United States Diabetes Care Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drugs (Oral Anti-diabetic drugs, Insulin, Non-Insulin Injectable Drugs, and Combination Drugs), By Drug Class (Insulin, GLP-1 Receptor agonists, DPP-4 inhibitors, SGLT2 Inhibitors, and Others), By Diabetes Type (Type 1 and Type 2), By Distribution Channel (Online pharmacies, Hospital Pharmacies, and Retail Pharmacies), and United States Diabetes Care Drugs Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Diabetes Care Drugs Market Insights Forecasts to 2033

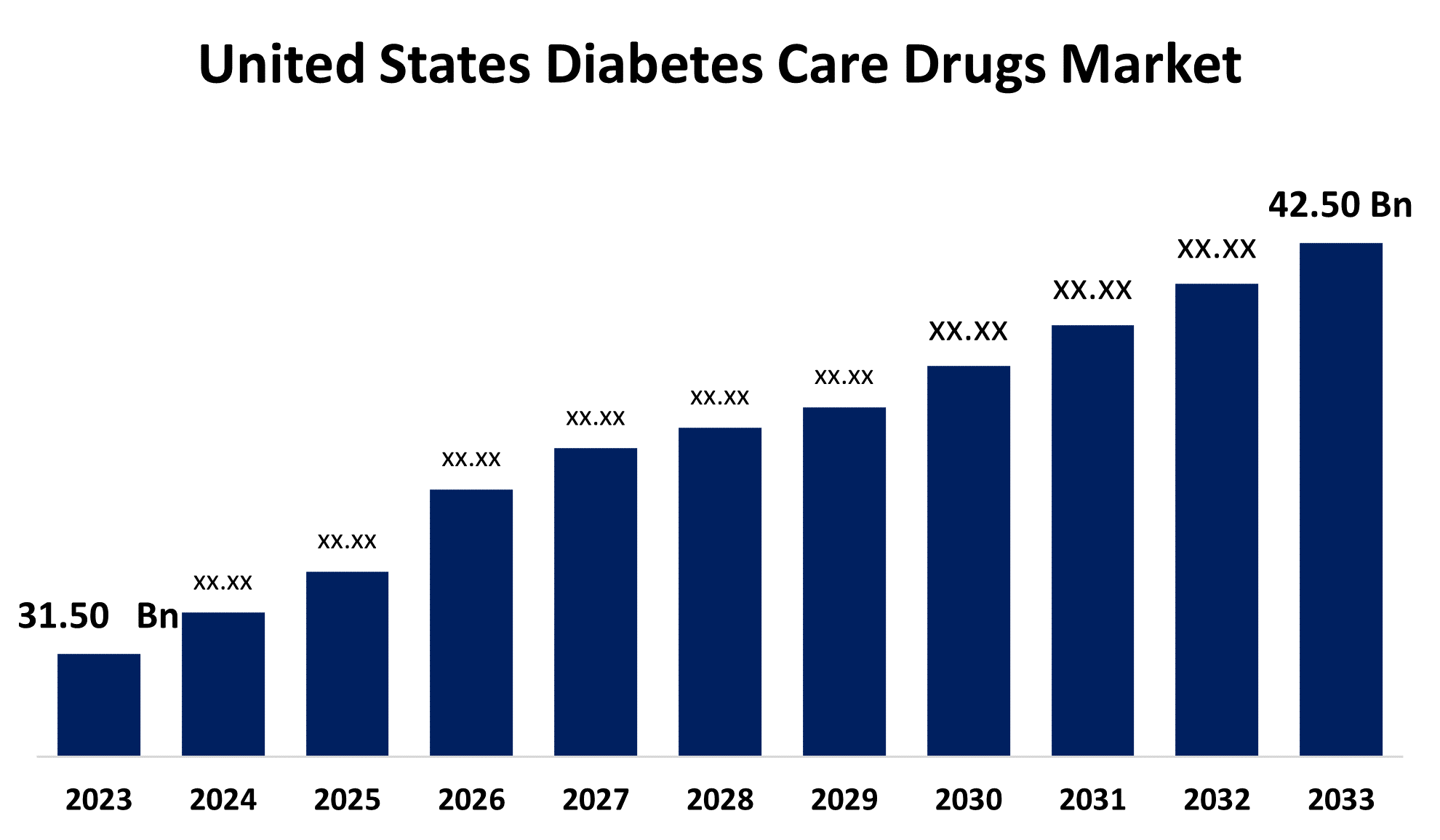

- The United States Diabetes Care Drugs Market Size was valued at USD 31.50 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.04% from 2023 to 2033

- The U.S. Diabetes Care Drugs Market Size is Expected to Reach USD 42.50 Billion by 2033

Get more details on this report -

The United States Diabetes Care Drugs Market is anticipated to exceed USD 42.50 billion by 2033, growing at a CAGR of 3.04% from 2023 to 2033. The growing prevalence of diabetes among the aging population and young individuals due to unhealthy lifestyles is driving the growth of the diabetes care drugs market in the United States.

