United States Dermatology Imaging Devices Market Size, Share, and COVID-19 Impact Analysis, By Modality (Digital Photographic Imaging, Optical Coherence Tomography (OCT), Dermatoscope, High Frequency Ultrasound, and Others), By Application (Skin Cancers, Inflammatory Dermatoses, Plastic & Reconstructive Surgery, and Others), By End Use (Hospitals, Dermatology Centers, and Specialty Clinics), and United States Dermatology Imaging Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Dermatology Imaging Devices Market Insights Forecasts to 2033

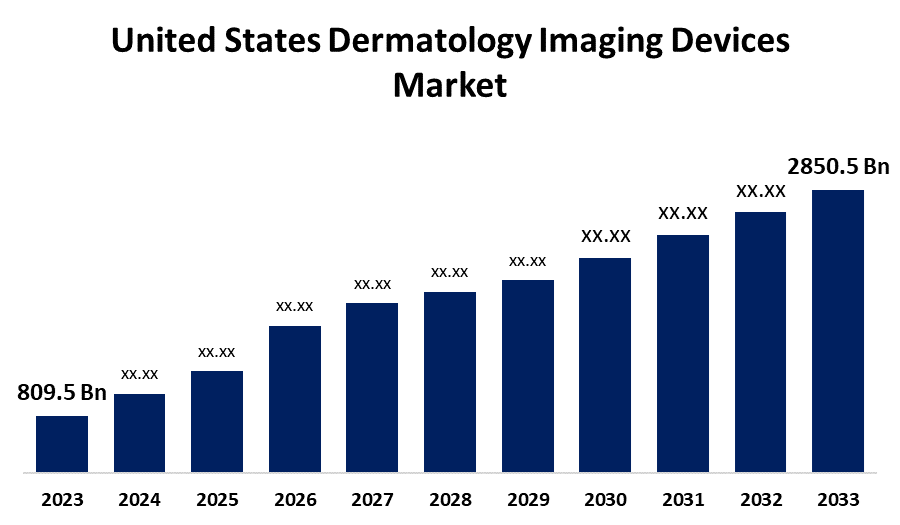

- The U.S. Dermatology Imaging Devices Market Size was valued at USD 809.5 Million in 2023.

- The Market is growing at a CAGR of 13.41% from 2023 to 2033

- The U.S. Dermatology Imaging Devices Market Size is expected to reach USD 2850.5 Million by 2033

Get more details on this report -

The United States Dermatology Imaging Devices Market is Anticipated to Exceed USD 2850.5 Million by 2033, growing at a CAGR of 13.41% from 2023 to 2033. The growing cases of skin disorders, technological advancements, and public health programs are driving the growth of the dermatology imaging devices market in the US.

Market Overview

Dermatology imaging devices are used by dermatologists to recognize and monitor changes in the skin over time, by using high-resolution digital cameras to take pictures of the skin. Over 5.4 million cases of skin cancer are treated each year in the United States, where it is estimated that one in five people may get the disease at some point in their lives. The need for noninvasive imaging technologies for the diagnosis and treatment of skin malignancies and other skin-related illnesses is providing market opportunities for dermatology imaging devices. Noninvasive methods are preferred by both patients and doctors because they are less uncomfortable, carry fewer dangers, and require less recovery time.

Report Coverage

This research report categorizes the market for the US dermatology imaging devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States dermatology imaging devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US dermatology imaging devices market.

United States Dermatology Imaging Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 809.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.41% |

| 2033 Value Projection: | USD 2850.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Modality, By Application, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Canfield Scientific, Inc., Clarius, Caliber Imaging and Diagnosis., Cortex Technology, DermLite, GE HealthCare, e-con Systems Inc., Koninklijke Philips N.V., Longport, Inc., FotoFinder Systems GmbH, VisualSonics, Michelson Diagnostics Ltd (MDL), and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

According to the American Academy of Dermatology Association, 84.5 million Americans that is one in four individuals are impacted by skin disease. Thus, the increased incidence of skin disorders in the US contributes to driving market demand. The US healthcare system spent $75 billion on medical, preventative, prescription, and over-the-counter medicine costs related to skin conditions. The diagnostic skills of dermatologists have been greatly improved by innovations including high-resolution imaging, AI integration, 3D visualization, optical coherence tomography, digital photography, and high-frequency ultrasound which is enhancing the market growth. The public is becoming more aware of the value of early identification and prevention of skin cancer owing to the American Academy of Dermatology's education programs and public awareness initiatives. This awareness increased the demand for dermatology imaging devices.

