United States Credit Agency Market Size, Share, and COVID-19 Impact Analysis, By Client Type (Individual and Commercial), By Vertical (Direct-To-Consumer, Government & Public Sector, Healthcare, Financial Services, Software & Professional Services, Media & Technology, Automotive, Telecom & Utilities, and Retail & E-Commerce), and United States Credit Agency Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Credit Agency Market Insights Forecasts to 2033

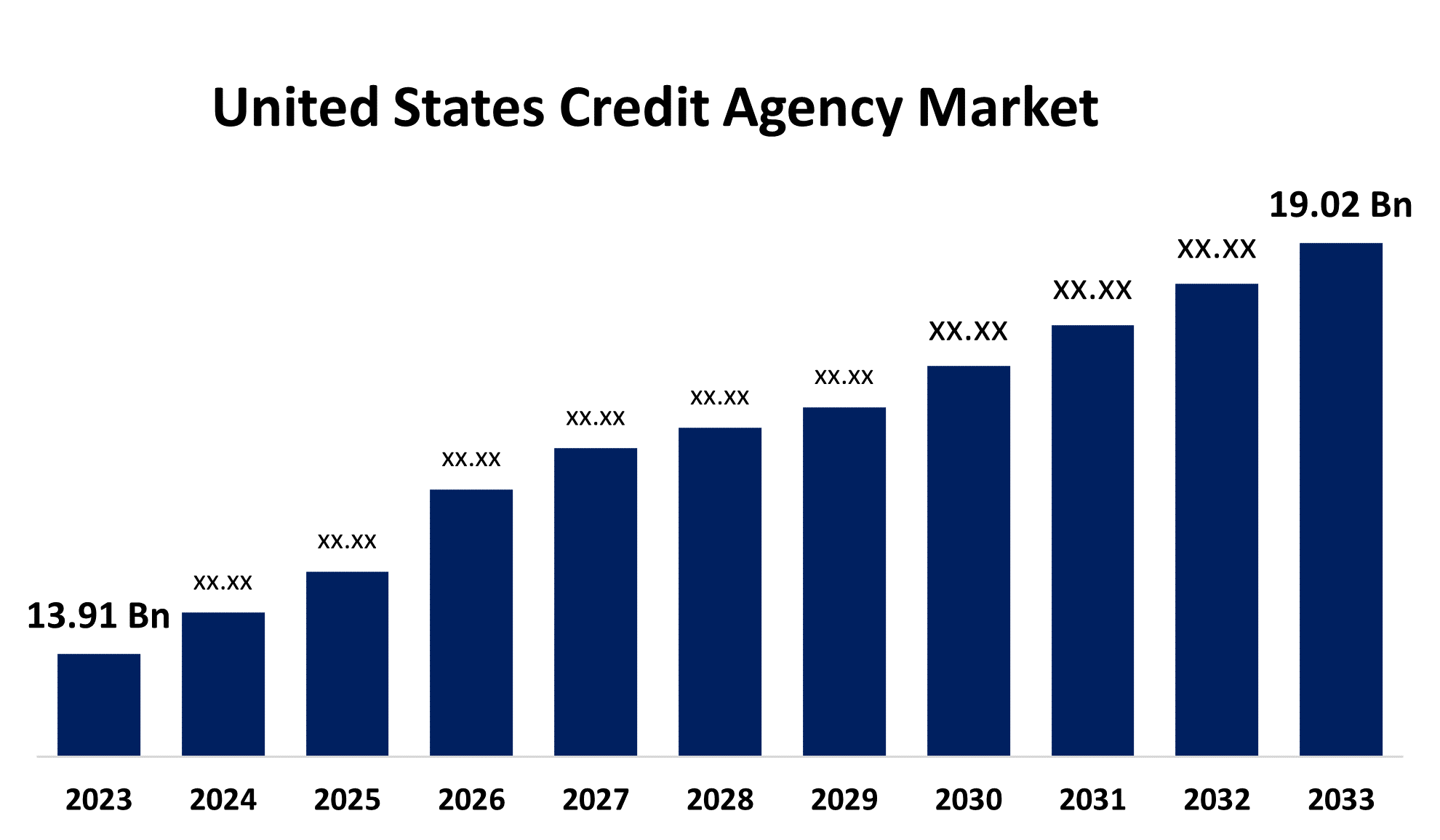

- The US Credit Agency Market Size was valued at USD 13.91 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.18% from 2023 to 2033

- The U.S. Credit Agency Market Size is Expected to Reach USD 19.02 Billion by 2033

Get more details on this report -

United States Credit Agency Market is Anticipated to Exceed USD 19.02 Billion by 2033, growing at a CAGR of 3.18% from 2023 to 2033.

