United States Dental Market Size, Share, and COVID-19 Impact Analysis, By Type (Dental Consumables and Dental Equipment), By End User (Solo Practices, DSO/Group Practices, and Others), and United States Dental Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Dental Market Insights Forecasts to 2033

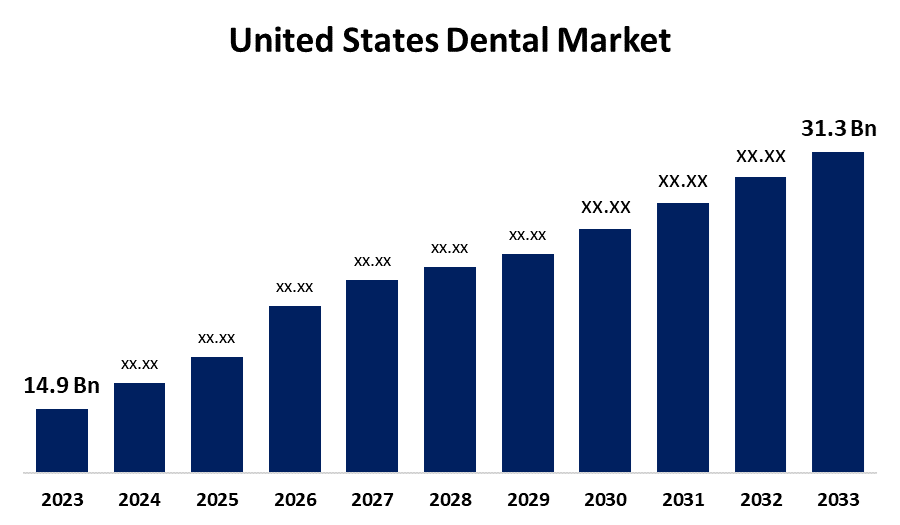

- The U.S. Dental Market Size was valued at USD 14.9 Billion in 2023.

- The Market is growing at a CAGR of 7.70% from 2023 to 2033

- The U.S. Dental Market Size is Expected to Reach USD 31.3 Billion by 2033

Get more details on this report -

The United States Dental Market is Anticipated to Exceed USD 31.3 Billion by 2033, growing at a CAGR of 7.70% from 2023 to 2033. The growing demand for aesthetic dentistry, rising awareness about oral

Market Overview

Dental services are the procedures and treatments that help to maintain oral health and treat teeth-related issues. Dental products including tools and supplies aid in the prevention, diagnosis, and treatment of a range of conditions, including cavities, malocclusion, periodontitis, and tooth decay. The number of professionally practicing dentists per 100,000 residents in the United States increased by 2.9% in September 2022, according to a report released by the Centres for Disease Control and Prevention (CDC). There is a persistent popular trend of smile makeover operations and a great need for invisible braces that aid in aligning and reshaping teeth. Furthermore, the acceptance of root canal treatments has been aided by technological advancements in the field of endodontics. The notable development in the sector has resulted from the integration of robotics engineering into these processes. A new national standard of care for dental implantology has been adopted as a result of minimally invasive and robot-assisted oral operations, which is anticipated to further accelerate market expansion.

Report Coverage

This research report categorizes the market for the US dental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States dental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US dental market.

United States Dental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.70% |

| 2033 Value Projection: | USD 31.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Dentsply Sirona, Align Technology, Inc., Anson Dental Supply, 3M, Zimmer Biomet, Ultradent Products Inc., and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A growing number of people are looking for cosmetic procedures to improve their smile's alignment, form, and general appearance. There is an increasing focus on the significance of regular dental care as it is believed that poor oral health negatively affects life. The increasing awareness about dental health and dentist visits among the people of the US contributes to driving the market. Digital dentistry offers many benefits in terms of accuracy, productivity, and personalization. The technological advancements in dentistry for more personalized and efficient patient care are driving the market growth.

Restraining Factors

Unfavorable reimbursement regulations and the high cost of therapy for this operation are the factors that are hampering the market growth for dental.

Market Segmentation

The United States Dental Market share is classified into type and end user.

- The dental consumables segment dominates the US dental market with the largest share in 2023.

The United States dental market is segmented by type into dental consumables and dental equipment. Among these, the dental consumables segment dominates the US dental market with the largest share in 2023. Dental consumables include products such as braces, crowns, implants prostheses, impression supplies, etc. for treating a variety of dental disorders, including periodontal diseases, dental caries, gingival tissue concerns, tooth restorations, and other dental conditions. The growing cases of dental ailments and new product launches by the market players are driving the market growth.

- The solo practices segment dominates the US dental market during the forecast period.

Based on the end user, the U.S. dental market is divided into solo practices, DSO/group practices, and others. Among these, the solo practices segment dominates the US dental market during the forecast period. In solo practices, solo practitioners profit directly from the practice's financial success since they maintain complete ownership of their clinic as they are in charge of making financial decisions. The high number of solo surgeons and orthodontists in the United States, who prioritize private practices over institutional settings, is responsible for market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. dental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dentsply Sirona

- Align Technology, Inc.

- Anson Dental Supply

- 3M

- Zimmer Biomet

- Ultradent Products Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, CareStack, a leading cloud-based technology company serving the dental industry, announced strategic equity investment and commercial partnership with the Straumann Group. CareStack would expand its service offering and presence in the United States market and beyond.

- In May 2022, Align Technology, Inc., a leading global medical device company that designs, manufactures, and sells the Invisalign system of clear aligners, iTero intraoral scanners, and exocad CAD/CAM software for digital orthodontics and restorative dentistry, announced an agreement with Asana, Inc., a leading work management platform for teams. The strategic partnership would offer Invisalign-trained doctors in the U.S. a new workflow solution, Asana Smiles for Align.

- In August 2021, Sonoma Pharmaceuticals, announced that it has launched two new dental products. OroGenix Oral Hygiene Rinse is Sonoma’s second dental product in the U.S. and was developed with its partner Gabriel Science, LLC.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Dental Market based on the below-mentioned segments:

US Dental Market, By Type

- Dental Consumables

- Dental Equipment

US Dental Market, By End User

- Solo Practices

- DSO/Group Practices

- Others

Need help to buy this report?