Restraining Factors

The side effects associated with the use of dermatological procedures may hamper the market for dermatology imaging devices.

Market Segmentation

The United States Dermatology Imaging Devices Market share is classified into modality, application, and end-use.

- The dermatoscope segment dominated the US dermatology imaging devices market with the largest share in 2023.

The United States dermatology imaging devices market is segmented by modality into digital photographic imaging, optical coherence tomography (OCT), dermatoscope, high frequency ultrasound, and others. Among these, the dermatoscope segment dominated the US dermatology imaging devices market with the largest share in 2023. A dermatoscope is a portable visual aid that a medical professional or layperson can use to inspect and diagnose diseases and skin lesions, including melanoma. The increased demand for sophisticated diagnostic techniques to treat the increasing cases of skin conditions is driving the market.

- The skin cancers segment dominates the market with the largest market share during the forecast period.

The United States dermatology imaging devices market is segmented by application into skin cancers, inflammatory dermatoses, plastic & reconstructive surgery, and others. Among these, the skin cancers segment dominates the market with the largest market share during the forecast period. Skin cancer is the most common cancer in the US with approximately 9,500 diagnosed cases every day. The increased cases of skin cancer as well as their awareness are driving the market demand in the skin cancers segment.

- The hospitals segment held the largest revenue share of the US dermatology imaging devices market in 2023.

Based on the end use, the U.S. dermatology imaging devices market is divided into hospitals, dermatology centers, and specialty clinics. Among these, the hospitals segment held the largest revenue share of the US dermatology imaging devices market in 2023. Hospitals make the best use of cutting-edge technologies by hiring dermatologists and imaging technologists who are highly skilled and knowledgeable. They are equipped with the knowledge, resources, and infrastructure needed to offer patients thorough diagnosis, care, and aftercare.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. dermatology imaging devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canfield Scientific, Inc.

- Clarius

- Caliber Imaging and Diagnosis.

- Cortex Technology

- DermLite

- GE HealthCare

- e-con Systems Inc.

- Koninklijke Philips N.V.

- Longport, Inc.

- FotoFinder Systems GmbH

- VisualSonics

- Michelson Diagnostics Ltd (MDL)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Enspectra Health, a health tech company, announced that the U.S. Food and Drug Administration (FDA) has granted Breakthrough Device Designation for its next generation AI-powered VIO Skin Platform (VIO) for the evaluation of lesions suspicious of basal cell carcinoma (BCC) and squamous cell carcinoma (SCC) in select high risk populations.

- In March 2024, EMZ Partners’ portfolio company FotoFinder Systems, a global leader in skin imaging solutions, entered into a definitive agreement to acquire DermLite, a renowned provider of handheld dermatoscopes.

- In June 2023, DeepX Diagnostics, the skin cancer teledermatology and diagnostics company, received clearance from the US Food and Drug Administration (FDA) for its digital dermatoscope DermoSight for teledermatology screening of suspect skin cancer lesions in the United States.

- In January 2023, GE HealthCare announced it has entered into an agreement to acquire IMACTIS, an innovator in the rapidly growing field of computed tomography (CT) interventional guidance across an array of care areas.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Dermatology Imaging Devices Market based on the below-mentioned segments:

US Dermatology Imaging Devices Market, By Modality

- Digital Photographic Imaging

- Optical Coherence Tomography (OCT)

- Dermatoscope

- High Frequency Ultrasound

- Others

US Dermatology Imaging Devices Market, By Application

- Skin Cancers

- Inflammatory Dermatoses

- Plastic & Reconstructive Surgery

- Others

US Dermatology Imaging Devices Market, By End Use

- Hospitals

- Dermatology Centers

- Specialty Clinics

Need help to buy this report?