Market Overview

Diabetes is a chronic, metabolic disease characterized by elevated blood glucose levels or hyperglycemia, which results from abnormalities in either insulin secretion or insulin action, or both. According to the report from CDC’s National Diabetes Statistics Report, there are about 37.3 million cases of diabetes in the US which is 11.3% of the US population. Type 1 and type 2 diabetes are the two major types of diabetes that can be treated by medication to manage blood sugar levels in the body. Insulin is the most common type of medication used in type 1 diabetes treatment. There are more than five classes of insulin (short-acting, rapid-acting, intermediate, long-acting, and combination (premixed) insulin) sold in the United States under many names, both brand and generic. Type 2 diabetes treatment helps to enhance the body's function to use insulin better or to get rid of extra glucose in the blood. Most medications for type 2 diabetes are oral diabetes drugs including insulin, alpha-glucosidase inhibitors, biguanides, dopamine-2 agonists, DPP-4 inhibitors, GLP-1 receptor agonists, meglitinides and SGLT2 inhibitors, sulfonylureas, thiazolidinediones, and others. During the last decade, new drug combinations have gained substantial use for treating diabetes. Several drugs are in clinical trials, that help to achieve more personalized and accessible treatments in the near future.

Report Coverage

This research report categorizes the market for the US diabetes care drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the diabetes care drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the diabetes care drugs market.

United States Diabetes Care Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 31.50 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.04% |

| 2033 Value Projection: | USD 42.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drugs, By Drug Class, By Diabetes Type, By Distribution Channel |

| Companies covered:: | Astrazeneca, Eli Lilly, Sanofi, Boehringer Ingelheim, NovoNordisk, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

According to the Pan American Health Organization, both the number of cases and the prevalence of diabetes have been steadily increasing over the past few decades. The increasing risk of diabetes with the increasing geriatric population in North America leads to enhanced market demand for the diabetes care drugs market. A significant percentage of the aging population is diagnosed with diabetes and the rise in unhealthy lifestyles among young individuals leads to rising cases of diabetes that surges the demand for diabetes care drugs. Additionally, the high cost and health expenditure including prescription drugs, medical devices, and hospital care in the US contribute to the market growth. The significant investments in R&D for the development of new and effective drug treatments including both branded and generic drugs lead to enhance the diabetes care drugs market.

Restraining Factors

High cost of diabetes medication such as insulin, reducing accessibility and affordability for low-income patients impeding the diabetes care drugs market. The lengthy process of drug approval slows down the market growth due to limiting innovation and competition. The availability of alternative therapies for treating diabetes limits the market demand for diabetes care drugs. Further, the expiration of patents leads to increased competition from generic drugs also restraining the market.

Market Segmentation

The United States Diabetes Care Drugs Market share is classified into drugs, drug class, diabetes type, and distribution channel.

- The oral anti-diabetic drugs segment is expected to grow at the fastest CAGR during the forecast period.

Based on the drugs, the United States Diabetes Care Drugs Market is categorized into oral anti-diabetic drugs, insulin, non-insulin injectable drugs, and combination drugs. Among these, the oral anti-diabetic drugs segment is expected to grow at the fastest CAGR during the forecast period. Metformin has the highest share among oral anti-diabetes drugs. It is the biguanide anti-diabetic drug that is used to treat type 2 diabetes. IDF guidelines have recommended Metformin as a first-line prescription for treating type 2 diabetes.

- The GLP-1 receptor agonists segment accounted for the largest market share with significant CAGR growth during the forecast period.

Based on the drug class, the United States diabetes care drugs market is categorized into insulin, GLP-1 receptor agonists, DPP-4 inhibitors, SGLT2 inhibitors, and others. Among these, the GLP-1 receptor agonists segment accounted for the largest market share with significant CAGR growth during the forecast period. The rising demand for drugs with enhanced safety and high glycemic efficacy as compared to traditional drugs and increasing R&D investments are expected to drive the market in the segment. For instance, Sun Pharma has planned to increase spending for conducting additional studies on the diabetes drug GLP-1.

- The type 2 segment accounted for the largest market share of the United States diabetes care drugs market during the forecast period.

Based on the diabetes type, the United States diabetes care drugs market is categorized into type 1 and type 2. Among these, the type 2 segment accounted for the largest market share of United States diabetes care drugs market during the forecast period. The growing number of type 2 diabetes among the US and increasing number of clinical trials of diabetes drugs are expected to drive the market in the type 2 segment.

- The retail pharmacies segment accounted for the largest market share during the forecast period.

Based on the distribution channel, the United States diabetes care drugs market is categorized into hospital pharmacies, online pharmacies, and retail pharmacies. Among these, the retail pharmacies segment accounted for the largest market share during the forecast period. The affordability and accessibility of anti-diabetic drugs in retail stores and the growing number of retail pharmacies across the country boost the market in the retail pharmacies segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US diabetes care drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Astrazeneca

- Eli Lilly

- Sanofi

- Boehringer Ingelheim

- NovoNordisk

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent developments

- In June 2023, the U.S. Food and Drug Administration approved Lantidra, the first allogeneic (donor) pancreatic islet cellular therapy made from deceased donor pancreatic cells for the treatment of type 1 diabetes.

- In June 2023, the U.S. Food and Drug Administration approved Jardiance (empagliflozin) and Synjardy (empagliflozin and metformin hydrochloride) as additions to diet and exercise to improve blood sugar control in children 10 years and older with type 2 diabetes.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Diabetes Care Drugs Market based on the below-mentioned segments:

United States Diabetes Care Drugs Market, By Drugs

- Oral anti-diabetic drugs

- Insulin

- Non-insulin injectable drugs

- Combination drugs

United States Diabetes Care Drugs Market, by Drug Class

- Insulin

- GLP-1 receptor agonists

- DPP-4 inhibitors

- SGLT2 inhibitors

- Others

United States Diabetes Care Drugs Market, By Diabetes Type

- Type 1

- Type 2

United States Diabetes Care Drugs Market, By Distribution Channel

- Online pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Need help to buy this report?