United States Electric Mobility Market Size, Share, and COVID-19 Impact Analysis, By Voltage (24V, 36V, 48V, and Greater Than 48V), By Battery (Sealed Lead Acid, NiMh, and Li-Ion), and by United States Electric Mobility Market Insights Forecasts to 2033

Industry: Automotive & TransportationUnited States Electric Mobility Market Insights Forecasts to 2033

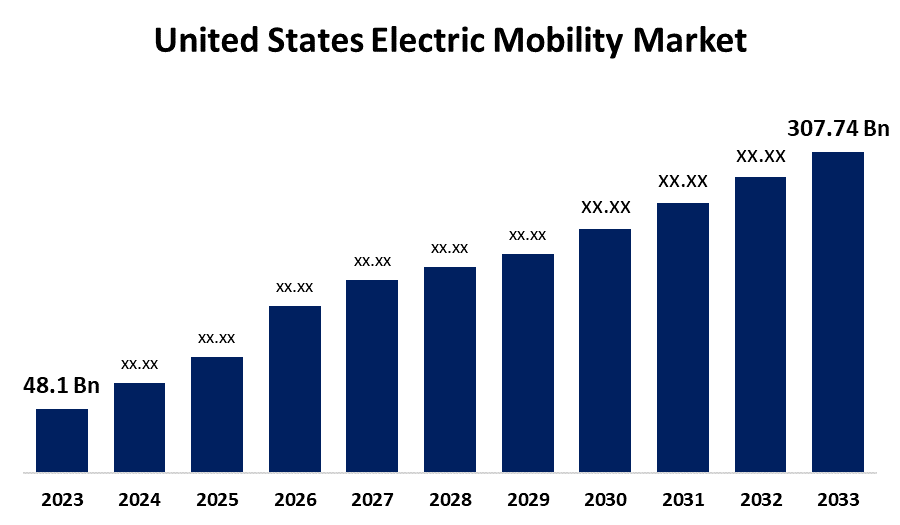

- The United States Electric Mobility Market Size was valued at USD 48.1 Billion in 2023.

- The Market is Growing at a CAGR of 20.39% from 2023 to 2033

- The United States Electric Mobility Market Size is Expected to Reach USD 307.74 Billion by 2033

Get more details on this report -

The United States Electric Mobility Market Size is Anticipated to Exceed USD 307.74 Billion by 2033, Growing at a CAGR of 20.39% from 2023 to 2033.

Market Overview

The United States electric mobility market refers to the sector focused on the development and adoption of electric-powered transportation solutions, including electric vehicles (EVs), e-scooters, electric bikes, and other electric-based modes of transportation. This market is driven by advancements in battery technology, a growing shift toward sustainable and energy-efficient solutions, and the increasing demand for environmentally friendly transportation options. Several factors are driving the growth of the electric mobility market in the United States. Rising concerns over environmental sustainability, increasing urbanization, and a shift towards reducing carbon emissions have led to higher consumer demand for electric-powered vehicles. Furthermore, the growing availability of public and private charging infrastructure and continuous advancements in EV battery technology contribute to greater convenience and longer driving ranges. Government initiatives also play a pivotal role in accelerating market growth. Federal and state-level policies, including tax incentives, rebates, and regulations aimed at reducing carbon footprints, have significantly promoted the adoption of electric mobility solutions. Additionally, programs supporting research and development of advanced battery technologies and EV infrastructure continue to enhance the feasibility and attractiveness of electric mobility. These government-driven efforts, coupled with the ongoing technological innovation in electric vehicles, are expected to propel the market forward throughout the forecast period.

Report Coverage

This research report categorizes the market for the United States electric mobility market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States electric mobility market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States electric mobility market sub-segment.

United States Electric Mobility Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 48.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 20.39% |

| 2033 Value Projection: | USD 307.74 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Voltage, By Battery |

| Companies covered:: | Accell Group, Airwheel Technology Holding (USA) Co., Ltd., Derby Bicycle, HARLEY-DAVIDSON, Honda Motor Co. Ltd., Invacare Holdings Corporation, SEGWAY INC., Lightning Motorcycles, Nissan Motor Co., Ltd, BMW AG, and Others. |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States electric mobility market is primarily driven by the increasing demand for sustainable and eco-friendly transportation options. Rising concerns over air pollution, carbon emissions, and climate change have intensified the shift towards electric mobility solutions. Technological advancements in battery efficiency and energy storage have significantly improved the range and performance of electric vehicles. Additionally, the growing expansion of charging infrastructure and government incentives, such as tax credits and subsidies, have made electric vehicles more accessible and affordable. Consumer preferences for cost-effective, low-maintenance, and energy-efficient transportation further contribute to market expansion.

Restraining Factors

The United States electric mobility market faces challenges such as high upfront costs of electric vehicles and limited availability of charging infrastructure in certain areas. Additionally, concerns regarding battery life, long recharging times, and range anxiety continue to hinder widespread adoption. Market growth is also affected by supply chain disruptions.

Market Segment

The U.S. electric mobility market share is classified into voltage and battery.

- The 48V segment is expected to hold the largest market share through the forecast period.

The US electric mobility market is segmented by voltage into 24V, 36V, 48V, and greater than 48V. Among these, the 48V segment is expected to hold the largest market share through the forecast period. This dominance is attributed to the growing demand for electric vehicles and mobility solutions that require higher power for performance and efficiency. The 48V system is commonly used in electric vehicles, e-bikes, and electric scooters, offering a balanced combination of power, efficiency, and affordability.

- The Li-Ion segment is expected to hold the largest market share through the forecast period.

The US electric mobility market is segmented by battery into sealed lead acid, NiMh, and Li-Ion. Among these, the Li-Ion segment is expected to hold the largest market share through the forecast period. This is due to the superior energy density, longer lifespan, and faster charging capabilities of lithium-ion batteries compared to sealed lead acid and NiMH batteries. Additionally, the decreasing cost of lithium-ion batteries, coupled with advancements in battery technology, has made them the preferred choice for electric vehicles, e-bikes, and other electric mobility solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States electric mobility market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Accell Group

- Airwheel Technology Holding (USA) Co., Ltd.

- Derby Bicycle

- HARLEY-DAVIDSON

- Honda Motor Co. Ltd.

- Invacare Holdings Corporation

- SEGWAY INC.

- Lightning Motorcycles

- Nissan Motor Co., Ltd

- BMW AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, Tesla announced plans to produce an affordable robotaxi and a low-cost electric vehicle priced at USD 25,000, which will be based on the same vehicle architecture. Their production would begin toward the end of 2025. This strategic move aims to position Tesla competitively against more affordable gasoline-powered cars and an increasing number of low-cost electric vehicles, such as those manufactured by China's BYD.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States electric mobility market based on the below-mentioned segments:

United States Electric Mobility Market, By Voltage

- 24V

- 36V

- 48V

- Greater Than 48V

United States Electric Mobility Market, By Battery

- Sealed Lead Acid

- NiMh

- Li-Ion

Need help to buy this report?