United States Crowdsourced Security Market Size, Share, and COVID-19 Impact Analysis, By Type (Web Application, Mobile Application, Others), By Deployment Mode (Cloud, and On-Premises), By Organization Size (Large Enterprises, and SMEs), and the United States Crowdsourced Security Market Insights Forecasts 2023 – 2033

Industry: Electronics, ICT & MediaUnited States Crowdsourced Security Market Insights Forecasts to 2033s

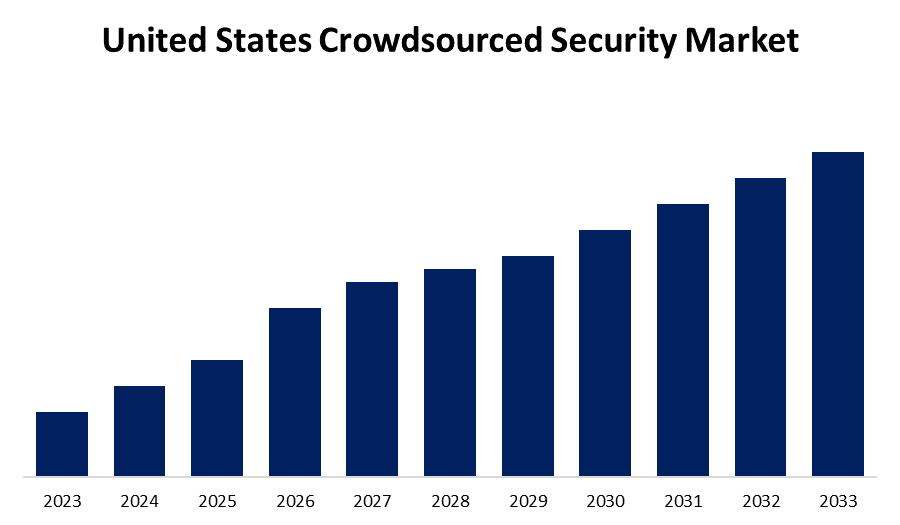

- The Market Size is Growing at a CAGR of 7.9% from 2023 to 2033.

- The United States Crowdsourced Security Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Crowdsourced Security Market size is expected to hold a significant share by 2033, at a CAGR of 7.9% during the forecast period 2023 to 2033.

Market Overview

Crowdsourced security is a collection of security-related solutions and services that all involve inviting people to test a specific product for any flaws, vulnerabilities, or cyber threats that may exist. A variety of security tools are used to test the effectiveness of security measures in place within the target product by outside people and developers, which is referred to as crowdsourced security. The United States crowdsourced security market is witnessing substantial growth as organizations increasingly turn to decentralized cybersecurity solutions. As cybersecurity threats become more sophisticated, the crowdsourced approach offers a dynamic and comprehensive defense mechanism. Crowdsourced security enables organizations to identify vulnerabilities across applications, networks, and systems in real-time. The competitive landscape is driving businesses to use crowdsourced security platforms to protect themselves from cyber threats, fostering innovation in the cybersecurity sector and establishing the United States as a key player in the global crowdsourced security market.

Report Coverage

This research report categorizes the market for the United States crowdsourced security market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States crowdsourced security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States crowdsourced security market.

United States Crowdsourced Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Deployment Mode, By Organization Size |

| Companies covered:: | Intigriti, YesWeHack, Open Bug Bounty, Detectify, Synopsys, Inc., Bugcrowd, Inc., Synack, Inc., CyberGuard Networks, HackerOne, Inc., Cobalt, CROWDSTRIKE, Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The unmatched ability of crowdsourcing to detect and address vulnerabilities is a major driver of the United States crowdsourced security market. Furthermore, the cost-effectiveness and scalability that the United States crowdsourced security market provides to organizations are compelling drivers of its growth. The demand for real-time threat response and continuous monitoring is a key driver propelling the crowdsourced security market in the United States. Furthermore, in the United States, increasingly stringent compliance and regulatory requirements are a significant driving force behind the adoption of crowdsourced security solutions. The desire for innovation in cybersecurity practices is driving the increased adoption of crowdsourced security in the United States.

