United States Electric Commercial Vehicle Battery Pack Market Size, Share, and COVID-19 Impact Analysis, By Body Type (Bus, LCV, M&HDT), By Propulsion Type (BEV, PHEV), By Capacity (15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh, Less than 15 kWh), and US Electric Commercial Vehicle Battery Pack Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationUnited States Electric Commercial Vehicle Battery Pack Market Insights Forecasts to 2033

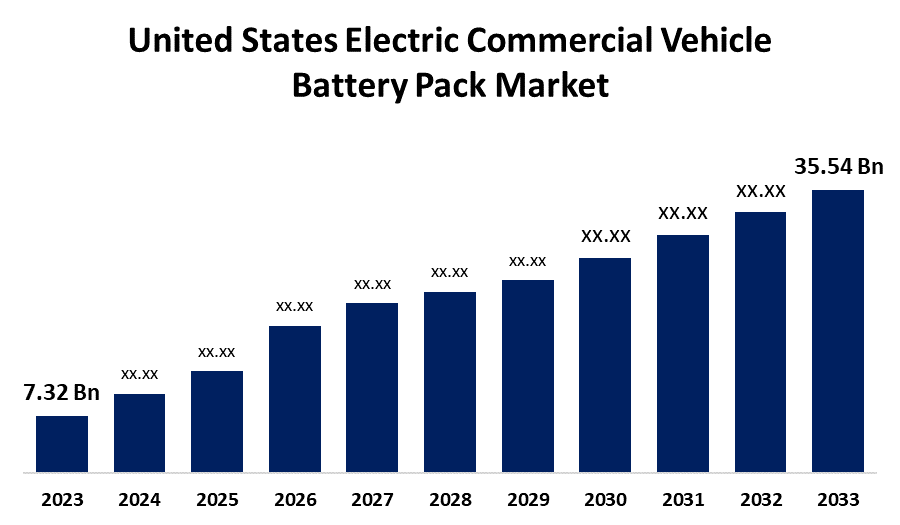

- The US Electric Commercial Vehicle Battery Pack Market Size was Valued at USD 7.32 Billion in 2023

- The US Electric Commercial Vehicle Battery Pack Market Size is Growing at a CAGR of 17.12% from 2023 to 2033

- The US Electric Commercial Vehicle Battery Pack Market Size is Expected to Reach USD 35.54 Billion by 2033

Get more details on this report -

The U.S. Electric Commercial Vehicle Battery Pack Market Size is anticipated to exceed USD 35.54 Billion by 2033, Growing at a CAGR of 17.12% from 2023 to 2033. The United States Electric Commercial Vehicle Battery Pack Market Size is expanding fast, led by fleet electrification, government incentives, and technology improvements, with growing demand for high-capacity packs in trucks, buses, and logistics vehicles.

Market Overview

The US electric commercial vehicle battery pack market specializes in designing, manufacturing, and marketing battery packs for electric commercial vehicles such as buses, trucks, and vans. These battery packs, such as lithium-ion and solid-state technologies, substitute internal combustion engines, facilitating environmentally friendly transportation for logistics, public services, and fleet operations. Moreover, driving potential growth in the USA electric commercial vehicle battery pack market is increasing demand for zero-emission transport, government subsidies, and tightening emission standards. Improved battery technology, such as increased energy density and quicker charging, increases adoption. Growing charging infrastructure, accelerating fleet electrification, and declining lithium-ion and solid-state battery costs further enhance market potential, positioning electric commercial vehicles as a realistic alternative to conventional fuel-powered counterparts. Furthermore, opportunities such as solid-state battery advancements, second-life battery use, wireless charging, battery leasing schemes, and collaborations for building out charging infrastructure, of which can promote adoption and stimulate market growth.

Report Coverage

This research report categorizes the market for the US electric commercial vehicle battery pack market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA electric commercial vehicle battery pack market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. electric commercial vehicle battery pack market.

