United States Dental Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Dental Radiology Equipment, Dental Lasers, Dental Surgical Navigation Systems, CAD/CAM Equipment, Dental Chairs, and Others), By Treatment (Orthodontic, Endodontic, Periodontic, and Prosthodontic), By End-User (Hospitals, Dental Clinics, and Others), and United States Dental Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Dental Equipment Market Insights Forecasts to 2033

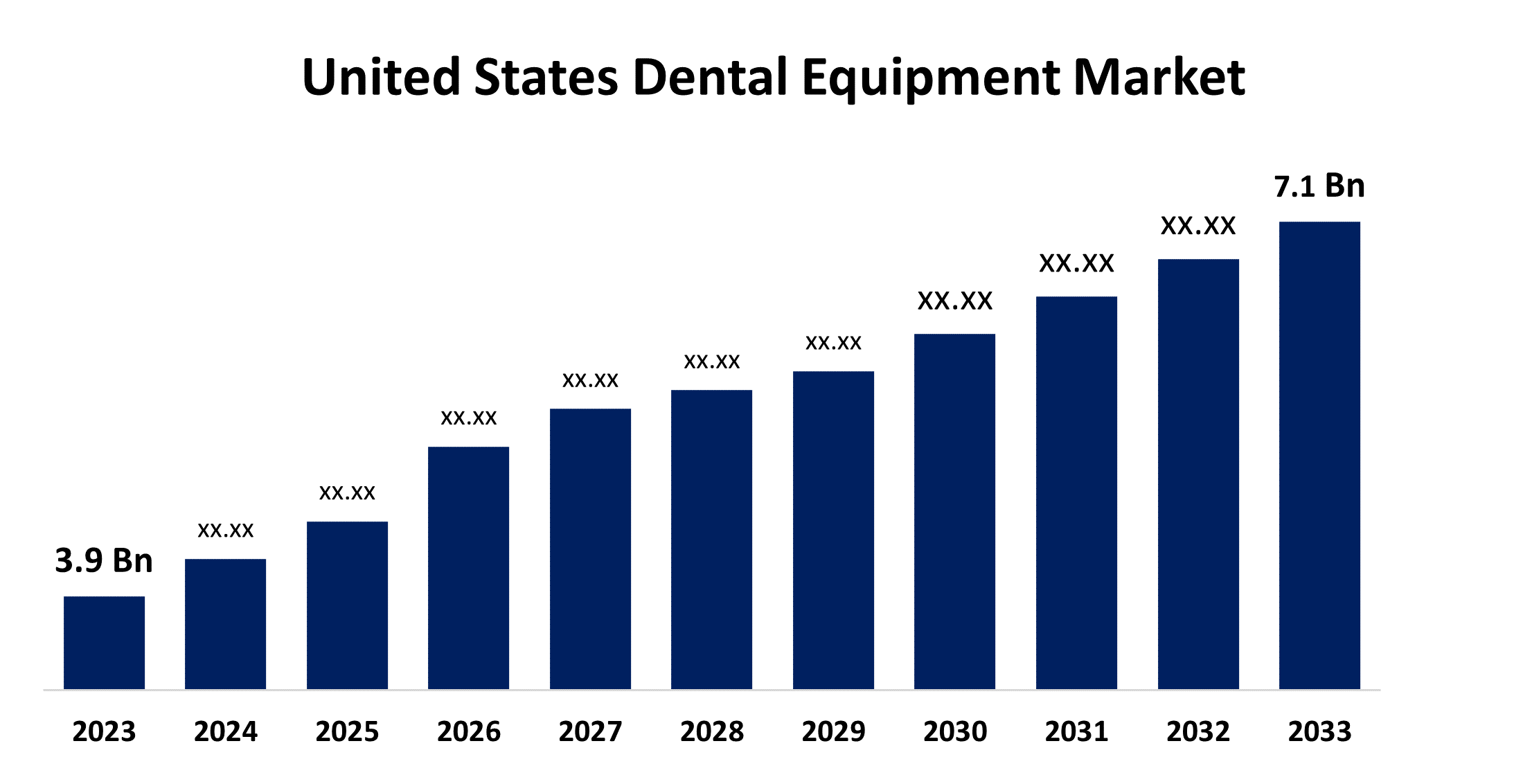

- The United States Dental Equipment Market Size was valued at USD 3.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.1% from 2023 to 2033

- The U.S. Dental Equipment Market Size is Expected to reach USD 7.1 Billion by 2033

Get more details on this report -

The United States Dental Equipment Market is anticipated to exceed USD 7.1 billion by 2033, growing at a CAGR of 6.1% from 2023 to 2033. The growing burden of dental diseases, support of large-scale vaccination programs, increasing geriatric population, and technological advancements in dentistry are driving the growth of the dental equipment market in the United States.

