U.S. Defense Market Size, Share, and COVID-19 Impact Analysis, By Armed Forces (Army, Navy, and Air Force), By Type (Fixed-Wing Aircraft, Rotorcraft, Ground Vehicles, Naval Vessels, C4isr, Weapons and Ammunition, Protection and Training Equipment, and Unmanned Systems), and U.S. Defense Market Insights, Industry Trend, Forecasts to 2033.

Industry: Aerospace & DefenseUnited States Defense Market Insights Forecasts to 2033

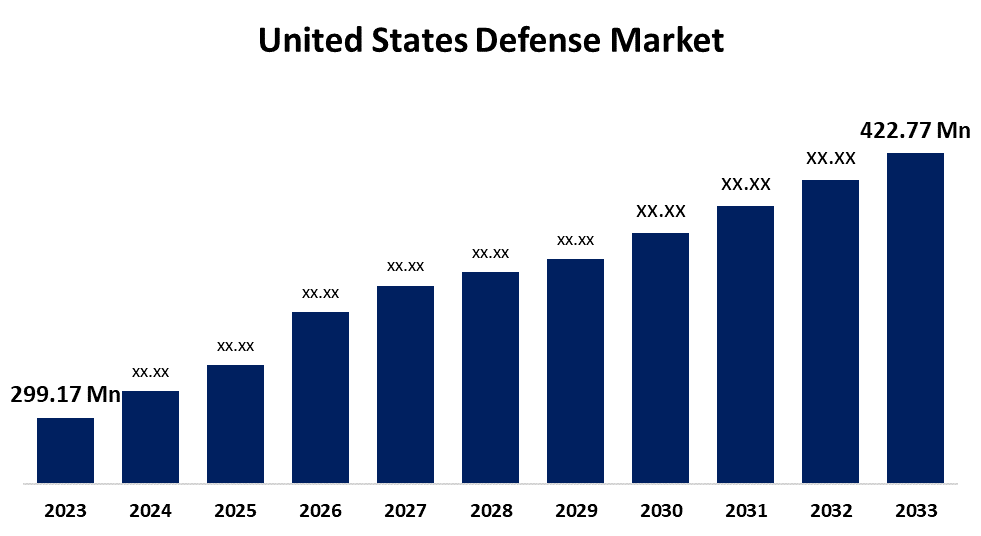

- The United States Defense Market Size was valued at USD 299.17 Million in 2023.

- The Market Size is Growing at a CAGR of 3.52% from 2023 to 2033

- The United States Defense Market Size is Expected to Reach USD 422.77 Million by 2033

Get more details on this report -

The United States Defense Market Size is Anticipated to Exceed USD 422.77 Million by 2033, Growing at a CAGR of 3.52% from 2023 to 2033.

Market Overview

An important aspect of a just trial is having a robust defense. The defense teams advocate for and safeguard the defendant's rights suspect or accused. Every defendant is considered innocent until proven guilty beyond a reasonable doubt in front of the court. Several key elements are contributing to the significant growth in the market. Initially, there is a growing need for unmanned aerial vehicles (UAVs) that are being more and more utilized for surveillance, reconnaissance, and military missions. Furthermore, there is an increasing investment in strong cybersecurity infrastructure within the US defense sector due to the escalating risk of cyber-attacks. Furthermore, a shift towards modernizing defense is evident, with substantial funds being allocated towards acquiring new technologies and capabilities in order to uphold the technological superiority of the US military. Such tendencies are anticipated to persist, leading to expansion in the defense sector and generating possibilities for firms involved in fields like drone production, cybersecurity, and defense technology enhancement. In January 2024, Lockheed Martin Corporation revealed its intentions to provide the US with 75 to 110 F-35s in 2024. Around 90% of the F-35s scheduled for delivery in 2024 will be in TR-3 configuration.

Report Coverage

This research report categorizes the market for the US defense market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States defense market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. defense market.

United States Defense Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 299.17 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.52% |

| 2033 Value Projection: | USD 422.77 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 151 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Armed Forces, By Type |

| Companies covered:: | Lockheed Martin Corporation, The Boeing Company, RTX Corporation, General Dynamics Corporation, Northrop Grumman Corporation, L3Harris Technologies Inc., BAE Systems PLC, CACI International Inc., Textron Inc., Elbit Systems Ltd, Huntington Ingalls Industries Inc., Kongsberg Gruppen ASA, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The defense market in the US is projected to increase mainly because of the armed forces' efforts to acquire and update equipment in response to new challenges. Numerous contracts for the army, air force, and navy are in progress, with more contracts expected to be awarded in the coming period, leading to a simultaneous need for defense equipment. The US military employs various aircraft for operations within the air force and navy. Due to escalating tensions with China in the South China Sea, the United States is preparing to address any possible challenges China may pose for allies such as Taiwan and Japan. In recent years, there has been a notable increase in investments towards improving the current fleet or acquiring a new fleet with advanced technologies.

Restraining Factors

It is confronted with daunting obstacles in supply chain weaknesses. Supply chains in the industry, which are frequently worldwide and complex, are vulnerable to interruptions, as shown by the pandemic's effect on manufacturing and transportation.

Market Segmentation

The US defense market share is classified into armed forces and application.

- The army segment is expected to hold a significant market share through the forecast period.

The United States defense market is segmented by armed forces into army, navy, and air force. Among these, the army segment is expected to hold a significant market share through the forecast period. This is mainly because the army has a wide range of needs for advanced technologies and equipment, such as ground combat systems, tactical communications, and logistics support. The army's emphasis on updating armored vehicles, precision weaponry, and surveillance systems leads to significant investment and acquisition efforts in modernization and capability enhancement.

- The C4ISR segment is expected to dominate the US defense market during the projected period.

Based on the type, the United States defense market is divided into fixed-wing aircraft, rotorcraft, ground vehicles, naval vessels, C4ISR, weapons and ammunition, protection and training equipment, and unmanned systems. Among these, the C4ISR segment is expected to dominate the US defense market during the projected period. This is because of the vital function C4ISR systems have in contemporary military operations, offering improved situational awareness, live intelligence, and efficient command and control abilities. Substantial investment in C4ISR systems is driven by the growing focus on network-centric warfare, data integration, and advanced communication technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States defense market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lockheed Martin Corporation

- The Boeing Company

- RTX Corporation

- General Dynamics Corporation

- Northrop Grumman Corporation

- L3Harris Technologies Inc.

- BAE Systems PLC

- CACI International Inc.

- Textron Inc.

- Elbit Systems Ltd

- Huntington Ingalls Industries Inc.

- Kongsberg Gruppen ASA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, the USAF revealed its intention to acquire 26 E-7s from Boeing by 2032 in order to replace its older E-3 Sentry airborne warning and control system aircraft.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Defense Market based on the below-mentioned segments:

United States Defense Market, By Armed Forces

- Army

- Navy

- Air Force

United States Defense Market, By Type

- Fixed-Wing Aircraft

- Rotorcraft

- Ground Vehicles

- Naval Vessels

- C4ISR

- Weapons and Ammunition

- Protection and Training Equipment

- Unmanned Systems

Need help to buy this report?