United States Disposable Gloves Market Size, Share, and COVID-19 Impact Analysis, By Material (Natural, Nitrile, Vinyl, Neoprene, Polyethylene, and Others), By Lubricant (Powdered and Powder Free), By End-use (Construction, Manufacturing, Oil & Gas, Chemicals, Food, Pharmaceuticals, Healthcare, Transportation, Mining, and Others), and United States Disposable Gloves Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Disposable Gloves Market Insights Forecasts to 2033

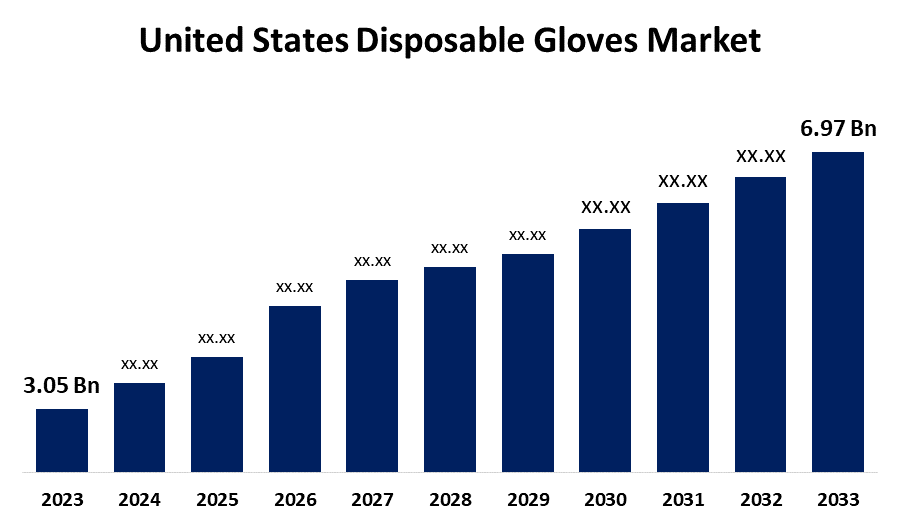

- The U.S. Disposable Gloves Market Size was valued at USD 3.05 Billion in 2023.

- The Market is growing at a CAGR of 8.62% from 2023 to 2033

- The U.S. Disposable Gloves Market Size is expected to reach USD 6.97 Billion by 2033

Get more details on this report -

The United States Disposable Gloves Market is anticipated to exceed USD 6.97 Billion by 2033, growing at a CAGR of 8.62% from 2023 to 2033. The growing hospital industry, ongoing innovations & surgical breakthroughs, and implementation of high-reliability organizing (HRO) are driving the growth of the disposable gloves market in the US.

Market Overview

Disposable gloves are a type of personal protective equipment (PPE) that is used to protect the health of the wearer. These are one type of use-and-throw equipment that prevents the spread of infection and cross-contamination among individuals. In order to keep the healthcare environment secure and stop the spread of infections, disposable gloves are an essential line of defense. They are in high demand due to rising awareness of infection prevention and the value of good hand hygiene. There is a rising awareness about the importance of raw materials that are used in making disposable gloves with superior heat resistance, comfort, flexibility, and lightweight characteristics. Further, there is a high demand for examination gloves in the medical sector that are used by physicians, nurses, and other medical professionals to perform non-invasive physical examinations. The increasing prevalence of infectious and parasitic diseases in the country surges the demand for disposable gloves as protective equipment among healthcare practitioners to prevent the spread of infection during medical procedures or examinations of patients.

Report Coverage

This research report categorizes the market for the US disposable gloves market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States disposable gloves market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US disposable gloves market.

United States Disposable Gloves Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.05 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.62% |

| 2033 Value Projection: | USD 6.97 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 286 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Material, By Lubricant, By End-use |

| Companies covered:: | Adenna LLC, MCR Safety, Kimberly-Clark Corporation, Atlantic Safety Products, Inc., 3M, Renco Corporation, Sempermed USA, Inc., Halyard Health, Inc., Ammex Corporation, Medline Industries, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for disposable medical gloves has increased due to an increase in patient visits to healthcare facilities and the prevalence of various diseases rising in the United States. As per the report by the American Hospital Association, the number of hospitals in the US was 6,093 in the year 2022 which has increased to 6,129 in 2023. The increasing number of hospitals with the rising number of medical professionals are responsible for driving the market demand for disposable gloves. Further, due to ongoing advancements and surgical advances like standardizing processes, increasing technology, and applying high-reliability organizing (HRO), the hospital industry is expected to rise, which is driving the market for disposable gloves.

Restraining Factors

The presence of substandard and falsified medical gloves which increases the risk of infection in patients and caregivers is hampering the market for disposable gloves.

Market Segmentation

The United States Disposable Gloves Market share is classified into material, lubricant, and end-use.

- The natural segment dominates the US disposable gloves market with the largest share in 2023.

The United States disposable gloves market is segmented by material into natural, nitrile, vinyl, neoprene, polyethylene, and others. Among these, the natural segment dominates the US disposable gloves market with the largest share in 2023. Natural disposable gloves are biodegradable and made from a sustainable material namely rubber latex or sometimes made from biodegradable plastics like polylactic acid or polybutylene adipate terephthalate. The extensive application of natural gloves in medical, surgery, and laboratory, as well as in chemicals, oil & gas, and food processing industries are driving the market.

- The powder free segment dominates the market with the largest market share in 2023.

The United States disposable gloves market is segmented by lubricant into powdered and powder free. Among these, the powder free segment dominates the market with the largest market share in 2023. The use of powder-free gloves reduces the possibility of contamination and allergic reactions that can happen with powdered gloves. The increasing demand for powder-free gloves in various industries including food processing, chemical, and medical sectors is driving the market expansion.

- The healthcare segment accounted for the largest revenue share of the US disposable gloves market in 2023.

Based on the end-use, the U.S. disposable gloves market is divided into construction, manufacturing, oil & gas, chemicals, food, pharmaceuticals, healthcare, transportation, mining, and others. Among these, the healthcare segment accounted for the largest revenue share of the US disposable gloves market in 2023. Disposable medical gloves are one of the parts of an infection control strategy in healthcare sector. The strict regulations and requirements for safety and hygiene procedures in healthcare facilities as well as the need for disposable gloves during medical operations are fueling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. disposable gloves market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adenna LLC

- MCR Safety

- Kimberly-Clark Corporation

- Atlantic Safety Products, Inc.

- 3M

- Renco Corporation

- Sempermed USA, Inc.

- Halyard Health, Inc.

- Ammex Corporation

- Medline Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Medline, a market-leading manufacturer and supplier of medical supplies and solutions, announced the successful acquisition of United Medco, a national provider and partner of supplemental benefits and member engagement solutions.

- In January 2024, Kimberly-Clark Professional announced the availability of new Kimtech Polaris Nitrile Exam Gloves for use in laboratory settings that afford users the highest level of protection, durability, and comfort from a glove in the Kimtech portfolio.

- In April 2023, AMMEX Corp. launched a new lineup of disposable gloves that help protect in the most unusual situations. These gloves are the result of a research and development project spanning 35 years. They can be used for protecting environments ranging from the office to the garage to outer space.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Disposable Gloves Market based on the below-mentioned segments:

US Disposable Gloves Market, By Material

- Natural

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

US Disposable Gloves Market, By Lubricant

- Powdered

- Powder Free

US Disposable Gloves Market, By End-use

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Healthcare

- Transportation

- Mining

- Others

Need help to buy this report?