United States Dredging Market Size, Share, and COVID-19 Impact Analysis, By Type (Dipper, Water Injection, Pneumatic, Bed Leveler, Others), By Application (Trade Activity, Trade Maintenance, Energy Infrastructure, Urban Development, Coastal Protection, Leisure), By End-User (Government, O&G Companies, Mining Companies, Renewables, Others), and United States Dredging Market Insights Forecasts 2023 – 2033

Industry: Machinery & EquipmentUnited States Dredging Market Insights Forecasts to 2033

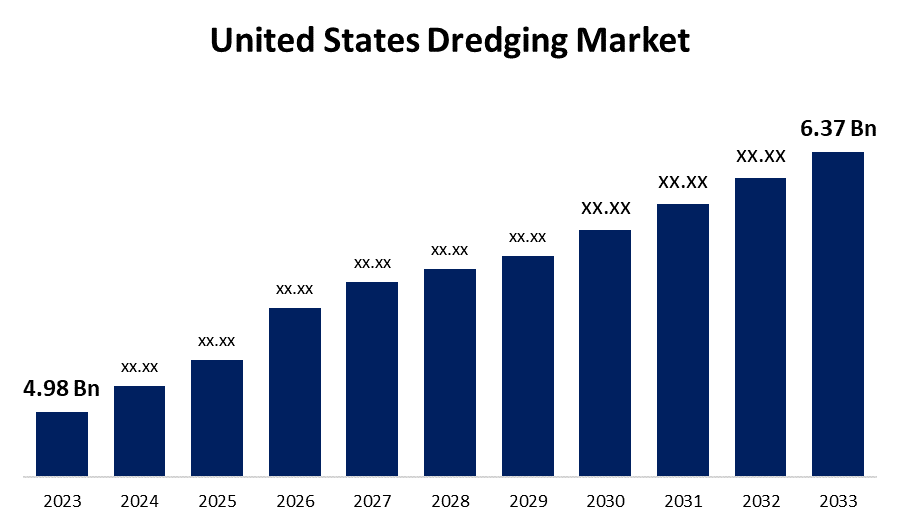

- The United States Dredging Market Size was valued at USD 4.98 Billion in 2023

- The Market Size is Growing at a CAGR of 2.49% from 2023 to 2033.

- The United States Dredging Market Size is Expected to Reach USD 6.37 Billion by 2033.

Get more details on this report -

The United States Dredging Market size is Expected to Reach USD 6.37 Billion by 2033, at a CAGR of 2.49% during the forecast period 2023 to 2033.

Market Overview

Dredging is defined as an excavation activity that is typically performed at least partially underwater in shallow water areas to collect bottom sediments and dispose of them in a different location. It is a type of maritime transportation of natural materials from one part of the water environment to another that uses specialized dredging vessels. The primary purpose of dredging is to keep waterways and ports navigable, to build new ports, to protect coastal areas, to reclaim land, and to win sediments such as sand and gravel for use in the construction industry. Dredging is critical to maintaining navigable waterways, protecting ports, and mitigating the effects of siltation. Furthermore, ongoing initiatives to strengthen resilience in the face of rising sea levels and extreme weather events drive up demand for dredging services. As the United States focuses on improving its coastal infrastructure and adapting to environmental challenges, the dredging market is poised for long-term growth, providing opportunities for both established players and new entrants.

Report Coverage

This research report categorizes the market for the United States dredging market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States dredging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States dredging market.

United States Dredging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.98 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.49% |

| 2033 Value Projection: | USD 6.37 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Great Lakes Dredge & Dock Corporation, Weeks Marine Inc., Cashman Dredging and Marine Contracting Co., LLC, Manson Construction Co., Dutra Group, Callan Marine Ltd., Marinex Construction Inc., Cavache Inc., Mike Hooks, Inc., Great River Energy, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The escalating market growth of the United States dredging market is the country's ambitious infrastructure development and modernization initiatives. The United States government’s commitment to upgrading transportation networks, including maritime infrastructure, highlights the importance of dredging projects in facilitating seamless connectivity and bolstering the country's economic competitiveness on a global scale. The United States dredging market is critical to improving coastal protection and resilience. The escalating effects of climate change, including rising sea levels and extreme weather events, necessitate proactive measures to protect coastal areas. The ongoing economic expansion and increased trade activity are driving the surge in the United States dredging market. A growing economy increases trade volumes, necessitating the optimization and expansion of port facilities. Another important factor shaping the United States dredging market is the growing focus on environmental remediation and habitat restoration. The intersection of environmental concerns and the dredging industry reflects a broader commitment to balancing economic development and ecological preservation, opening up opportunities for sustainable and environmentally sensitive dredging projects. The United States dredging market is constantly evolving and integrating advanced technologies into dredging equipment. Precision dredging, real-time monitoring systems, and more efficient dredgers are all examples of innovations that improve dredging operations effectiveness and environmental sustainability.