Market Overview

A credit agency is one of the primary types of credit reporting agencies. Credit agency gathers data from various financial and non-financial sources such as microfinance institutions and credit card companies, offering detailed consumer credit information and additional services like credit scores to private lenders. Credit reporting agencies are privately owned and privately operated businesses. In contrast, credit registries, the second main type of credit reporting institution, are usually operated by bank supervisors or central banks and are public entities. As per privately owned business enterprises, credit agency serves the informational needs of commercial lenders. Although there is variation in the type and scope of information they collect, credit agencies generally attempt to collect very detailed data on individual clients. They therefore cover smaller debts than credit registries and often collect information from various financial and non-financial institutions, including retailers, credit card companies, and micrfinance institutions. As a result, the data collected by credit agencies is often more comprehensive and better equipped to assess and monitor the creditworthiness of individual clients. Credit rating agencies took several rating actions in response to the pandemic. Many institutions, including corporations, municipalities, and even entire industries, saw their credit ratings adjusted to reflect the increased risk and uncertainty associated with the pandemic. Downgrades were prevalent, especially in industries directly affected by the lockdown and travel restrictions.

Report Coverage

This research report categorizes the market for the United States credit agency market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US credit agency market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. credit agency market.

United States Credit Agency Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.91 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.18% |

| 2033 Value Projection: | USD 19.02 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Client Type, By Vertical |

| Companies covered:: | Equifax Inc, TransUnion, Fair Isaac Corp. (commonly known as FICO), Moody’s Corporation, S&P Global Inc., Kroll Bond Rating Agency (KBRA), DBRS Morningstar, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in demand for credit cards is predicted to fuel the expansion of the credit agency market shortly. Credit cards act as cash or check alternatives, usually offering an unsecured revolving line of credit. Credit card providers regularly provide credit agencies with cardholder activity data, helping to assess individual creditworthiness. This information forms the basis for the customer's loan eligibility and also offers benefits such as unlimited reward points, insurance coverage, discounts, cashback, and credit score improvement. Blockchain adoption is an important trend gaining traction in the credit agency market. Major players in the industry are focusing their attention on implementing cutting-edge technologies to strengthen their market position.

Restraining Factors

Credit agencies are severely controlled because of their role in financial markets. Compliance with regulations such as the Dodd-Frank Act and SEC regulations requires significant resources and can impact operations.

Market Segmentation

The United States credit agency market share is classified into client type and vertical.

- The individual segment is expected to hold the largest market share through the forecast period.

The US credit agency market is segmented by client type into individual and commercial. Among them, the individual segment is expected to hold the largest market share through the forecast period. The demand in this segment is attributed to the increasing awareness of credit management, consumer lending activities, and regulatory changes affecting consumer rights.

- The financial services segment dominates the market with the largest market share over the predicted period.

The U.S. credit agency market is segmented by vertical into direct-to-consumer, government & public sector, healthcare, financial services, software & professional services, media & technology, automotive, telecom & utilities, and retail & e-commerce. Among them, the financial services segment dominates the market with the largest market share over the predicted period. This is attributed to the lending activities, economic conditions affecting borrowing and lending rates, and regulatory requirements that mandate the use of credit information in financial decision-making.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US credit agency market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Equifax Inc

- TransUnion

- Fair Isaac Corp. (commonly known as FICO)

- Moody's Corporation

- S&P Global Inc.

- Kroll Bond Rating Agency (KBRA)

- DBRS Morningstar

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Moody's declared a novel strategic partnership with Microsoft to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and the global knowledge workforce. Built on a combination of Moody's strong data and analytics capabilities and the power and scale of the Microsoft Azure OpenAI service, the partnership creates an innovative offering that leverages insights in corporate intelligence and risk assessment, powered by Microsoft AI and Moody's proprietary analytics and data.

Market Segment

This study forecasts revenue at the US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Credit Agency Market based on the below-mentioned segments:

United States Credit Agency Market, By Client Type

- Individual

- Commercial

United States Credit Agency Market, By Vertical

- Direct-To-Consumer

- Government and Public Sector

- Healthcare

- Financial Services

- Software and Professional Services

- Media and Technology

- Automotive

- Telecom and Utilities

- Retail and E-Commerce

Need help to buy this report?