Restraining Factors

The United States crowdsourced security market faces major impendent in ensuring the quality and consistency of findings from a diverse group of ethical hackers, in addition to navigating regulatory and legal compliance. Trust and confidentiality concerns pose an important obstacle to the widespread adoption of crowdsourced security solutions in the United States.

Market Segment

- In 2023, the web application segment accounted for the largest revenue share over the forecast period.

Based on type, the United States crowdsourced security market is segmented into web applications, mobile applications, and others. Among these, the web application segment has the largest revenue share over the forecast period. The proliferation of web-based platforms, combined with the increasing complexity of online applications, has raised cybersecurity concerns, making web applications a top priority for crowdsourced security initiatives. Organizations ranging from e-commerce platforms to financial institutions prioritize web application security due to the sensitive data they handle. The dynamic and diverse nature of crowdsourced security allows for effective testing across a wide range of web applications, identifying vulnerabilities such as injection attacks, cross-site scripting, and authentication flaws. Crowdsourced security's flexibility in addressing the unique challenges posed by web applications, combined with its scalability and cost-effectiveness, positions it as a critical enabler for organizations looking to fortify their online presence against an ever-expanding range of cyber threats.

- In 2023, the cloud segment is witnessing significant growth over the forecast period.

Based on deployment mode, the United States crowdsourced security market is segmented into cloud, and on-premises. Among these, the cloud segment is witnessing significant growth over the forecast period. The use of cloud-based deployment in crowdsourced security solutions provides unparalleled benefits in terms of scalability, accessibility, and real-time collaboration. Cloud deployment allows organizations to interact seamlessly with a network of ethical hackers, ensuring that a diverse pool of talent is available to identify vulnerabilities. This adaptability aligns with the dynamic nature of cyber threats, allowing organizations to conduct crowdsourced security assessments on demand while optimizing resource utilization. The cloud model also enables continuous monitoring, real-time updates, and streamlined communication channels, which improves the effectiveness of crowdsourced security initiatives. The ongoing evolution of cloud technologies, in addition to the inherent benefits they bring to crowdsourced security practices, solidifies cloud deployment's position as a pivotal force in shaping the cybersecurity landscape in the United States.

- In 2023, the large enterprises segment accounted for the largest revenue share over the forecast period.

Based on organization size, the United States crowdsourced security market is segmented into large enterprises and SMEs. Among these, the large enterprises segment has the largest revenue share over the forecast period. Large enterprises, with complex and extensive IT infrastructures, have been at the forefront of adopting crowdsourced security solutions to strengthen their cybersecurity defenses. Crowdsourced security's scalability and depth of expertise are ideal for large organizations' complex security requirements. The ability to tap into a diverse and community of ethical hackers gives large enterprises a comprehensive and multifaceted approach to identifying vulnerabilities across their vast networks and applications. Furthermore, large enterprises' financial resources enable them to invest heavily in cutting-edge cybersecurity practices, such as crowdsourced security programs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States crowdsourced security market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Intigriti

- YesWeHack

- Open Bug Bounty

- Detectify

- Synopsys, Inc.

- Bugcrowd, Inc.

- Synack, Inc.

- CyberGuard Networks

- HackerOne, Inc.

- Cobalt

- CROWDSTRIKE, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, CyberGuard Networks, a leading player in the US Crowdsourced Security Market, launched a comprehensive cybersecurity training program for ethical hackers and security professionals. The program aims to improve the skill sets of ethical hackers involved in crowdsourced security initiatives, ensuring a high level of expertise in the community. CyberGuard Networks' dedication to continuous learning and skill development is consistent with the imperative of staying ahead of evolving cyber threats. The training program covers emerging cybersecurity trends, threat landscape analysis, and specialized skill development, demonstrating the company's commitment to maintaining a skilled and dynamic ethical hacking community.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Crowdsourced Security Market based on the below-mentioned segments:

United States Crowdsourced Security Market, By Type

- Web Application

- Mobile Application

- Others

United States Crowdsourced Security Market, By Deployment Mode

- Cloud

- On-Premises

United States Crowdsourced Security Market, By Organization Size

- Large Enterprises

- SMEs

Need help to buy this report?