United States Dry Mouth Relief Consumption Market Size, Share, and COVID-19 Impact Analysis, By Type (OTC and Prescribed), By Product (Mouthwash, Spray, Lozenges, and Gel), and United States Dry Mouth Relief Consumption Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Dry Mouth Relief Consumption Market Insights Forecasts to 2033

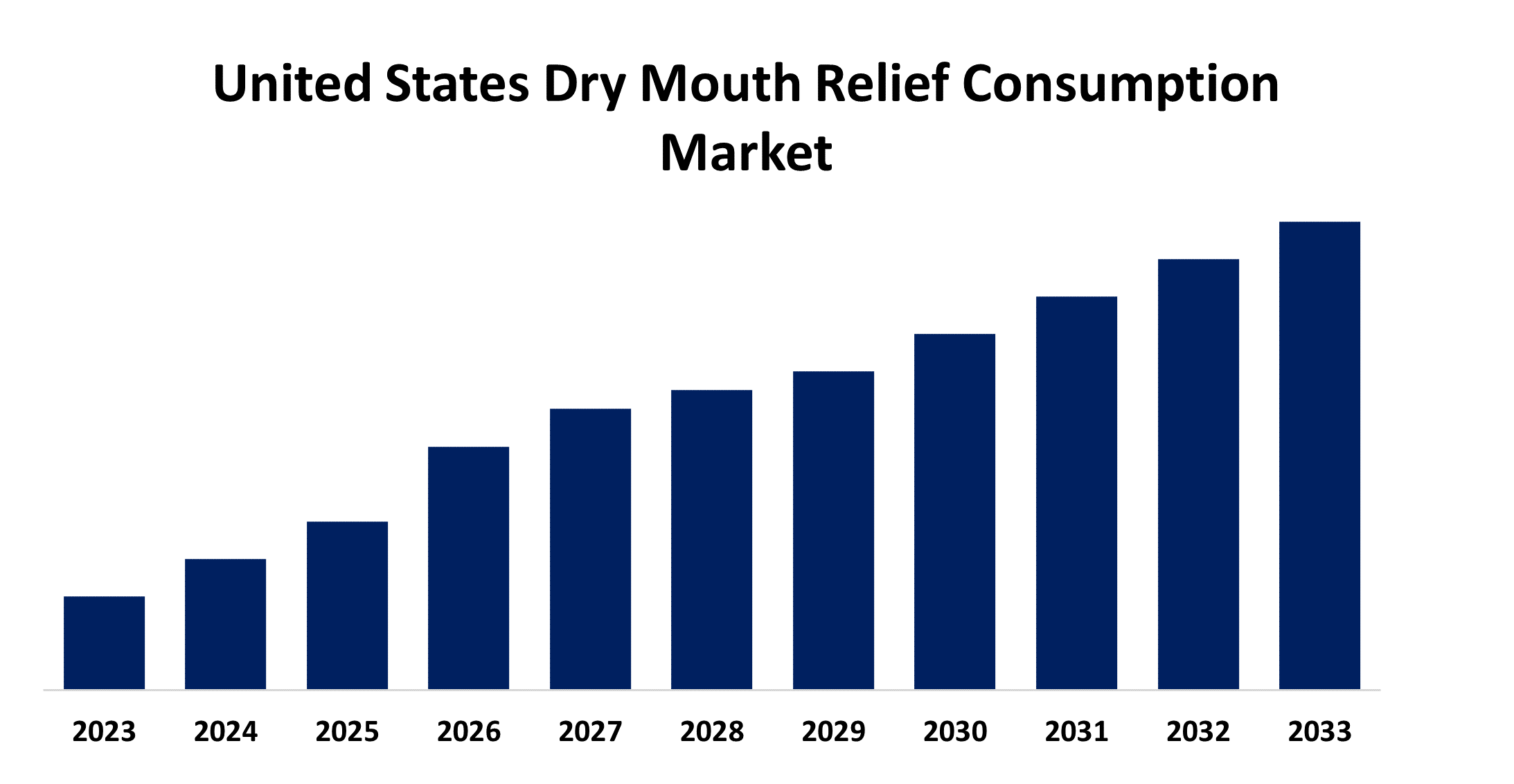

- The Market Size is Growing at a CAGR of 7.01% from 2023 to 2033

- The United States Dry Mouth Relief Consumption Market Size is Expected to hold a significant share by 2033.

Get more details on this report -

The United States Dry Mouth Relief Consumption Market is anticipated to hold a significant share by 2033, growing at a CAGR of 7.01% from 2023 to 2033.

