United States Digital Signage Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Type (Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Kiosks, and Others), By Application (Retail, Hospitality, Entertainment, Stadiums & Playgrounds, Corporate, Banking, Healthcare, Education, and Transport), By Location (In-Store and Out-Store), By Technology (LCD, LED, OLED, and Projection), By Content Category (Broadcast and Non-Broadcast), and United States Digital Signage Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Digital Signage Market Insights Forecasts to 2033

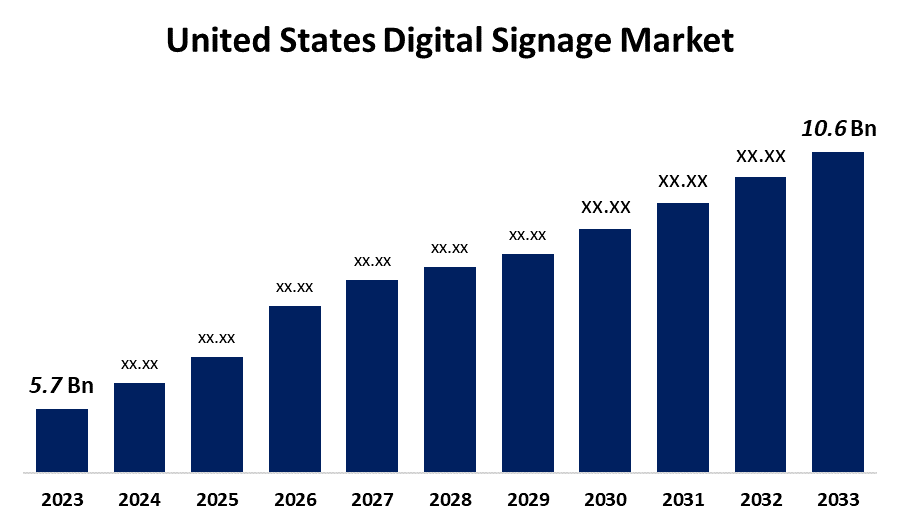

- The United States Digital Signage Market Size was valued at USD 5.7 billion in 2023.

- The Market is growing at a CAGR of 6.4% from 2023 to 2033

- The U.S. Digital Signage Market Size is expected to reach USD 10.6 billion by 2033

Get more details on this report -

The United States Digital Signage Market is anticipated to exceed USD 10.6 billion by 2033, growing at a CAGR of 6.4% from 2023 to 2033. The growing adoption of advanced technologies and significant amount of merger and acquisition (M&A) activity in the U.S. are driving the growth of the digital signage market in the United States.

Market Overview

Digital signage is a subset of electronic signage that shows tests, photos, videos, websites, weather information, and restaurant menus using display technologies such as LCD, LED, projection, and e-paper. It refers to the use of digital displays for the creative display of advertisements, photographs, graphics, videos, and other forms of instructive and promotional content. Innovative advertising material has the power to draw viewers and customers, engage viewers with powerful content management, and sway viewers’ opinions, resulting in the adoption of digitalized exhibiting technologies. There is a continuous evolution and preference for digitized promotion over conventional marketing. The use of innovative digitized signs to attract an audience in the advertising segment is responsible for enhancing market growth. The growing use of 3D digital signage for effective branding and promotion of the product is anticipated to provide a lucrative platform for market growth. Furthermore, artificial intelligence (AI) is transforming the digital signage market by providing unprecedented levels of personalization and engagement, hence enabling more intelligent and successful communication methods.

Report Coverage

This research report categorizes the market for the US digital signage market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digital signage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the digital signage market.

United States Digital Signage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.7 billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 6.4% |

| 2033 Value Projection: | USD 10.6 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Component, By Type, By Application, By Location, By Technology, By Content Category and COVID-19 Impact Analysis |

| Companies covered:: | BrightSign, LLC, Cisco Systems, Inc., Panasonic Corporation, SAMSUNG, Intel Corporation, Microsoft, KeyWest Technology, Inc., LG Electronics (LG Corporation), NEC Display Solutions, Omnivex Corporation, Scala Digital Signage, Winmate Inc., Christie Digital Systems USA, Inc, Meridian Kiosks, and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing adoption of advanced technologies such as single or multi-touch display technologies and gesture-based displays is likely to drive the market. There has been a significant amount of merger and acquisition (M&A) activity in the US digital signage market. Further, purchasing innovative startups or combining them with complementary service providers by larger firms to strengthen product offers, expand distribution networks, and promote synergies contributes to driving market growth.

