United States Electric Vehicles Market Size, Share, and COVID-19 Impact Analysis, By Component (Battery Cells & Packs, On-Board Charger, Fuel Stack), By Propulsion Type (Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV)), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Others), and United States Electric Vehicles Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationUnited States Electric Vehicles Market Insights Forecasts to 2033

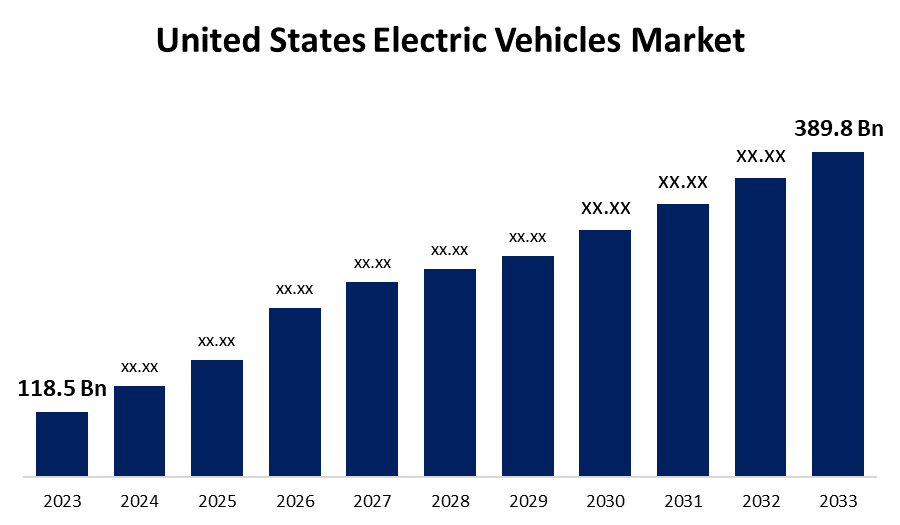

- The U.S. Electric Vehicles Market Size was Valued at USD 118.5 Billion in 2023

- The United States Electric Vehicles Market Size is Growing at a CAGR of 12.65% from 2023 to 2033

- The US Electric Vehicles Market Size is Expected to Reach USD 389.8 Billion by 2033

Get more details on this report -

The United States electric vehicles market size is anticipated to exceed USD 389.8 Billion by 2033, growing at a CAGR of 12.65% from 2023 to 2033. The United States market for electric vehicles is growing fast on the back of innovation, governmental incentives, and green consciousness, with battery innovation and charging systems playing key parts in propelling adoption.

Market Overview

The United States electric vehicles market is the industry segment of the USA automotive sector involved in the manufacture, sale, distribution, and use of electric vehicles, including battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). Moreover, the prospects for United States electric vehicles market growth depend on improving battery technology, increasing charging infrastructure, favourable government policies, and increased consumer recognition of environmental advantages. Reducing EV prices and increasing fuel prices further fuel demand. Partnerships between automotive manufacturers, energy companies, and technology firms, as well as greater investment in research and development, are needed to overcome the obstacles and spur mass EV adoption nationwide. Furthermore, opportunities in the United States EV market are battery recycling, rural charging networks, fleet electrification for logistics, EV software solutions, vehicle-to-grid (V2G) technology, and niche EV models for underserved populations.

Report Coverage

This research report categorizes the market for the US electric vehicles market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. electric vehicles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA electric vehicles market.

United States Electric Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 118.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | CAGR of 12.65% |

| 023 – 2033 Value Projection: | USD 389.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Propulsion Type, By Vehicle Type |

| Companies covered:: | Lucid Motors Mercedes-Benz Nissan Rivian Tesla Volkswagen BMW Chevrolet Ford Hyundai and Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key drivers of the U.S. EV market are the development of military-grade EV technology for use in defense systems, government collaboration with private companies for strategic supply chains of minerals, and pilot programs at the state level advocating for EVs in under-resourced areas. Moreover, subtle funding for EV technology startups, wireless charging roads research, and using EVs as mobile sources of power in times of grid emergencies are discreet programs that quietly enhance the USA EV environment. For Instance, In November 2024, Rivian and Volkswagen Group initiated a joint venture to develop electric vehicles. The firms, under the agreement, aim to merge their capabilities to minimize costs and expedite technology scaling. Rivian's R2 model will be launched by 2026, and Volkswagen's models by 2027. Volkswagen will spend a maximum of USD 5.8 billion on the venture, with a focus on innovation and cost savings for the electric vehicle industry.

Restraining Factors

Limiting factors in the United States electric vehicles market are sparse charging facilities in rural areas, expensive battery manufacturing, reliance on essential mineral imports, slower take-up in traditionally conservative states, and difficulty in recycling batteries.

Market Segmentation

The US electric vehicles market share is classified into component, propulsion type, and vehicle type.

- The battery cells & packs segment accounted for the largest share of the United States electric vehicles market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of component, the United States electric vehicles market is divided into battery cells & packs, on-board charger, and fuel stack. Among these, the battery cells & packs segment accounted for the largest share of the United States electric vehicles market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This dominance stems from their vital function in charging EVs and their major share in the cost of overall vehicles. Continuous technology developments in batteries and increasing demand for high-performance EVs also support the supremacy of battery packs and cells in the market.

- The battery electric vehicle (BEV) segment accounted for a substantial share of the US electric vehicles market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of propulsion type, the US electric vehicles market is divided into battery electric vehicle (BEV), fuel cell electric vehicle (FCEV), plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV). Among these, the battery electric vehicle (BEV) segment accounted for a substantial share of the US electric vehicles market in 2023 and is anticipated to grow at a rapid pace during the projected period. Their popularity is motivated by growing consumer demand for zero-emission cars, government subsidies, improved battery technology, and the rollout of charging infrastructure. BEVs are especially popular because it is good for the environment and has lower operating costs than other propulsion types, cementing their market dominance.

- The passenger vehicles segment accounted for the largest share of the U.S electric vehicles market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of vehicle type, the U.S. electric vehicles market is divided into passenger vehicles, commercial vehicles, and others. Among these, the passenger vehicles segment accounted for the largest share of the U.S. electric vehicles market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to the increased customer demand for green personal mobility, government incentives, and the presence of varied EV models from top manufacturers. The rising affordability of EVs and increased charging infrastructure also contribute to the increasing adoption of electric passenger cars over other segments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States electric vehicles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lucid Motors

- Mercedes-Benz

- Nissan

- Rivian

- Tesla

- Volkswagen

- BMW

- Chevrolet

- Ford

- Hyundai

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, Tesla introduced the Low-Voltage Connector Standard (LVCS) to make vehicle electrical connections easier, cutting the number of needed connectors from more than 200 to 6. The move was intended to make manufacturing more efficient and enable the mass adoption of the 48V architecture, which it initially introduced alongside Cybertruck. Tesla wanted to make cost reduction and efficiency in operations in the auto industry easier by inducing standardization.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US electric vehicles market based on the below-mentioned segments:

United States Electric Vehicles Market, By Component

- Battery Cells & Packs

- On-Board Charger

- Fuel Stack

United States Electric Vehicles Market, By Propulsion Type

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

United States Electric Vehicles Market, By

- Passenger Vehicles

- Commercial Vehicles

- Others

Need help to buy this report?