United States Contract Research Organization (CROs) Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Drug Discovery, Preclinical Studies, Early Phase I - IIa, Phase IIa - III, Phase IIIb - IV, Medical Coding & Writing, Monitoring, Clinical Data Management, and Others), By Size Of CROs (Small Size (Less Than 100 Employees), Medium Size (100-500 Employees), and Large Size (More Than 500 Employees)), By Therapeutic Application (Oncology, Cardiovascular Diseases, Central Nervous System Diseases, Infectious Diseases, Immunological Disorders, Respiratory Disorders, and Others), and United States Contract Research Organization (CROs) Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Contract Research Organization (CROs) Market Insights Forecasts to 2033

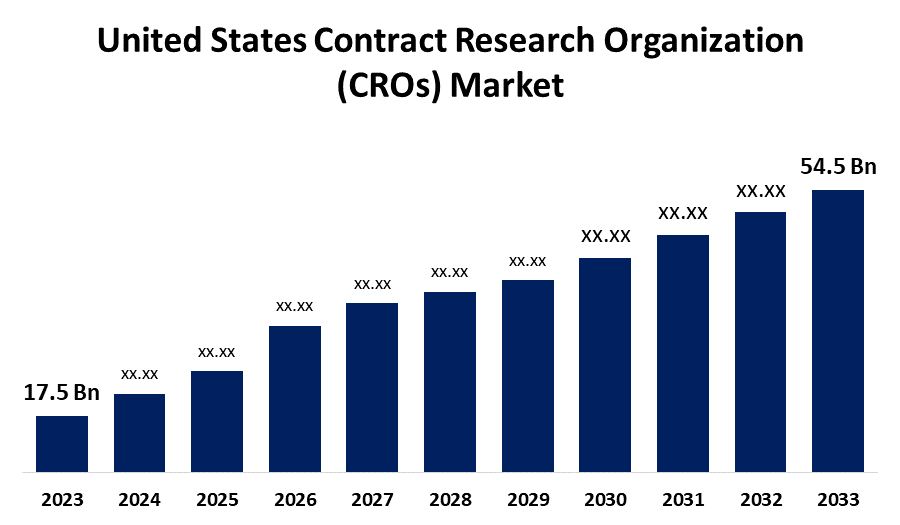

- The U.S. Contract Research Organization (CROs) Market Size was valued at USD 17.5 Billion in 2023.

- The Market is growing at a CAGR of 12.03% from 2023 to 2033

- The U.S. Contract Research Organization (CROs) Market Size is Expected to Reach USD 54.5 Billion by 2033

Get more details on this report -

The United States Contract Research Organization (CROs) Market is Anticipated to Exceed USD 54.5 Billion by 2033, growing at a CAGR of 12.03% from 2023 to 2033. The growing number of clinical trials and R&D expenditures in the pharmaceutical and biotechnology industries are driving the growth of the contract research organization (CROs) market in the US.

Market Overview

Contract research organizations (CROs) provide preclinical, clinical data collection, and services to the biotechnology, pharmaceutical, and medical devices industry. Life science firms can lower the costs associated with developing and introducing new treatments and medical devices by working with contract research organization (CRO) service providers. The need for contract research organization (CRO) services to outsource their R&D has been fueled by the rise of new small and mid-sized pharmaceutical and biotechnological enterprises, that have limited resources for performing R&D independently. There is a growing emphasis on implementing cutting-edge technology by major players to improve their products. Further, expensive clinical trial studies result in the rising cost of medication development, thereby raising R&D investment. The development of hybrid models with CRO-CDMO alliances and the requirement for novel clinical trial designs for complicated cell and gene therapies are enabling market opportunities for contract research organizations (CROs).

Report Coverage

This research report categorizes the market for the US contract research organization (CROs) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States contract research organization (CROs) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US contract research organization (CROs) market.

United States Contract Research Organization (CROs) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.03%. |

| 2033 Value Projection: | USD 54.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Service Type, By Size of CROs, and By Therapeutic Application |

| Companies covered:: | IQVIA Inc., ICON Plc., Syneos Health, Labcorp, Caidya, Premier Research, Medpace, Inc., Paraxel International Corporation, Charles River Laboratories, Inc., WuXi AppTec, Courante Oncology, PROMETRIKA, LLC., EPS Corporation, Worldwide Clinical Trials, Tigermed, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing R&D investment by pharmaceutical and biotechnology companies for the development of novel drugs and therapies is driving the market growth. The necessity of clinical trials for evaluating the safety and effectiveness of drugs is further responsible for propelling the market. According to the National Library of Medicine (NLM), 20,465 clinical trials were accepting new participants in the United States as of January 2024. NLM reported that 65,474 studies were recruiting participants worldwide.

Restraining Factors

The complexity of data handling and ethical considerations are restraining the market for contract research organizations (CROs). For CROs, adhering to various data protection rules and regulations across many jurisdictions increases complexity and may pose legal concerns.

Market Segmentation

The United States Contract Research Organization (CROs) Market share is classified into service type, size of CROs, and therapeutic application.

- The drug discovery segment dominated the market with the largest market share in 2023.