Restraining Factors

Small and mid-sized businesses have been particularly slow to adopt digital signs because of the upfront costs associated with purchasing the necessary hardware, software, and technology which leads to restraining the US digital signage market. The lack of awareness regarding the advantages of digital signage is also restraining the market growth.

Market Segmentation

The United States Digital Signage Market share is classified into component, type, application, location, technology, and content category.

- The hardware segment dominates the market with the largest market share in 2023.

The United States digital signage market is segmented by component into hardware, software, and services. Among these, the hardware segment dominates the market with the largest market share in 2023. Hardware is crucial since it is a big factor in how content is shown. Hardware segment of a digital signage system include mounts, media players, display panels, front projection, and additional accessories. The greater need for hardware panels than software are driving the market demand.

- The video walls segment accounted for the largest market share through the forecast period.

The United States digital signage market is segmented by type into video walls, video screen, transparent LED screen, digital poster, kiosks, and others. Among these, the video walls segment accounted for the largest market share through the forecast period. The growing use of video walls because of their capacity to provide consistent brightness and excellent pixel density for each image are driving the market. In retail establishments, malls, shopping centers, theaters and multiplexes, auditoriums, bus and metro stations, airports, and institutions, video walls are used to show advertisements and information.

- The retail sector segment dominates the market with the largest market share in 2023.

The United States digital signage market is segmented by application into retail, hospitality, entertainment, stadiums & playgrounds, corporate, banking, healthcare, education, and transport. Among these, the retail sector segment dominates the market with the largest market share in 2023. Retailers are becoming more and more conscious of the benefits of digital signage, which draws customers in addition to advertising deals and merchandise. The increasing adoption of various marketing strategies to promote their products leads to drive the market growth.

- The in-store segment accounted for the largest share of the United States digital signage market during the forecast period.

Based on the location, the United States digital signage market is divided into in-store and out-store. Among these, the in-store segment accounted for the largest share of the United States digital signage market during the forecast period. The installation of digital signage in retail stores, shopping centers, offices, banks, hotels, healthcare facilities, and educational institutions is included in the in-store section. The installation of digital signage in the retail store premises is driving the market.

- The LCD segment accounted for the largest share of the United States digital signage market in 2023.

Based on the technology, the United States digital signage market is divided into LCD, LED, OLED, and projection. Among these, the LCD segment accounted for the largest share of the United States digital signage market in 2023. LCD is widely used in advertising and marketing sectors due to its ease of production and decreased cost of manufacturing. LCD is anticipated to be used with much higher resolution screens; it is believed that BT.2020, which consists of embedded panels with 4K and 8K resolution, will replace sRGB.

- The broadcast segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the content category, the United States digital signage market is divided into broadcast and non-broadcast. Among these, the broadcast segment is anticipated to grow at the fastest CAGR during the forecast period. The broadcast content category is further categorized into news, weather, sports, and others. The growing use of digital signage to show sports-related content across the stadium and sports field during tournaments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US digital signage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BrightSign, LLC

- Cisco Systems, Inc.

- Panasonic Corporation

- SAMSUNG

- Intel Corporation

- Microsoft

- KeyWest Technology, Inc.

- LG Electronics (LG Corporation)

- NEC Display Solutions

- Omnivex Corporation

- Scala Digital Signage

- Winmate Inc.

- Christie Digital Systems USA, Inc

- Meridian Kiosks

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, Christie announced its acquisition of assets from Brass Roots Technologies LLC, an Allen, Texas-based technology innovation company specializing in consulting and the engineering design of advanced optics and electronics for high-performance display and imaging systems.

- In February 2022, Intel Corporation and Tower Semiconductor, a leading foundry for analog semiconductor solutions, announced a definitive agreement under which Intel will acquire Tower for $53 per share in cash, representing a total enterprise value of approximately $5.4 billion.

- In January 2022, Microsoft Corp. announced plans to acquire Activision Blizzard Inc., a leader in game development and interactive entertainment content publisher. This acquisition would accelerate the growth in Microsoft’s gaming business across mobile, PC, console and cloud and will provide building blocks for the metaverse.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Digital Signage Market based on the below-mentioned segments:

United States Digital Signage Market, By Component

- Hardware

- Software

- Services

United States Digital Signage Market, By Type

- Video Walls

- Video Screen

- Transparent LED Screen

- Digital Poster

- Kiosks

- Others

United States Digital Signage Market, By Application

- Retail

- Hospitality

- Entertainment

- Stadiums & Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transport

United States Digital Signage Market, By Location

- In-Store

- Out-Store

United States Digital Signage Market, By Technology

- LCD

- LED

- OLED

- Projection

United States Digital Signage Market, By Content Category

- Broadcast

- Non-Broadcast

Need help to buy this report?