United States Dermatological Drugs Market Size, Share, and COVID-19 Impact Analysis, By Therapy (Acne and Psoriasis), By Type (Prescription and Over-the-Counter), and By United States Dermatological Drugs Market Insights Forecasts to 2033

Industry: HealthcareUnited States Dermatological Drugs Market Insights Forecasts to 2033

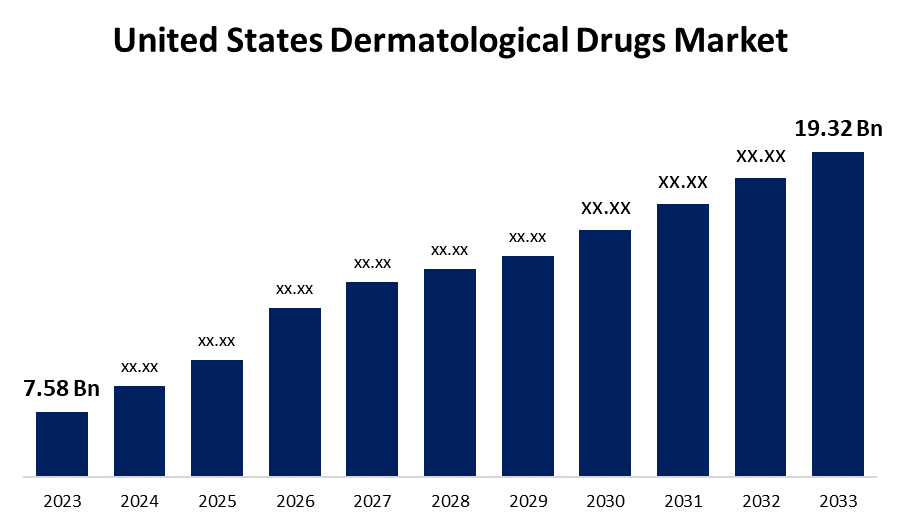

- The United States Dermatological Drugs Market Size was valued at USD 7.58 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.81% from 2023 to 2033

- The United States Dermatological Drugs Market Size is Expected to Reach USD 19.32 Billion by 2033

Get more details on this report -

The United States Dermatological Drugs Market Size is Anticipated to Exceed USD 19.32 Billion by 2033, Growing at a CAGR of 9.81% from 2023 to 2033.

Market Overview

The United States dermatological drugs market refers to the pharmaceutical segment dedicated to the treatment and management of skin disorders, including acne, psoriasis, dermatitis, eczema, and skin infections. This market encompasses prescription and over-the-counter medications such as corticosteroids, biologics, retinoids, antifungals, and immunosuppressants. The increasing prevalence of dermatological conditions, coupled with advancements in drug formulations and targeted therapies, has significantly contributed to market growth. Several factors are driving the expansion of this market. The rising incidence of chronic skin diseases, growing awareness regarding dermatological health, and increasing demand for aesthetic and cosmetic dermatology treatments have propelled market growth. Additionally, advancements in biotechnology have facilitated the development of innovative biologics and personalized treatment approaches, further enhancing therapeutic outcomes. The expanding geriatric population, which is more susceptible to skin disorders, also contributes to increased demand for dermatological drugs. Government initiatives supporting dermatological research and innovation have further strengthened market growth. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) have expedited approvals for novel dermatological treatments, particularly biologics and targeted therapies. Increased funding for dermatology-focused research and development programs, along with healthcare policies aimed at improving access to dermatological care, continue to shape the United States dermatological drugs Market.

Report Coverage

This research report categorizes the market for the United States dermatological drugs market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States dermatological drugs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States dermatological drugs market sub-segment.

United States Dermatological Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.58 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.81% |

| 2033 Value Projection: | USD 19.32 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Therapy, By Type. |

| Companies covered:: | AbbVie Inc., Pfizer Inc., GSK plc., LEO Pharma A/S, Sun Pharmaceutical Industries Ltd., GALDERMA, Amgen Inc., Johnson & Johnson Services Inc., Novartis AG, Eli Lilly and Company, Almirall, S.A, Bausch Health Companies Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States dermatological drugs market is driven by multiple factors, including the rising prevalence of chronic skin conditions such as acne, psoriasis, eczema, and dermatitis. Increased consumer awareness and demand for advanced dermatological treatments have further fueled market expansion. Technological advancements in drug development, particularly in biologics and targeted therapies, have significantly improved treatment efficacy. Additionally, the growing aging population, which is more prone to skin-related disorders, has contributed to increased demand. Expanding investments in dermatology research, along with pharmaceutical companies' focus on innovative formulations and personalized medicine, continue to enhance the market's growth trajectory.

Restraining Factors

The United States dermatological drugs market faces challenges such as high treatment costs, and limiting accessibility for certain patient groups. Stringent regulatory approvals for new drug formulations prolong market entry. Additionally, potential side effects associated with dermatological drugs and the availability of alternative therapies hinder widespread adoption and market expansion.

Market Segment

The U.S. dermatological drugs market share is classified into therapy and route of administration.

- The psoriasis segment is expected to hold the largest market share through the forecast period.

The US dermatological drugs market is segmented by therapy into acne and psoriasis. Among these, the psoriasis segment is expected to hold the largest market share through the forecast period. This dominance is driven by the increasing prevalence of psoriasis, the chronic nature of the disease requiring long-term management, and the growing adoption of biologic therapies. The introduction of advanced treatment options, including monoclonal antibodies and targeted immunomodulators, has significantly improved disease management and patient outcomes.

- The prescription segment is expected to hold the largest market share through the forecast period.

The US dermatological drugs market is segmented by type into prescription and over-the-counter. Among these, the prescription segment is expected to hold the largest market share through the forecast period. This is primarily due to the increasing demand for specialized treatments for chronic and severe dermatological conditions such as psoriasis, eczema, and acne, which require prescription-strength medications. The growing adoption of biologics targeted therapies, and immunosuppressants, which are typically available by prescription, further contributes to the dominance of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States dermatological drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Pfizer Inc.

- GSK plc.

- LEO Pharma A/S

- Sun Pharmaceutical Industries Ltd.

- GALDERMA

- Amgen Inc.

- Johnson & Johnson Services Inc.

- Novartis AG

- Eli Lilly and Company

- Almirall, S.A

- Bausch Health Companies Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, GALDERMA received U.S. FDA approval for a monoclonal antibody, Nemluvio (nemolizumab). It is approved as a pre-filled pen for subcutaneous injection for treating adults suffering from chronic prurigo nodularis.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States dermatological drugs market based on the below-mentioned segments:

United States Dermatological Drugs Market, By Therapy

- Acne

- Psoriasis

United States Dermatological Drugs Market, By Type

- Prescription

- Over-the-Counter

Need help to buy this report?