United States Diabetes Devices Market Size, Share, and COVID-19 Impact Analysis, By Management Devices (Insulin Pumps, Insulin Syringes, Cartridges in Reusable Pens, Insulin Disposable Pens, and Jet Injectors), By Monitoring Devices (Self-Monitoring Blood Glucose and Continuous Glucose Monitoring), and United States Diabetes Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Diabetes Devices Market Insights Forecasts to 2033

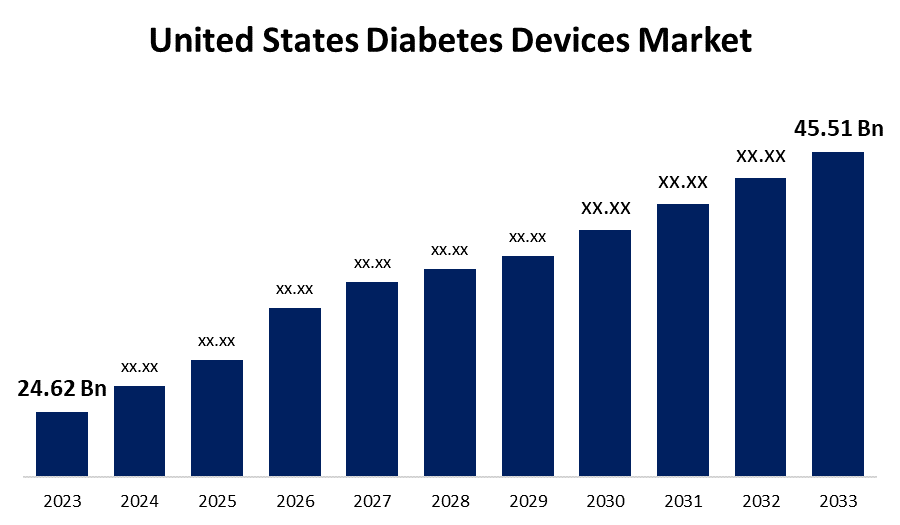

- The United States Diabetes Devices Market Size was valued at USD 24.62 Billion in 2023

- The Market Size is Growing at a CAGR of 6.34% from 2023 to 2033

- The U.S Diabetes Devices Market Size is Expected to Reach USD 45.51 Billion By 2033

Get more details on this report -

The United States Diabetes Devices Market is anticipated to Exceed USD 45.51 Billion by 2033, Growing at a CAGR of 6.34% from 2023 to 2033. The growing prevalence of diabetes, awareness about diabetes devices, innovations, and technological advancements are driving the growth of the diabetes devices market in the United States.

Market Overview

Diabetes devices are used to diagnose and monitor blood glucose levels in a diabetic patient’s body. According to a CDC report, 29.7 million people of all ages, or 8.9 % US population have been diagnosed with diabetes as per estimates for 2021. Thus, the increasing number of diabetes patients upsurges the need for diabetes devices to manage diabetes. Further, the increasing need for minimally invasive devices has prompted companies to launch patient-convenient blood glucose monitoring devices. The diabetes management software through a wireless network allows patients to understand the disease better, thereby helping them to manage it more effectively. The adoption of the latest innovative technologies like continuous glucose monitoring, insulin pumps or smart injection systems, and AI-powered closed-loop solutions has revolutionized the way of treating diabetes, benefiting both healthcare professionals and, more importantly, people living with the condition. The increasingly popular usage of interconnected gadgets is leveraging market opportunity for diabetes devices.

Report Coverage

This research report categorizes the market for the US diabetes devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the diabetes devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the diabetes devices market.

United States Diabetes Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 24.62 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.34% |

| 023 – 2033 Value Projection: | USD 45.51 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Management Devices, By Monitoring Devices |

| Companies covered:: | Abbott, Medtronic, Dexcom, Becton Dickinson, F. Hoffmann-La Roche AG, and Others key vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The prevalence of diabetes has increased owing to factors such as obesity and lifestyle changes such as less physical activity, unhealthy food habits, and sedentary lifestyle. According to WHO, chronic conditions, such as diabetes, are highly prevalent in people aged 65 and above. Thus, the growing number of elderly population also contributes to driving the market demand. Further, the development and launch of innovative devices by startup companies like Glooko, One Drop, Verily are significantly propelling the market growth. The increasing awareness about advanced diabetes devices and their adaptability has promoted market demand. In addition, the growing emphasis on technological innovations and the development of advanced products are also driving the market. The increasing innovations and technological advancements have led to the offer of many conveniences for diabetes management. The implementing strategies such as merger & acquisition, product launch, regulatory approvals, partnership, and collaborations by the key market players. The Economic Report found that the total annual cost of diabetes in 2022 is $412.9 billion. People with diagnosed diabetes account for one of every four health care dollars spent in the U.S. Thus, the rise in healthcare spending fuels market growth.

Restraining Factors

The lack of awareness about the usage of devices in remote and underdeveloped regions is restraining the market. Further, the long registration process and reimbursement issues are likely to restrain the market growth.

Market Segmentation

The United States Diabetes Devices Market share is classified into management devices and monitoring devices.

- The insulin disposable pens segment is expected to hold the largest share of the United States diabetes devices market during the forecast period.

Based on the management devices, the United States diabetes devices market is divided into insulin pumps, insulin syringes, cartridges in reusable pens, insulin disposable pens, and jet injectors. Among these, the insulin disposable pens segment is expected to hold the largest share of the United States diabetes devices market during the forecast period. Insulin disposable pens offer precise dosing with accuracy and convenient self-administration of insulin. Technological advancements, such as smart insulin pens with connectivity features augment the market growth.

- The continuous glucose monitoring segment is anticipated to grow at the fastest CAGR during the forecast period.

The United States diabetes devices market is segmented by monitoring devices into self-monitoring blood glucose and continuous glucose monitoring. Among these, the continuous glucose monitoring segment is anticipated to grow at the fastest CAGR during the forecast period. Continuous glucose monitoring devices are minimally invasive and facilitate the analysis of blood glucose levels at different time intervals with the help of a sensor. The growing number of prediabetes cases owing to increasing obesity rates is fueling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US diabetes devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- Medtronic

- Dexcom

- Becton Dickinson

- F. Hoffmann-La Roche AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, Roche announced that its Accu-Chek Solo insulin patch pump and wireless touchscreen handheld device has received FDA approval for people with diabetes aged 2 years and older.

- In February 2023, U.S. Centers for Medicare & Medicaid Services has approved coverage for Dexcom G7, the most accurate, easy-to-use Continuous Glucose Monitoring (CGM) system that helps people with diabetes gain greater control of their health.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Diabetes Devices Market based on the below-mentioned segments:

United States Diabetes Devices Market, By Management Devices

- Insulin Pumps

- Insulin Syringes

- Cartridges in Reusable Pens

- Insulin Disposable Pens

- Jet Injectors

United States Diabetes Devices Market, By Monitoring Devices

- Self-Monitoring Blood Glucose

- Continuous Glucose Monitoring

Need help to buy this report?