United States Direct-to-Consumer Genetic Testing Market Size, Share, and COVID-19 Impact Analysis, By Test Type (Nutrigenomics Testing, Predictive Testing, Carrier Testing); By Technology (Whole Genome Sequencing, Single Nucleotide Polymorphism Chips, Targeted Analysis); By Distribution Channel (Online Platform, OTC), and United States Direct-to-Consumer Genetic Testing Market Insights Forecasts to 2033

Industry: HealthcareUnited States Direct-to-Consumer Genetic Testing Market Insights Forecasts to 2033

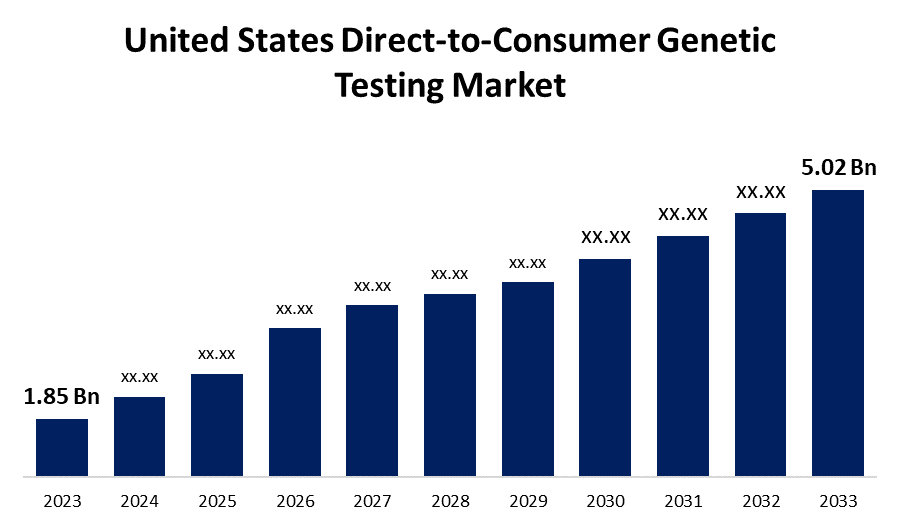

- The United States Direct-to-Consumer Genetic Testing Market Size was valued at USD 1.85 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.5% from 2023 to 2033.

- The United States Direct-to-Consumer Genetic Testing Market Size is Expected to Reach USD 5.02 Billion by 2033.

Get more details on this report -

The United States Direct-to-Consumer Genetic Testing Market Size is Expected to Reach USD 5.02 Billion by 2033, at a CAGR of 10.5% during the forecast period 2023 to 2033.

Market Overview

Direct-to-consumer (DTC) testing, also known as direct access testing, enables customers to order laboratory tests directly from the laboratory rather than through their healthcare provider. The rise in public awareness is expected to drive the growth of the United States direct-to-consumer (DTC) genetic testing market over the forecast period. Furthermore, rising income levels in advanced countries are expected to fuel the growth of the United States direct-to-consumer (DTC) genetic testing market. The genetic testing market in the United States is direct-to-consumer (DTC), which means that genetic testing services and products are sold directly to consumers rather than through medical professionals or intermediaries. Direct-to-consumer (DTC) genetic testing allows people to access and analyze their genetic information for a variety of purposes, including ancestry tracing, health risk assessment, and personalized medicine. Companies in the United States provide genetic testing kits, online test ordering and result interpretation platforms, as well as related services. Consumers are becoming increasingly interested in understanding their genetic makeup in order to make more informed lifestyle, disease prevention, and treatment decisions. Direct-to-consumer genetic testing provides individuals with valuable insights into their unique genetic profile, allowing for a more personalized health approach.

Report Coverage

This research report categorizes the market for United States direct-to-consumer genetic testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States direct-to-consumer genetic testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States direct-to-consumer genetic testing market.

