United States Crime Risk Report Market Size, Share, and COVID-19 Impact Analysis, By Type (Financial & Cybercrime, Personal Crime, and Property Crime), By Deployment (On-premise and Cloud), and by the United States Crime Risk Report Market Insights Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Crime Risk Report Market Insights Forecasts to 2033

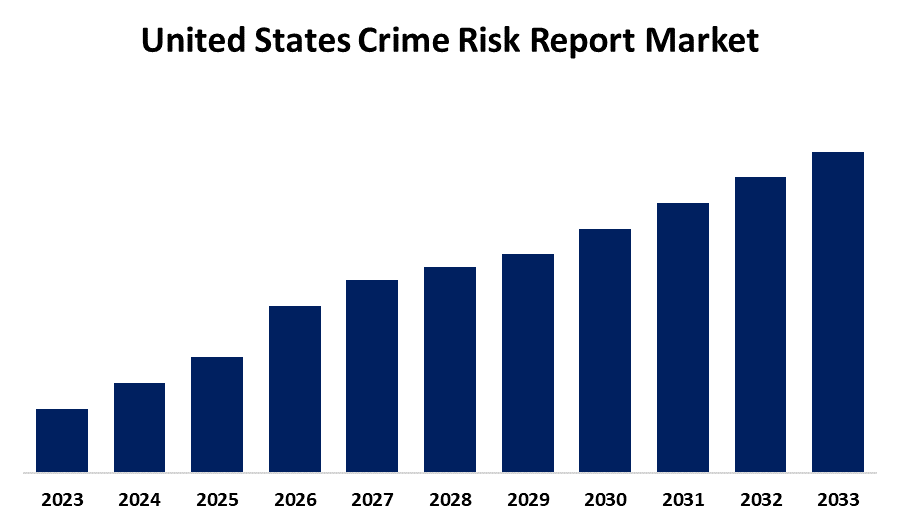

- The United States Crime Risk Report Market Size is Growing at a CAGR of XX% from 2023 to 2033

- The United States Crime Risk Report Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The United States Crime Risk Report Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of XX% from 2023 to 2033.

Market Overview

The United States crime risk report market refers to the industry involved in the collection, analysis, and distribution of crime-related data to assess risk levels across various regions. These reports are widely utilized by businesses, real estate developers, financial institutions, law enforcement agencies, and government bodies to evaluate safety conditions and make informed decisions. Crime risk reports incorporate statistical analysis, geospatial mapping, and predictive modeling to identify crime patterns and trends, aiding in risk mitigation strategies. The market is driven by increasing concerns over public safety, rising crime rates in urban areas, and the growing need for data-driven decision-making in security planning. Advancements in big data analytics, artificial intelligence, and geographic information systems (GIS) enhance the accuracy and accessibility of crime risk assessments. Demand from real estate and financial sectors for crime risk evaluation further supports market growth, as businesses seek to minimize security-related risks. Government agencies such as the Federal Bureau of Investigation (FBI) and the Bureau of Justice Statistics (BJS) play a crucial role in providing crime data and enhancing transparency in crime reporting. Initiatives such as the National Crime Statistics Exchange (NCS-X) and improvements in the Uniform Crime Reporting (UCR) program promote real-time crime data collection and accessibility. Investments in smart policing technologies and crime prevention programs further support the development of crime risk assessment tools, enhancing their adoption across various industries.

Report Coverage

This research report categorizes the market for the United States crime risk report market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States crime risk report market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each United States crime risk report market sub-segment.

United States Crime Risk Report Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | XX% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By Deployment |

| Companies covered:: | ACI Worldwide, CAP Index, Inc., CoreLogic, Fenergo, Fiserv, Inc., IBM, Intelligent Direct, Inc., SAP SE, Oracle, London Stock Exchange Group plc, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The United States crime risk report market is driven by increasing concerns over public safety and the rising demand for data-driven security solutions. Urbanization and population growth have heightened the need for crime risk assessments in real estate, financial services, and business planning. Advancements in big data analytics, artificial intelligence, and geographic information systems (GIS) enhance the accuracy of crime reports, making them more reliable for decision-making. Government initiatives promoting real-time crime data collection, such as the National Crime Statistics Exchange (NCS-X), further support market growth. Additionally, the increasing adoption of predictive analytics in law enforcement and corporate security boosts demand.

Restraining Factors

High costs associated with advanced crime risk analysis tools limit adoption among small businesses and individuals. Data privacy concerns and regulatory challenges restrict access to detailed crime reports. Additionally, inconsistencies in crime reporting across regions affect the accuracy of risk assessments.

Market Segment

The U.S. crime risk report market share is classified into type and deployment.

- The financial & cybercrime segment is expected to hold the largest market share through the forecast period.

The US crime risk report market is segmented by type into financial & cybercrime, personal crime, property crime. Among these, the financial & cybercrime segment is expected to hold the largest market share through the forecast period. The rising prevalence of cyber threats, identity theft, fraud, and financial crimes has significantly increased the demand for crime risk reports in this category. Businesses, financial institutions, and government agencies increasingly rely on risk assessments to mitigate cybersecurity threats and fraud-related risks.

- The cloud segment is expected to hold the largest market share through the forecast period.

The US crime risk report market is segmented by deployment into on-premise and cloud. Among these, the cloud segment is expected to hold the largest market share through the forecast period. Cloud-based crime risk reporting solutions offer scalability, real-time data access, and cost-effectiveness, making them the preferred choice for businesses, financial institutions, and law enforcement agencies. Advancements in big data analytics, artificial intelligence, and cybersecurity enhance cloud-based platforms, improving crime trend analysis and predictive modeling.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States crime risk report market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACI Worldwide

- CAP Index, Inc.

- CoreLogic

- Fenergo

- Fiserv, Inc.

- IBM

- Intelligent Direct, Inc.

- SAP SE

- Oracle

- London Stock Exchange Group plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

- This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States crime risk report market based on the below-mentioned segments:

United States Crime Risk Report Market, By Type

- Financial & Cybercrime

- Personal Crime

- Property Crime

United States Crime Risk Report Market, By Deployment

- On-premise

- Cloud

Need help to buy this report?