Market Overview

Dental equipment is a set of tools used to examine, manipulate, treat, and restore any oral disorders. Dental professionals use this equipment to provide dental treatment, allowing them to manipulate tissue for better visual access during treatment or a regular examination. Dental X-rays with digital X-rays are used for medical images at reduced cost and better care. The emergence of CAD/CAM (computer-aided design/computer-aided manufacturing) technologies is revolutionizing the dental industry and dental prosthetic manufacturing. These are applied to the fabrication of complete dentures, offering many advantages to dentists and patients, thus reducing the number of appointments. Further, CAD software, intricate algorithmic designs, and artificial intelligence help in modeling objects to reproduce them as desired. The investment in digital X-ray equipment, growing adoption of 3D printing, and rising awareness about dental health are creating lucrative market opportunities.

Report Coverage

This research report categorizes the market for the US dental equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dental equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dental equipment market.

United States Dental Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.9 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.1% |

| 2033 Value Projection: | USD 7.1 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Treatment, By End-User |

| Companies covered:: | 3M, Straumann Holding AG, Dentsply Sirona, ZimVie, Envista, Planmeca Oy, A-Dec Inc., GC Corp., Patterson Companies Inc., Biolase Inc, Carestream Health Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing burden of dental diseases, support of large-scale vaccination programs, increasing geriatric population, and technological advancements in dentistry are driving the US dental equipment market. Dental problems such as dental cavities, roots, coronal caries, and periodontitis increase with aging; thus, the high geriatric population in the country is expected to drive market demand. Periodontal disease, or gum disease, affects more than 2 out of every 5 people between the ages of 45 and 64. It is associated with nearly 60 different health problems, including diabetes, heart problems, and Alzheimer’s disease. Thus, the increased geriatric population is also responsible for driving the market demand for dental equipment. Further, new product launches and technological advancements are driving the market growth.

Restraining Factors

The massive price of dental imaging systems is restraining the US dental equipment market. The expensive price of the product is preventing the widespread implementation of digital dental imaging systems. Further, the dearth of dental professionals is restraining the market growth.

Market Segmentation

The United States Dental Equipment Market share is classified into product type, treatment, and end-user.

- The dental radiology equipment segment dominates the market with the largest market share in 2023.

The United States dental equipment market is segmented by product type into dental radiology equipment, dental lasers, dental surgical navigation systems, CAD/CAM equipment, dental chairs, and others. Among these, the dental radiology equipment segment dominates the market with the largest market share in 2023. The effective imaging facilitated by X-ray beam alignment, well-supported tube housing assembly, beam-on indicators, and controlled radiation exposure of extraoral X-ray systems in radiology equipment enables dentists and dental surgeons to accurately assess every fragmented structure in a patient’s mouth. The increasing demand and technologically advanced dental radiology equipment like CBCT equipment are driving the market growth.

- The periodontic segment is anticipated to witness the fastest CAGR growth during the forecast period.

Based on the treatment, the United States dental equipment market is divided into orthodontic, endodontic, periodontic, and prosthodontic. Among these, the periodontic segment is anticipated to witness the fastest CAGR growth during the forecast period. A periodontal treatment includes professionally cleaning the pockets around the teeth. Over 47% of adults in the United States, ages 30 and older, have some form of periodontal disease, and about 30% of adults have moderate gum disease. The increased cases of periodontal diseases and the rise in research funding for periodontitis studies are augmenting market growth.

- The hospitals segment accounted for the largest share of the United States dental equipment market in 2023.

Based on the end-user, the United States dental equipment market is divided into hospitals, dental clinics, and others. Among these, the hospitals segment accounted for the largest share of the United States dental equipment market in 2023. The presence of digitally modified equipment along with an increasing number of hospitals are driving the market growth. The high number of hospital patients visiting for dental care due to the high purchasing power of hospitals is driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US dental equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Straumann Holding AG

- Dentsply Sirona

- ZimVie

- Envista

- Planmeca Oy

- A-Dec Inc.

- GC Corp.

- Patterson Companies Inc.

- Biolase Inc

- Carestream Health Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, Henry Schein, Inc., the world's largest provider of healthcare products and services to office-based dental and medical practitioners, announced an agreement to acquire S.I.N. Implant System, one of Brazil’s leading manufacturers of dental implants, pending regulatory approval. The acquisition of S.I.N. represents the natural progression of the BOLD+1 Strategy to expand fast-growing dental specialties businesses.

- In March 2023, BIOLASE, Inc., the global leader in dental lasers and a company continually focused on improving the dental ecosystem, has launched a new e-commerce website for its U.S. customers.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Dental Equipment Market based on the below-mentioned segments:

United States Dental Equipment Market, By Product Type

- Dental Radiology Equipment

- Dental Lasers

- Dental Surgical Navigation Systems

- CAD/CAM Equipment

- Dental Chairs

- Others

United States Dental Equipment Market, By Treatment

- Orthodontic

- Endodontic

- Periodontic

- Prosthodontic

United States Dental Equipment Market, By End-User

- Hospitals

- Dental Clinics

- Others

Need help to buy this report?