United States Direct-to-Consumer Genetic Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.85 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.5% |

| 2033 Value Projection: | USD 5.02 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Test Type, By Technology, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Ancestry, Family Tree DNA, Genesis HealthCare, Veritas, Myriad Genetics Inc., Full Genomes Corporation, Inc, Color Health, Inc., Pathway genomics, Living DNA Ltd., Counsyl, 23andMe, Inc., HomeDNA, Easy DNA, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing public awareness of the benefits of genetic testing, such as ancestry, disease risk assessment, and personalized healthcare insights, has driven up demand for direct-to-consumer genetic testing. Consumers are becoming more health-conscious, and they want easy access to genetic information. In addition, advancements in gene sequencing technology and bioinformatics have significantly reduced the cost and time required for genetic analysis. Genetic testing is now significantly less expensive thanks to technological advancements. The development of high-throughput sequencing technologies, such as next-generation sequencing (NGS), has made it possible to analyze multiple genes or even entire genomes for a fraction of the cost of traditional methods. Furthermore, with a greater emphasis on personalized healthcare and wellness, demand for direct-to-consumer genetic testing is growing.

Restraining Factors

The United States direct-to-consumer genetic testing market faces challenges in terms of data protection and responsible use of genetic information. Genetic testing requires the collection and analysis of personal genomic data, raising ethical and privacy concerns. Consumers may have reservations about sharing their genetic information with companies due to potential risks of unauthorized access, data breaches, or misuse of information. These concerns may limit market growth as people prioritize the security and privacy of their genetic data.

Market Segment

- In 2023, the carrier testing segment accounted for the largest revenue share over the forecast period.

Based on the test type, the United States direct-to-consumer genetic testing market is segmented into nutrigenomics testing, predictive testing, and carrier testing. Among these, the carrier testing segment has the largest revenue share over the forecast period. It can be attributed to the increasing prevalence of genetic disorders caused by chromosomal and gene mutations. Many genetic mutations are caused by preexisting conditions, complications in the family history, or congenital disabilities. As a result, carrier screening is routinely performed among pregnant women to assess the risk of passing on specific genetic disorders to their children. These factors all contribute to market expansion, accelerating the growth of the U.S direct-to-consumer genetic testing sector.

- In 2023, the whole genome sequencing segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States direct-to-consumer genetic testing market is segmented into whole genome sequencing, single nucleotide polymorphism chips, targeted analysis. Among these, the whole genome sequencing segment has the largest revenue share over the forecast period. Whole genome sequencing stands out as the best approach for understanding specific cancers, providing comprehensive insights ranging from single-base changes to large chromosomal rearrangements. The increasing demand for malignant tumor identification coincides with the market's expansion. Whole-genome sequencing (WGS) provides an unparalleled understanding of pathogenesis and cancer biology, with implications for diagnostics, prognosis, and treatment selection.

- In 2023, the online platform segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States direct-to-consumer genetic testing market is segmented into online platform, and OTC. Among these, the online platform segment has the largest revenue share over the forecast period owing to its ease and accessibility. Customers are increasingly attracted to the convenience of ordering and receiving genetic testing kits from the comfort of their own homes. This segment also benefits from effective marketing strategies, easy-to-use interfaces, and the ability to reach a large audience. These factors all contribute to the online platform's dominant position in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States direct-to-consumer genetic testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ancestry

- Family Tree DNA

- Genesis HealthCare

- Veritas

- Myriad Genetics Inc.

- Full Genomes Corporation, Inc

- Color Health, Inc.

- Pathway genomics

- Living DNA Ltd.

- Counsyl

- 23andMe, Inc.

- HomeDNA

- Easy DNA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, 23andMe, a consumer genetics and research firm, has received FDA approval for a direct-to-consumer genetic test on a hereditary prostate cancer marker. This strategic move will help the company strengthen its position in the marketplace.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States direct-to-consumer genetic testing market based on the below-mentioned segments:

United States Direct-to-Consumer Genetic Testing Market, By Test Type

- Nutrigenomics Testing

- Predictive Testing

- Carrier Testing

United States Direct-to-Consumer Genetic Testing Market, By Technology

- Whole Genome Sequencing

- Single Nucleotide Polymorphism Chips

- Targeted Analysis

United States Direct-to-Consumer Genetic Testing Market, By Distribution Channel

- Online Platform

- OTC

Need help to buy this report?