United States Dairy Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Coconut, Almond, Rice, Oats, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Online Retail, Convenience Stores, and Others), and U.S. Dairy Alternatives Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Dairy Alternatives Market Insights Forecasts to 2033

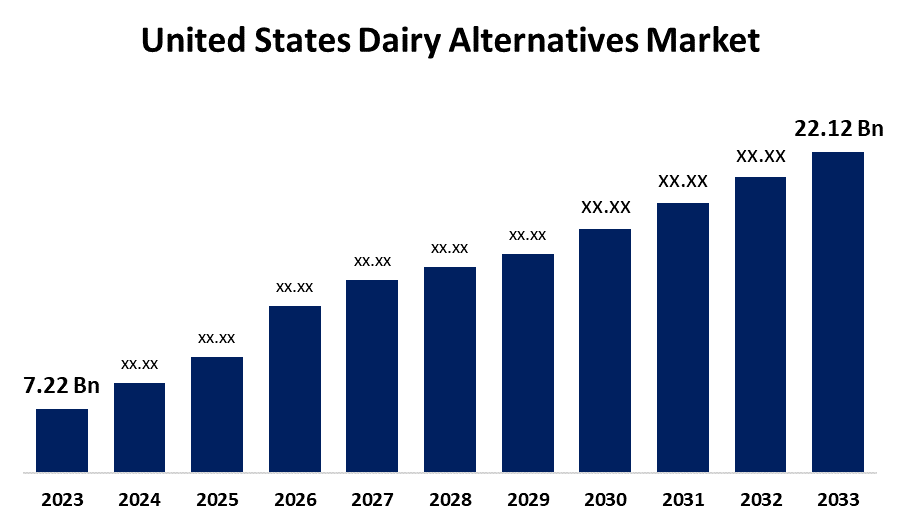

- The United States Dairy Alternatives Market Size Was Estimated at USD 7.22 Billion in 2023.

- The Market Size is Growing at a CAGR of 11.85% from 2023 to 2033

- The USA Dairy Alternatives Market Size is Expected to Reach USD 22.12 Billion by 2033

Get more details on this report -

The United States Dairy Alternatives Market Size is Expected to reach USD 22.12 Billion by 2033, Growing at a CAGR of 11.85% from 2023 to 2033.

Market Overview

The market for plant-based products that approximate dairy, such as milk, yogurt, cheese, and cream, is expanding significantly in the United States. These products are marketed to consumers who are lactose intolerant, vegan, and ecologically conscientious. The market is mainly being driven by the rising incidence of lactose intolerance in the United States and the growing number of health-conscious consumers. Additionally, the market for dairy substitutes is expanding due to the rising acceptance of the vegan diet and the rise in plant-based diets. The dairy alternatives business is seeing a surge in product innovation due to increased health concerns, including lactose intolerance, dairy allergies, and growing health consciousness. Additionally, dairy alternatives including plant-based cheeses, ice creams, and yogurts are becoming more and more well-liked. These developments support the market's growth by catering to consumers' changing interests and preferences. The government initiatives aid the market expansion. For instance, in June 2024, the U.S. Department of Agriculture (USDA) announced that $12 million in grant money is available through the Dairy Business Innovation Initiatives (DBI) to support producer technical assistance services, on-farm upgrades, and processing capacity development.

Report Coverage

This research report categorizes the market for the U.S. dairy alternatives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US dairy alternatives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA dairy alternatives market.

United States Dairy Alternatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 7.22 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.85% |

| 2033 Value Projection: | USD 22.12 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By Distribution Channel |

| Companies covered:: | Chobani, LLC, Danone S.A., Hain Celestial, Ripple Foods, Organic Valley, Living Harvest, Daiya Foods, Eden Foods, SunOpta, Melt Organic, Oatly AB, Blue Diamond Growers, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The United States dairy alternatives market is expanding due to the market continues to expand as a result of consumers' growing consumption of plant-based foods as a result of growing environmental and health concerns. In addition, the market is expanding due to the adoption of plant-based diets by younger generations of the world's population, such as Gen Z and millennials, which raises demand for dairy substitutes. The rise of veganism, the prevalence of lactose intolerance, and the quest for cleaner and more sustainable food production are further factors driving the market's expansion. Additionally, the negative effects of dairy production and worries about animal welfare are widely acknowledged in society and help to increase demand.

Restraining Factors

The market for dairy alternatives in the United States poses significant challenges such as high production costs and price sensitivity among specific customer categories are some of the market's constraints. In addition, growth may also be impacted by regulatory issues about labeling and health claims. There's also the issue of competition from fortified and regular dairy products.

Market Segmentation

The U.S. dairy alternatives market share is classified into source and distribution channel.

- The almond segment accounted for the largest market share of 35.28% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the source, the U.S. dairy alternatives market is divided into soy, coconut, almond, rice, oats, and others. Among these, the almond segment accounted for the largest market share of 35.28% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing because of its adaptability, nutritional value, and sustainability, almonds are a major factor in the growth of the dairy substitutes market in the United States. In addition, products made from almonds, like almond milk, have become more well-liked as customers look for plant-based, lactose-free, and calorie-efficient substitutes for conventional dairy. Almonds are a desirable choice for consumers who are concerned about their health because they are high in vitamins, minerals, and good fats.

- The supermarkets & hypermarkets segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the U.S. dairy alternatives market is classified into supermarkets & hypermarkets, online retail, convenience stores, and others. Among these, the supermarkets & hypermarkets segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. Supermarkets and hypermarkets are important market drivers because they offer consumers looking for plant-based products convenient access to a large range of items. Additionally, the convenience of one-stop shopping and the option to quickly compare and buy dairy substitutes in addition to conventional dairy products appeal to consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. dairy alternatives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chobani, LLC

- Danone S.A.

- Hain Celestial

- Ripple Foods

- Organic Valley

- Living Harvest

- Daiya Foods

- Eden Foods

- SunOpta

- Melt Organic

- Oatly AB

- Blue Diamond Growers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, in the United States, Nike just unveiled a brand-new quinoa milk product. NIÚKE, which is marketed as the first plant milk made from quinoa in the US, receives its quinoa from the Andes, guaranteeing that the product is grown naturally. Quinoa, which is technically a seed rather than a grain, has more protein and good fat than plant milk made from grains.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. dairy alternatives market based on the below-mentioned segments:

U.S. Dairy Alternatives Market, By Source

- Soy

- Coconut

- Almond

- Rice

- Oats

- Others

U.S. Dairy Alternatives Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Retail

- Convenience Stores

- Others

Need help to buy this report?