Restraining Factors

The high maintenance costs of dredging equipment are expected to thwart market growth in the dredging market. Furthermore, a lack of knowledge about degrading operations is expected to impede market growth. However, new technologies are being developed to reduce production costs and increase dredging productivity.

Market Segment

- In 2023, the dipper segment accounted for the largest revenue share over the forecast period.

Based on type, the United States dredging market is segmented into the dipper, water injection, pneumatic, bed leveler, and others. Among these, the dipper segment has the largest revenue share over the forecast period. The dipper dredging method, which uses a clamshell bucket suspended from a crane or excavator, has proven to be extremely versatile and effective in a variety of dredging applications. Its success can be attributed to the method's ability to handle a wide range of materials, from soft sediments to harder soils, making it perfect for a variety of marine and inland waterway projects. The efficiency and precision of dipper dredging in excavation and material removal contribute to its widespread use, especially in projects that require a targeted and controlled dredging approach. As the United States continues to invest in infrastructure development, coastal protection, and waterway maintenance, dipper dredging's versatility, effectiveness, and technological evolution make it the market's preferred option. Its ability to meet the multifaceted demands of dredging projects, combined with ongoing innovations, is expected to maintain its dominance, making the dipper dredging segment a driving force in shaping the trajectory of the United States dredging market over the forecast period.

- In 2023, the coastal protection segment is witnessing significant CAGR growth over the forecast period.

Based on application, the United States dredging market is segmented into trade activity, trade maintenance, energy infrastructure, urban development, coastal protection, and leisure. Among these, the coastal protection segment is witnessing the significant CAGR growth over the forecast period. Coastal protection projects, which aim to fortify shorelines, reduce erosion, and improve resilience to the effects of climate change, have grown in importance. The pressing need to protect coastal regions from rising sea levels and extreme weather events has resulted in significant investments in dredging activities designed specifically for coastal protection. Dredging is essential for preserving and restoring beaches, building protective barriers, and ensuring navigable waterways in coastal areas. The flexibility of dredging methods, including beach nourishment and channel maintenance, aligns seamlessly with the diverse needs of coastal protection initiatives. The coastal protection application segment is expected to remain a key driver of the United States dredging market, reflecting the continued commitment to preserving coastal environments and ensuring the long-term viability of coastal infrastructure. The segment's dominance is highlighted by its critical role in addressing climate-related challenges and promoting a comprehensive approach to coastal management, positioning it as a key driver of the dredging market's future growth.

- In 2023, the government segment accounted for the largest revenue share over the forecast period.

Based on the end-user, the United States dredging market is segmented into the government, O&G companies, mining companies, renewables, and others. Among these, the government segment has the largest revenue share over the forecast period. The government's significant involvement in infrastructure development, coastal protection, and waterway maintenance has been a major driver of the dredging market. Government agencies at all levels play an important role in commissioning and funding dredging projects, particularly those involving navigation channel maintenance, harbor deepening, and coastal resilience. The consistent demand for dredging services from government agencies reflects the nation's ongoing commitment to improving maritime infrastructure, ensuring navigable waterways, and strengthening coastal defenses. The government sector's dominance not only reflects its critical role in infrastructure development but also highlights the strategic importance of public investment in ensuring the efficiency and sustainability of the country's waterborne transportation and coastal protection infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States dredging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Great Lakes Dredge & Dock Corporation

- Weeks Marine Inc.

- Cashman Dredging and Marine Contracting Co., LLC

- Manson Construction Co.

- Dutra Group

- Callan Marine Ltd.

- Marinex Construction Inc.

- Cavache Inc.

- Mike Hooks, Inc.

- Great River Energy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, CoastalGuard Engineering, a leader in coastal protection and dredging projects, launched a sustainable dredging initiative aimed at reducing environmental impact. The program includes eco-friendly dredging practices, sediment recycling, and habitat restoration efforts to ensure that dredging operations are responsible and environmentally conscious. CoastalGuard Engineering's emphasis on sustainability demonstrates the growing importance of eco-friendly practices and environmental stewardship in the United States dredging market.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Dredging Market based on the below-mentioned segments:

United States Dredging Market, By Type

- Dipper

- Water Injection

- Pneumatic

- Bed Leveler

- Others

United States Dredging Market, By Application

- Trade Activity

- Trade Maintenance

- Energy Infrastructure

- Urban Development

- Coastal Protection

- Leisure

United States Dredging Market, By End-user

- Government

- O&G Companies

- Mining Companies

- Renewables

- Others

Need help to buy this report?