United States Dental X-ray Market Size, Share, and COVID-19 Impact Analysis, By Product (Analog and Digital), By Type (Intraoral and Extraoral), By Application (Medical, Cosmetic Dentistry, and Forensic), and United States Dental X-ray Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Dental X-ray Market Insights Forecasts to 2033

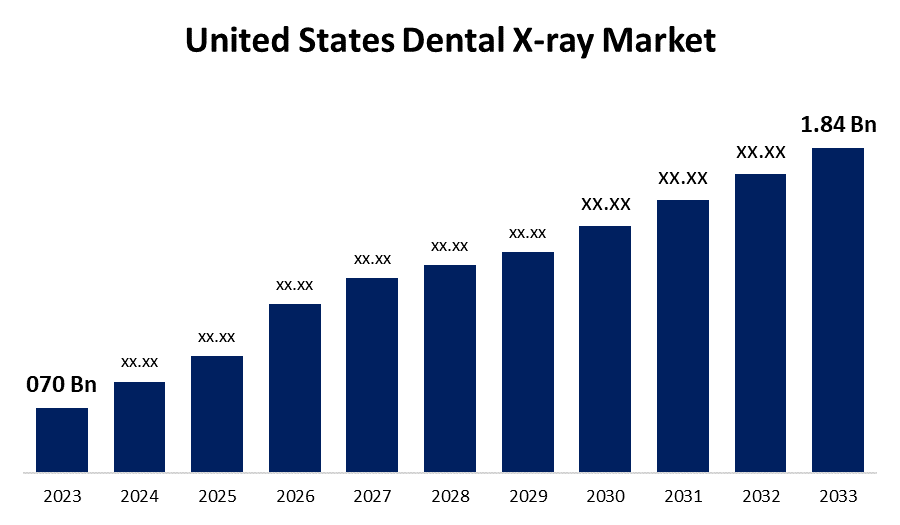

- The U.S. Dental X-ray Market Size was valued at USD 0.70 Billion in 2023.

- The Market is growing at a CAGR of 10.15% from 2023 to 2033

- The U.S. Dental X-ray Market Size is expected to reach USD 1.84 Billion by 2033

Get more details on this report -

The United States Dental X-ray Market is anticipated to exceed USD 1.84 Billion by 2033, growing at a CAGR of 10.15% from 2023 to 2033. The growing prevalence of dental ailments, the growing need for cosmetic dentistry services, and technological development are driving the growth of the dental x-ray market in the US.

Market Overview

Dental X-rays enable dentists to diagnose conditions of the teeth and surrounding tissue that are not visible during a routine oral examination. Over 5 million Americans between the ages of 65 and 74 have lost all of their teeth, with almost 3 million being edentulous, mostly as a result of dental caries, according to the American Dental Association (2020). A dental X-ray can be used to easily rule those out. As technology advances in dental imaging techniques, industry participants are coming up with new ideas and products. Integrating AI leads to accelerated operational efficiency and clinical consistency, particularly for digital X-rays. The market's participants are inventing and releasing new products in response to the growing technical advancements in dental imaging approaches, which are anticipated to further support the market expansion for dental X-ray systems.

Report Coverage

This research report categorizes the market for the US dental x-ray market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States dental x-ray market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US dental x-ray market.

United States Dental X-ray Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.70 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.15% |

| 2033 Value Projection: | USD 1.84 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Type, By Application |

| Companies covered:: | Dentsply Sirona, Danaher, Carestream Dental, LLC, Air Techniques, Inc., LED Medical Diagnostics Inc., Midmark Corporation, Vatech Co. Ltd., PLANMECA OY, Varex Imaging Corporation, Envista Holdings Corporation, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The increased prevalence of dental ailments including tooth decay especially among older working-age adults is responsible for driving the market demand. The promotion of cosmetic dentistry services for offering dental care to patients is propelling the market growth. Further, technological developments like advancements in dental imaging are driving the growth of the US dental X-ray market. The growing advancements like innovations in artificial intelligence (AI) are benefitting digital x-rays, enhancing operational effectiveness and clinical consistency which leads to drive the market expansion.

Restraining Factors

The market for dental X-ray systems is anticipated to be restrained by elements including the high cost of dental radiography equipment.

Market Segmentation

The United States Dental X-ray Market share is classified into product, type, and application.

- The analog segment dominates the market with the largest market share in 2023.

The United States dental x-ray market is segmented by product into analog and digital. Among these, the analog segment dominates the market with the largest market share in 2023. Analog X-ray machines produce thin-film diagnostic images of the inside body structures. The growing chronic illness, efficient diagnostic imaging demand, and technological advancements are driving the market growth in the analog dental x-ray segment.

- The intraoral segment held the largest revenue share of the US dental x-ray market in 2023.

Based on the type, the U.S. dental x-ray market is divided into intraoral and extraoral. Among these, the intraoral segment held the largest revenue share of the US dental x-ray market in 2023. Intraoral X-rays provide detailed images for monitoring and treating teeth and jawbone health. The various applications of intraoral for identifying endodontic file placements and diagnosis of caries are propelling the market.

- The medical segment dominates the US dental x-ray market with the largest market share in 2023.

Based on the application, the U.S. dental x-ray market is divided into medical, cosmetic dentistry, and forensic. Among these, the medical segment dominates the US dental x-ray market with the largest market share in 2023. Dental X-rays aid in the diagnosis and examination of tooth decay levels and oral health issues. The rising dental caries cases, more patient awareness, and an increasing requirement for accurate patient diagnosis and treatment planning are propelling the market growth in the medical segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. dental X-ray market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dentsply Sirona

- Danaher

- Carestream Dental, LLC

- Air Techniques, Inc.

- LED Medical Diagnostics Inc.

- Midmark Corporation

- Vatech Co. Ltd.

- PLANMECA OY

- Varex Imaging Corporation

- Envista Holdings Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, LunaLite Dental unveiled the LunaLite automated laser-guided dental x-ray positioner, designed to provide a more efficient and comfortable experience for dental professionals and patients.

- In February 2022, Overjet, the leader in dental artificial intelligence solutions for DSOs and insurance companies, announced that it had secured a United States Patent for its invention of breakthrough AI technology to accurately measure anatomical structures and quantify disease on dental X-rays.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Dental X-ray Market based on the below-mentioned segments:

US Dental X-ray Market, By Product

- Analog

- Digital

US Dental X-ray Market, By Type

- Intraoral

- Extraoral

US Dental X-ray Market, By Application

- Medical

- Cosmetic Dentistry

- Forensic

Need help to buy this report?