The United States contract research organization (CROs) market is segmented by service type into drug discovery, preclinical studies, early phase I – IIa, phase IIa – III, phase IIIb – IV, medical coding & writing, monitoring, clinical data management, and others. Among these, the drug discovery segment dominated the market with the largest market share in 2023. CROs provide complete drug discovery services, including lead optimization and target validation. They use cutting-edge technology to help clients expedite the discovery process, including genomic screening, bioinformatics, and artificial intelligence. The need to increase efficiency and flexibility while lowering expenses is driving increasing demand for outsourced drug discovery services.

- The large size (more than 500 employees) segment accounted for the largest market share in 2023.

Based on the size of CROs, the U.S. contract research organization (CROs) market is divided into small size (less than 100 employees), medium size (100-500 employees), and large size (more than 500 employees). Among these, the large size (more than 500 employees) segment accounted for the largest market share in 2023. Large CROs have extensive service portfolios encompassing the whole drug development lifecycle from pre-clinical to post-marketing. Further, the robust quality systems and certified regulatory compliance processes in large CROs drive market growth. Large, reputable CROs are preferred by pharmaceutical companies to manage their most well-known programs.

- The oncology segment dominates the US contract research organization (CROs) market during the forecast period.

Based on the therapeutic application, the U.S. contract research organization (CROs) market is divided into oncology, cardiovascular diseases, central nervous system diseases, infectious diseases, immunological disorders, respiratory disorders, and others. Among these, the oncology segment dominates the US contract research organization (CROs) market during the forecast period. The rising incidences of cancer surge R&D investment for the development of innovative oncology therapies by the pharmaceutical companies which results in driving the demand for contract research organizations. Modern technology, a large pool of skilled oncology researchers, and the increasing complexity of cancer studies have made CROs a vital resource that is propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. contract research organization (CROs) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IQVIA Inc.

- ICON Plc.

- Syneos Health

- Labcorp

- Caidya

- Premier Research

- Medpace, Inc.

- Paraxel International Corporation

- Charles River Laboratories, Inc.

- WuXi AppTec

- Courante Oncology

- PROMETRIKA, LLC.

- EPS Corporation

- Worldwide Clinical Trials

- Tigermed

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Veeda Group acquired European CRO- Health data specialists (Heads). Veeda Group strengthened its clinical trials arm and brought oncology focus through Heads acquisition.

- In November 2023, Ichor Life Sciences, a full-service contract research organization (CRO) and longevity biotechnology company, announced the launch of Ichor Clinical Trial Services. With the founding of Ichor Clinical, the company can serve biotechnology and pharmaceutical clients from early preclinical studies through late-stage clinical trials and FDA approval.

- In August 2023, Parexel, a clinical research organization (CRO), and Partex, a biopharmaceutical company that has developed a digital pharma platform, announced a preferred strategic alliance. The goal of the alliance is to leverage artificial intelligence (AI)-powered solutions to accelerate drug discovery and development.

- In July 2023, NAMSA, a medtech contract research organization (CRO), acquired CRI – The Clinical Research Institute, a German full-service CRO. CRI provides the European medtech market with clinical research solutions to accelerate scientific outcomes.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Contract Research Organization (CROs) Market based on the below-mentioned segments:

US Contract Research Organization (CROs) Market, By Service Type

- Drug Discovery

- Preclinical Studies

- Early Phase I – IIa

- Phase IIa – III

- Phase IIIb – IV

- Medical Coding & Writing

- Monitoring

- Clinical Data Management

- Others

US Contract Research Organization (CROs) Market, By Size of CROs

- Small Size (Less Than 100 Employees)

- Medium Size (100-500 Employees)

- Large Size (More Than 500 Employees)

US Contract Research Organization (CROs) Market, By Therapeutic Application

- Oncology

- Cardiovascular Diseases

- Central Nervous System Diseases

- Infectious Diseases

- Immunological Disorders

- Respiratory Disorders

- Others

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global steel framing market over the forecast period?The global Steel framing market size is expected to grow from USD 35.03 Billion in 2023 to USD 58.12 Billion by 2033, at a CAGR of 5.19% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global steel framing market?Asia-Pacific is projected to hold the largest share of the global steel framing market over the forecast period.

-

3. Who are the top key players in the Steel framing market?Keymark EnterprisesLLC, Aegis Metal Framing, The Steel Framing Company, Voestalpine Metsec Plc, Hadley Group, The Hadley Group, ClarkDietrich Building Systems, Olmar Supply Inc, Saint-Gobain S.A, The Stowell Company Inc, Zauba Technologies & Data Services Private Limited, Mill Steel Co, REIDsteel, and Others.

-

1. What is the CAGR of the global steel framing market over the forecast period?The global Steel framing market size is expected to grow from USD 35.03 Billion in 2023 to USD 58.12 Billion by 2033, at a CAGR of 5.19% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global steel framing market?Asia-Pacific is projected to hold the largest share of the global steel framing market over the forecast period.

-

3. Who are the top key players in the Steel framing market?Keymark EnterprisesLLC, Aegis Metal Framing, The Steel Framing Company, Voestalpine Metsec Plc, Hadley Group, The Hadley Group, ClarkDietrich Building Systems, Olmar Supply Inc, Saint-Gobain S.A, The Stowell Company Inc, Zauba Technologies & Data Services Private Limited, Mill Steel Co, REIDsteel, and Others.

Need help to buy this report?