Market Overview

Xerostomia, also known as hyposalivation or dry mouth, is the result of inadequate salivary gland function, leading to a dry sensation in the mouth. Common symptoms include decreased saliva production, dry mouth, frequent thirst, and bad breath (halitosis). While dry mouth is often a result of medications such as antihypertensives, antidepressants, antipsychotics, antispasmodics, and sedatives, dehydration is a frequent culprit. Doctors often recommend medications like pilocarpine, cevimeline, and amifostine, as well as saliva substitutes or stimulants such as Aquoral, Caphosol, and NeutraSal to encourage salivation and alleviate dry mouth. Several at-home treatments can be helpful. To effectively manage dehydration, it is recommended to maintain good oral hygiene, increase water consumption, and refrain from caffeine and alcohol usage. The need for items that relieve dry mouth is rising significantly in the US, due to several important causes that highlight how crucial it is to find practical treatments for this common ailment. One of the main factors driving demand in the United States is the rising awareness of dental health and its implications for general well-being. The importance of oral health has increased as people become more aware of the complex connections between it and systemic diseases like diabetes and cardiovascular disease. The need for dry mouth treatment products has been further fueled by initiatives by governmental authorities and health groups, such as the American Dental Association, which have helped to raise awareness of the need to preserve oral health.

Report Coverage

This research report categorizes the market for the United States dry mouth relief consumption market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dry mouth relief consumption market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dry mouth relief consumption market.

United States Dry Mouth Relief Consumption Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.01% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Product |

| Companies covered:: | Colgate-Palmolive Company, Procter & Gamble Co., Biotene (GlaxoSmithKline Consumer Healthcare), Chattem, Inc. (Sanofi), Sunstar Americas, Inc., Church & Dwight Co., Inc., OraCoat, TheraBreath, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing incidence of chronic illnesses, which is not specific to the United States but has a substantial effect on its populace, is driving up demand for dry mouth relief products. Dry mouth is a typical symptom of several chronic conditions that are common in the United States, including diabetes, autoimmune disorders, and Sjogren’s syndrome. The demand for dry mouth relief products is increasing across the country as the prevalence of these chronic disorders rises and the necessity for efficient relief options also grows. The demand for items that relieve dry mouth is also significantly influenced by the aging population in the United States. The U.S. Census Bureau projects that by 2050, the number of people 65 and older will have almost doubled. Due to factors like decreasing saliva production linked with age, using several drugs, and having underlying medical issues, the senior population is more prone to dry mouth. The overall demand for dry mouth treatment solutions in the United States is driven by this generational transition, which produces a sizable market segment seeking relief from symptoms of dry mouth.

Restraining Factors

The high price of dry mouth treatment solutions might present difficulties for the US market for their consumption. Those looking for relief from the symptoms of dry mouth might find it difficult to afford these goods. The price tag might discourage some customers from buying these goods or cause them to use them less frequently, which might have an impact on their capacity to properly manage their condition.

Market Segmentation

The United States dry mouth relief consumption market share is classified into type and product.

- The OTC segment dominates the market with the largest market share over the forecast period.

The United States dry mouth relief consumption market is segmented by type into OTC and prescribed. Among them, the OTC segment dominates the market with the largest market share over the forecast period. This is attributed to it being convenient, inexpensive, and easily accessible. OTC products can be bought directly from pharmacies, retail establishments, or internet retailers because they are easily accessible to customers without a prescription. They are a more cost-effective option than prescription drugs because of their low cost, particularly for people without insurance. For those who experience mild to moderate symptoms of dry mouth, over-the-counter (OTC) treatments are convenient because they might be easily included in daily routines without requiring a doctor's visit or additional medical intervention.

- The mouthwash segment dominates the market with the largest market share over the predicted period.

The United States dry mouth relief consumption market is segmented by product into mouthwash, spray, lozenges, and gel. Among them, the mouthwash segment dominates the market with the largest market share over the predicted period. Mouthwash products are designed to instantly relieve symptoms of dry mouth by hydrating oral tissues and stimulating salivation. They are easily accessible to a huge number of customers due to their widespread availability in pharmacies, supermarkets, and online platforms. Mouthwash is also an easy-to-use solution that fits in well with regular dental hygiene practices. It's a more affordable option when considering specialized therapies or prescription drugs. Additionally, mouthwash is multipurpose because it not only treats dry mouth but also improves dental hygiene by reducing plaque, freshening breath, and preventing cavities. The dominance of the mouthwash segment in the US market for dry mouth treatment consumption might be attributed to these combined causes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States dry mouth relief consumption market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Colgate-Palmolive Company

- Procter & Gamble Co.

- Biotene (GlaxoSmithKline Consumer Healthcare)

- Chattem, Inc. (Sanofi)

- Sunstar Americas, Inc.

- Church & Dwight Co., Inc.

- OraCoat

- TheraBreath

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, to incorporate smart technology into its product offerings, Sunstar Americas, Inc., a US-based subsidiary, partnered strategically with an oral health technology company to enhance its dry mouth relief portfolio.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Dry Mouth Relief Consumption Market based on the below-mentioned segments:

United States Dry Mouth Relief Consumption Market, By Type

- OTC

- Prescribed

United States Dry Mouth Relief Consumption Market, By Product

- Mouthwash

- Spray

- Lozenges

- Gel

Need help to buy this report?