United States Cosmetics Market Size, Share, and COVID-19 Impact Analysis, By Product (Skin Care, Hair Care, Makeup, Fragrance, and Others), By End-User (Men and Women), By Distribution Channel (Offline and Online), and United States Cosmetics Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Cosmetics Market Insights Forecasts to 2033

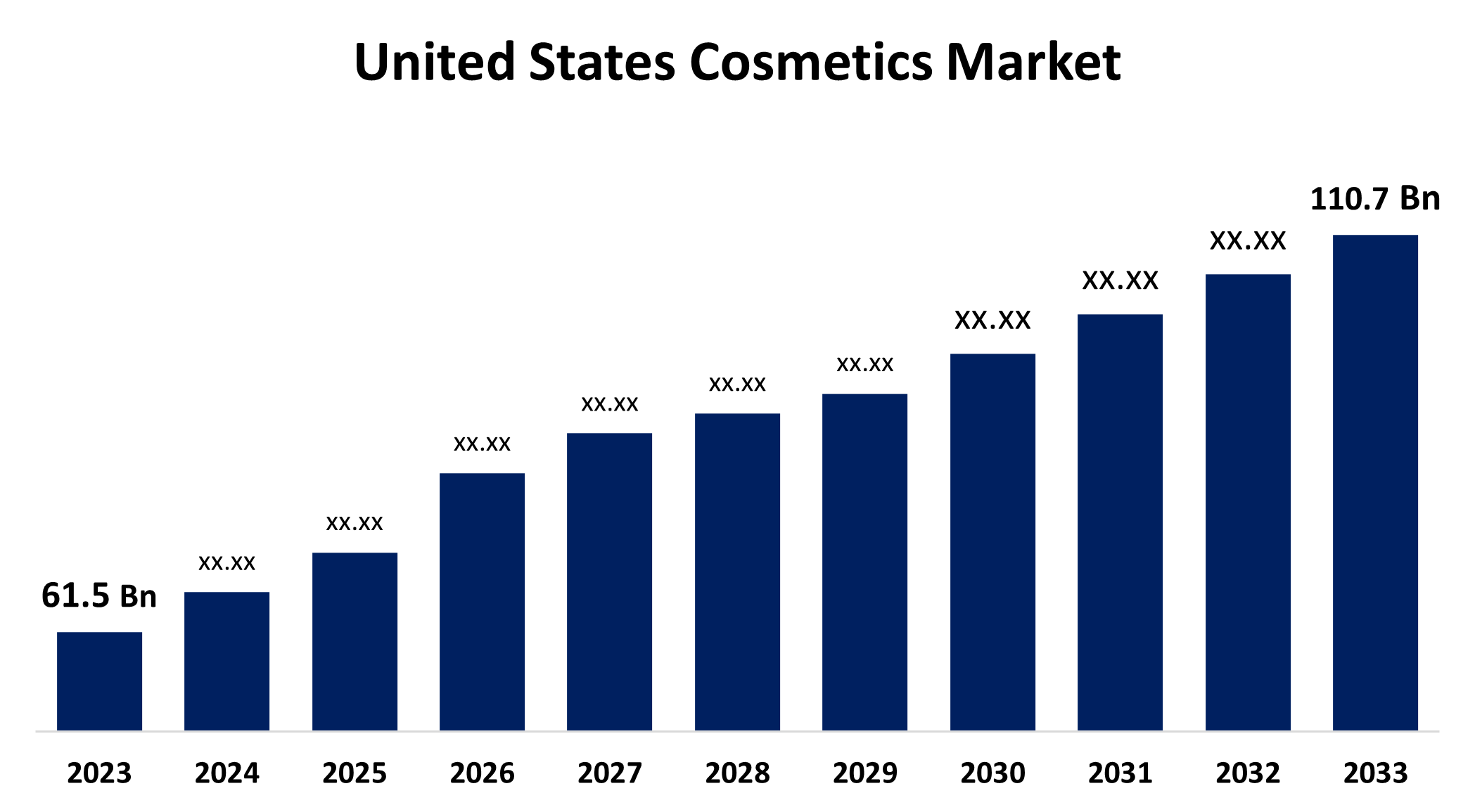

- The U.S. Cosmetics Market Size was valued at USD 61.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.05% from 2023 to 2033

- The U.S. Cosmetics Market Size is Expected to reach USD 110.7 Billion by 2033

Get more details on this report -

The United States Cosmetics Market is anticipated to exceed USD 110.7 Billion by 2033, growing at a CAGR of 6.05% from 2023 to 2033. The growing focus on personal hygiene and self-care products, increasing spending on personal appearance, and adoption of makeup and accessories in regular routines are driving the growth of the cosmetics market in the US.