United States Electric Commercial Vehicle Battery Pack Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.32 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 17.12% |

| 2033 Value Projection: | USD 35.54 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Body Type, By Propulsion Type, By Capacity |

| Companies covered:: | BYD Company Ltd., Tesla Inc., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., Panasonic Holdings Corporation, Samsung SDI Co. Ltd., SK Innovation Co. Ltd., Robert Bosch GmbH, Proterra Operating Company Inc., Envision AESC Japan Co. Ltd., Imperium3 New York (IM3NY), Econtrols LLC, XALT Energy, and Others. |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Less widely recognized driving force in the United States electric commercial vehicle battery pack market is the growth of vehicle-to-grid (V2G) technology, enabling fleet managers to return surplus power to the grid. Military uptake of electric transport for logistics also boosts demand. State-level clean energy regulations drive local fleet electrification, and nanotechnology innovations in battery cooling systems improve efficiency, making electric commercial vehicles more practical for extreme climates. For instance, In September 2022, LG Energy Solution announced its collaboration with three Canadian suppliers, Snow Lake Resources Ltd, Electra Battery Materials Corporation, and Avalon Advanced Materials Inc., to enhance the supply chain for EV batteries in North America.

Restraining Factors

The constraints for the USA electric commercial vehicle battery pack market are high up-front costs, scarcity of charging infrastructure, raw material shortages, battery disposal issues, supply chain disruption, and efficiency issues in extreme weather conditions.

Market Segmentation

The U.S. electric commercial vehicle battery pack market share is classified into body type, propulsion type, and capacity.

- The M&HDT segment accounted for the largest share of the U.S. electric commercial vehicle battery pack market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on body type, the U.S. electric commercial vehicle battery pack market is divided into bus, LCV, and M&HDT. Among these, the M&HDT segment accounted for the largest share of the U.S. electric commercial vehicle battery pack market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of growing electrification in freight movement, robust regulation assistance, and growing uptake by logistics companies striving for sustainability, reducing operating costs, and meeting targets on emissions reduction.

- The BEV segment accounted for a substantial share of the US electric commercial vehicle battery pack market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of propulsion type, the US electric commercial vehicle battery pack market is divided into BEV and PHEV. Among these, the BEV segment accounted for a substantial share of the US electric commercial vehicle battery pack market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because of zero emissions, government subsidies, and battery technology improvements. Rising fleet electrification and increasing charging infrastructure boost BEV over PHEV adoption in commercial use further.

- The above 80 kWh segment accounted for the largest share of the USA electric commercial vehicle battery pack market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of capacity, the USA electric commercial vehicle battery pack market is divided into 15 kWh to 40 kWh, 40 kWh to 80 kWh, above 80 kWh, and less than 15 kWh. Among these, the above 80 kWh NM segment accounted for the largest share of the US electric commercial vehicle battery pack market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Attributable to the increasing use of long-range electric buses and trucks. Improvements in high-capacity battery technology, rising fleet electrification, and robust government incentives fuel demand. Logistics and public transport operators prefer bigger battery packs for greater range and enhanced operational efficiency, which increases market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. electric commercial vehicle battery pack market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BYD Company Ltd.

- Tesla Inc.

- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- Robert Bosch GmbH

- Proterra Operating Company Inc.

- Envision AESC Japan Co. Ltd.

- Imperium3 New York (IM3NY)

- Econtrols LLC

- XALT Energy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, The Honda battery factory project in Ohio awarded LG Energy Solution USD 237 million, which will be paid over the course of the next ten years. This is on top of roughly USD 156.3 million in tax breaks and infrastructural upgrades.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the USA electric commercial vehicle battery pack market based on the below-mentioned segments:

US Electric Commercial Vehicle Battery Pack Market, By Body Type

- Bus

- LCV

- M&HDT

US Electric Commercial Vehicle Battery Pack Market, By Propulsion Type

- BEV

- PHEV

US Electric Commercial Vehicle Battery Pack Market, By Capacity

- 15 kWh to 40 kWh

- 40 kWh to 80 kWh

- Above 80 kWh

- Less than 15 kWh

Need help to buy this report?