systems, Incorporated, Viewpoint, a Trimble Company, PlanGrid, Inc., Sage Group plc, CMiC, Bluebeam, Inc., ConstructTech Solutions, and key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The United States construction software market is propelled by continuous technological advancements and the industry's drive towards digitization, and it is experiencing significant growth as the industry's demand for project management optimization tools increases. Furthermore, the growth of the United States construction software market is being driven by the sector's focus on cost efficiency and return on investment (ROI). The United States construction software market is expanding as the industry places a greater emphasis on sustainability and green construction practices. The industry's commitment to sustainable construction practices, in addition to the incorporation of environmental considerations into project planning, is driving the adoption of software solutions that enable eco-friendly construction methods in the United States.

Restraining Factors

One of the major obstacles confronting the United States construction software market is the complexity of integrating new software solutions with existing legacy systems within construction companies. Resistance to technology adoption among construction professionals and stakeholders creates a significant challenge in the United States construction software market. Data security and privacy are significant difficulties for the United States construction software market.

Market Segment

- In 2023, the project management segment accounted for the largest revenue share over the forecast period.

Based on type, the United States construction software market is segmented into project management, financial management, quality and safety, field productivity, and others. Among these, the project management segment has the largest revenue share over the forecast period. Project management software is at the top of construction technology solutions, meeting the industry's critical requirements for comprehensive project oversight, collaboration, and coordination. This segment includes software solutions for project planning, scheduling, resource allocation, and task management, providing a comprehensive approach to managing construction projects. The dominance of project management software is expected to continue, fueled by the industry's continued emphasis on operational efficiency, project optimization, and the pursuit of streamlined project delivery methodologies across the dynamic landscape of the construction sector.

- In 2023, the cloud segment is witnessing significant growth over the forecast period.

Based on deployment mode, the United States construction software market is segmented into the cloud, on-premise. Among these, the cloud segment is witnessing significant growth over the forecast period. The rise of cloud-based solutions represents a significant shift in the construction industry's approach to software deployment. Cloud-based construction software provides greater flexibility, accessibility, and scalability than traditional on-premise solutions. Furthermore, the Cloud-based model is consistent with the industry's digital transformation, enabling the incorporation of emerging technologies such as Artificial Intelligence (AI), Building Information Modeling (BIM), and the Internet of Things (IoT) into construction workflows.

- In 2023, the large enterprise segment accounted for the largest revenue share over the forecast period.

Based on organization size, the United States construction software market is segmented into small & medium enterprises, large enterprises. Among these, the large enterprises segment has the largest revenue share over the forecast period. Large construction companies use construction software to manage multiple projects simultaneously, optimize resource allocation, and ensure efficient project execution. These software solutions provide comprehensive features such as project planning, budget management, collaboration tools, and reporting capabilities, which are critical for managing the scale and complexity of large construction projects.

- In 2023, the general contractor segment is witnessing significant growth over the forecast period.

Based on application, the United States construction software market is segmented into general contractors, building owners, architects and engineers, specialty contractors, and sub-contractors. Among these, the general contractor segment is witnessing significant growth over the forecast period. General Contractors are responsible for overseeing and managing construction projects, necessitating the use of robust software solutions that address a wide range of project management requirements. Construction software designed for general contractors includes comprehensive project planning, scheduling, resource management, cost estimation, and collaboration tools that are specific to the needs of managing multiple aspects of construction projects. The general contractor’s segment's dominance is driven by the demand for software solutions that streamline workflows, improve project visibility, and allow for seamless communication among project stakeholders.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States construction software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Procore Technologies, Inc.

- Autodesk, Inc.

- Oracle Corporation

- Trimble Inc.

- Bentley Systems, Incorporated

- Viewpoint, a Trimble Company

- PlanGrid, Inc.

- Sage Group plc

- CMiC

- Bluebeam, Inc.

- ConstructTech Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, ConstructTech Solutions, a major player in the US construction software market, unveiled a groundbreaking software suite that represents a paradigm shift in construction project management. The suite combines advanced AI algorithms and IoT connectivity to transform project oversight and site management. The use of IoT sensors improves real-time data collection, giving construction professionals unprecedented insight into on-site operations. ConstructTech Solutions' commitment to innovation is consistent with the construction industry's growing reliance on technology to streamline project workflows and improve efficiency.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Construction Software Market based on the below-mentioned segments:

United States Construction Software Market, By Type

- White

- Black

- Additive

- Color

- Others

United States Construction Software Market, By Deployment Mode

- Cloud

- On-Premise

United States Construction Software Market, By Organization Size

- Small & Medium Enterprise

- Large Enterprise

United States Construction Software Market, By Application

- General Contractors

- Building Owners

- Architects and Engineers

- Specialty Contractors

- Sub-Contractors

Need help to buy this report?