United States Dental Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Dental Preferred Provider Organizations, Dental Health Maintenance Organizations, Dental Indemnity Plans, and Others), By Type (Major, Basic, and Preventive), and the United States Dental Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited States Dental Insurance Market Insights Forecasts to 2033.

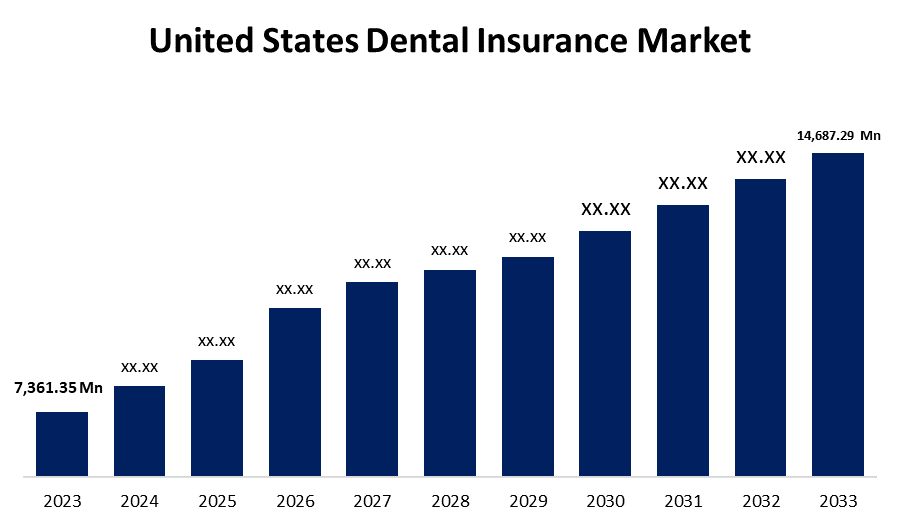

- The United States Dental Insurance Market Size was valued at USD 7,361.35 Million in 2023.

- The Market is growing at a CAGR of 7.15 % from 2023 to 2033

- The United States Dental Insurance Market Size is expected to reach USD 14,687.29 Million by 2033

Get more details on this report -

The United States Dental Insurance Market is anticipated to exceed USD 14,687.29 Million by 2033, growing at a CAGR of 7.15 % from 2023 to 2033.

Market Overview

Coverage for dental health and care is provided by dental insurance. Dental health is also known as oral health. Dental insurance is intended to pay a share of the costs related to the treatment of dental illness and preventive dental care. Dental insurance aids in paying for unpredicted dental crises that may be expensive to fix. Emerging countries are now getting worried regarding oral health and the demand for dental care is developing. Dental illnesses are an important public health problem around the world causing key health problems in many countries, causing pain, discomfort, and disfigurement, WHO identifies oral health as a vital part of general health. The importance of dental insurance has grown extremely in recent years due to growing awareness among customers and the information regarding oral hygiene has augmented not only in emerging nations but also in underdeveloped nations.

Report Coverage

This research report categorizes the market for the United States dental insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States dental insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States dental insurance market.

United States Dental Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7,361.35 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.15 % |

| 2033 Value Projection: | USD 14,687.29 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coverage, By Type |

| Companies covered:: | Aetna Inc, AXA, Guardian, AFLAC Inc, MetLife Services and Solutions, Humana, Ameritas Mutual Holding Company, Delta Dental Plan Association, Cigna, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The technological advancements are expected to drive the growth of the dental insurance market. Furthermore, numerous companies in the market are enterprise many tactical initiatives to strengthen their market presence. Additionally, increasing awareness regarding oral health is predicted to propel the growth of the dental insurance market. Moreover, the government is supporting dental insurance companies by offering the protection of dental insurance against variations in revenues, bills, and profits driving the growth of the dental insurance market.

Restraining Factors

People avoid routine dental check-ups and treatment due to worry about the spread of the infection is the main factor that hinders the growth of the dental insurance market. Furthermore, dental insurance plans' conditions and rates are frequently directly impacted by the expense and complexity of dental operations, which deters potential customers from signing up for them.

Market Segmentation

The United States dental insurance market share is classified into coverage and type.

- The dental preferred provider organizations segment is expected to hold the largest market share through the forecast period.

The United States dental insurance market is segmented by coverage into dental preferred provider organizations, dental health maintenance organizations, dental indemnity plans, and others. Among these, the dental preferred provider organizations segment is expected to hold the largest market share through the forecast period. Dentists in the network of DPPOs often consent to give plan participants services at a reduced cost. When compared to co-pays for services or medical bills, this can lower consumers' out-of-pocket costs. Plans that allow them to save money on dental care are often chosen by consumers.

- The preventive segment dominates the market with the largest market share over the predicted period.

The United States dental insurance market is segmented by type into major, basic, and preventive. Among these, the preventive segment dominates the market with the largest market share over the predicted period. Dental preventative programs often place a strong emphasis on routine examinations, cleanings, and early detection and treatment of dental issues. This strategy encourages policyholders to visit their dentist regularly to preserve their dental health. Furthermore, compared to primary or comprehensive dental insurance policies, the premiums for preventive dental insurance plans are typically lower. Their affordability increases their market appeal by bringing in a large number of individuals and families.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States dental insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aetna Inc

- AXA

- Guardian

- AFLAC Inc

- MetLife Services and Solutions

- Humana

- Ameritas Mutual Holding Company

- Delta Dental Plan Association

- Cigna

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, in 46 states, Aetna provides Medicare Advantage Prescription Drug (MAPD) plans. Aetna has expanded into 83 more counties, giving an extra 1 million Medicare enrollees access to its plans. In all, 53.2 million Medicare beneficiaries will be able to access MAPD plans in 1,875 counties by 2022.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States dental insurance market based on the below-mentioned segments:

United States Dental Insurance Market, By Coverage

- Dental Preferred Provider Organizations

- Dental Health Maintenance Organizations

- Dental Indemnity Plans

- Others

United States Dental Insurance Market, By Type

- Major

- Basic

- Preventive

Need help to buy this report?