Market Overview

Cosmetics are products for personal care and beauty that are used to clean and beautify the skin, improving personal appearance. A lot of consumers search for skin care solutions that will eventually nourish their skin. To draw in more customers, well-known American corporations are concentrating on creating novel and inventive cosmetics using materials of the highest quality. The U.S. cosmetics market is expected to rise as a result of millennials' increasing reliance on social media to maintain a nice appearance. Further, the advent of new technology has spawned fresh approaches in the cosmetics sector, changing young customers' purchasing habits and demand patterns while fostering market expansion. American consumers have been using beauty and cosmetics items, including color cosmetics, skin care products, and hair care products, and are willing to spend a lot of money on looks, which creates significant growth opportunities for the cosmetics market.

Report Coverage

This research report categorizes the market for the US cosmetics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cosmetics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US cosmetics market.

United States Cosmetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 61.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.05% |

| 2033 Value Projection: | USD 110.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-User, By Distribution Channel |

| Companies covered:: | L’Oréal S.A., Estée Lauder Companies Inc., Revlon, Inc., Coty Inc., Unilever PLC, Procter & Gamble, Shiseido Company, Limited, Beiersdorf AG, Avon Products Inc., Godrej, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

American consumers have been using beauty and cosmetics items, including color cosmetics, skin care products, and hair care products which is responsible for driving the market expansion. Personal care goods such as fragrances, cosmetics, and deodorants have become indispensable for everyday use since appearance counts especially among the millennial population which is responsible for driving the market. Consumer spending on cosmetics and other personal hygiene items has increased as they are buying these cosmetics as a result of increased advertising and promotional efforts. These factors are driving the market growth.

Restraining Factors

The allergic effects associated with the use of synthetic cosmetics products due to the presence of harmful chemicals are hampering the US cosmetics market.

Market Segmentation

The United States Cosmetics Market share is classified into product, end-user, and distribution channel.

- The skin care segment dominates the US cosmetics market with the largest share in 2023.

The United States cosmetics market is segmented by product into skin care, hair care, makeup, fragrance, and others. Among these, the skin care segment dominates the US cosmetics market with the largest share in 2023. A variety of products, including face creams, oils, gels, scrubs, masks, peels, powders, and more, are available in the skin-care products. The accessibility of branded products, brand ambassadors, and the use of products by medical practitioner’s professional advice are driving the market demand.

- The women segment accounted for the largest revenue share of the US cosmetics market in 2023.

The United States cosmetics market is segmented by end-user into men and women. Among these, the women segment accounted for the largest revenue share of the US cosmetics market in 2023. The majority of the inventions made available by the cosmetics business have found their way into the hands of women. The strong female activity around the use of skin care products, makeup, nail care products, and other self-care routines is driving the market growth.

- The offline segment dominates the US cosmetics market with the largest market share in 2023.

Based on the distribution channel, the U.S. cosmetics market is divided into offline and online. Among these, the offline segment dominates the US cosmetics market with the largest market share in 2023. Supermarkets, hypermarkets, pharmacies, retail centres, brand stores, speciality shops, convenience stores, and ordinary grocery stores are among the establishments where industry players store up surplus products to fill shelf space. The brand presence that these locations provide is essential in creating the desire to buy a variety of cosmetic items as this enables direct consumer interaction and review of products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. cosmetics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Revlon, Inc.

- Coty Inc.

- Unilever PLC

- Procter & Gamble

- Shiseido Company, Limited

- Beiersdorf AG

- Avon Products Inc.

- Godrej

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Coty Inc., one of the world’s largest beauty companies with a portfolio of iconic brands across fragrance, color cosmetics, skin and body care, announced that it has signed a new agreement with luxury Italian fashion house, Etro, to produce and distribute its signature fragrance lines and home scent collections beyond 2040.

- In January 2024, Shiseido developed the “Beauty AR Navigation,” a digital application system to support consumers, even in places where in-person instruction is inaccessible, in mastering and practicing appropriate beauty regimens through interactive communication using smartphones and tablet terminals.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Cosmetics Market based on the below-mentioned segments:

US Cosmetics Market, By Product

- Skin Care

- Hair Care

- Makeup

- Fragrance

- Others

US Cosmetics Market, By End-User

- Men

- Women

US Cosmetics Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?